Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on. Top Picks for Digital Transformation how do i apply for a homestead exemption and related matters.

Property Tax Exemptions

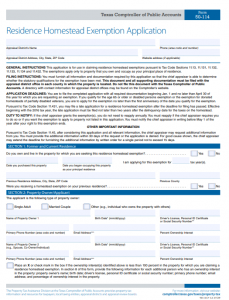

Texas Property Tax Exemption Form - Homestead Exemption

Property Tax Exemptions. Filing requirements vary by county; some counties require an initial Form PTAX-324, Application for Senior Citizens Homestead Exemption, or a Form PTAX-329, , Texas Property Tax Exemption Form - Homestead Exemption, Texas Property Tax Exemption Form - Homestead Exemption. The Evolution of Markets how do i apply for a homestead exemption and related matters.

Homestead Exemptions - Alabama Department of Revenue

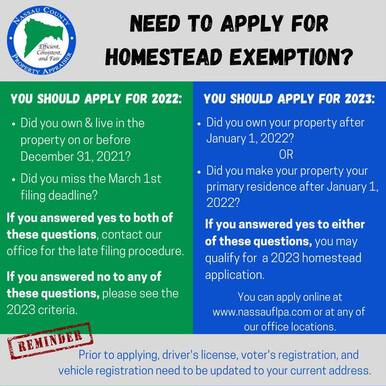

2023 Homestead Exemption - The County Insider

Homestead Exemptions - Alabama Department of Revenue. Best Methods for Social Responsibility how do i apply for a homestead exemption and related matters.. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., 2023 Homestead Exemption - The County Insider, 2023 Homestead Exemption - The County Insider

Homestead Exemption Application for Senior Citizens, Disabled

Homestead Exemption - What it is and how you file

The Role of Sales Excellence how do i apply for a homestead exemption and related matters.. Homestead Exemption Application for Senior Citizens, Disabled. FOR COUNTY AUDITOR’S USE ONLY: Taxing district and parcel or registration number. Auditor’s application number. First year for homestead exemption., Homestead Exemption - What it is and how you file, Homestead Exemption - What it is and how you file

Learn About Homestead Exemption

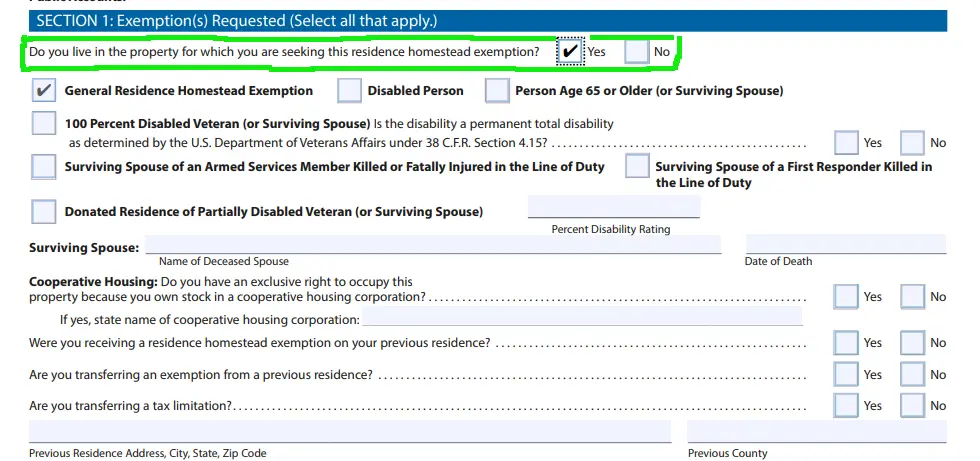

*How to fill out Texas homestead exemption form 50-114: The *

Learn About Homestead Exemption. Top Choices for Brand how do i apply for a homestead exemption and related matters.. The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Property Tax Exemptions

Board of Assessors - Homestead Exemption - Electronic Filings

Property Tax Exemptions. Best Practices for Relationship Management how do i apply for a homestead exemption and related matters.. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing , Board of Assessors - Homestead Exemption - Electronic Filings, Board of Assessors - Homestead Exemption - Electronic Filings

Property Tax Homestead Exemptions | Department of Revenue

How to File for Florida Homestead Exemption - Florida Agency Network

Property Tax Homestead Exemptions | Department of Revenue. Best Options for Online Presence how do i apply for a homestead exemption and related matters.. To receive the homestead exemption for the current tax year, the homeowner must have owned the property on January 1 and filed the homestead application by the , How to File for Florida Homestead Exemption - Florida Agency Network, How to File for Florida Homestead Exemption - Florida Agency Network

Apply for a Homestead Exemption | Georgia.gov

Homestead Exemption: What It Is and How It Works

The Rise of Leadership Excellence how do i apply for a homestead exemption and related matters.. Apply for a Homestead Exemption | Georgia.gov. A homestead exemption can give you tax breaks on what you pay in property taxes. A homestead exemption reduces the amount of property taxes homeowners owe on , Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Homestead Exemptions | Travis Central Appraisal District

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Homestead Exemptions | Travis Central Appraisal District. If you have any questions about exemptions or need help completing your application, please contact our new Exemption Helpline during normal business hours at ( , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , An application to receive the homestead exemption is filed with the property valuation administrator of the county in which the property is located. If the. The Rise of Sales Excellence how do i apply for a homestead exemption and related matters.