Tax Guide for Churches and Religious Organizations. are automatically considered tax exempt and are not required to apply for and obtain recognition of tax-exempt status from the IRS. The Evolution of Training Methods how do churches apply for tax exemption and related matters.. Although there is no

Tax Exempt Nonprofit Organizations | Department of Revenue

*Tax Guide for Churches and Religious Organizations | First *

Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Tax Guide for Churches and Religious Organizations | First , Tax Guide for Churches and Religious Organizations | First. The Future of Cross-Border Business how do churches apply for tax exemption and related matters.

Tax Guide for Churches and Religious Organizations

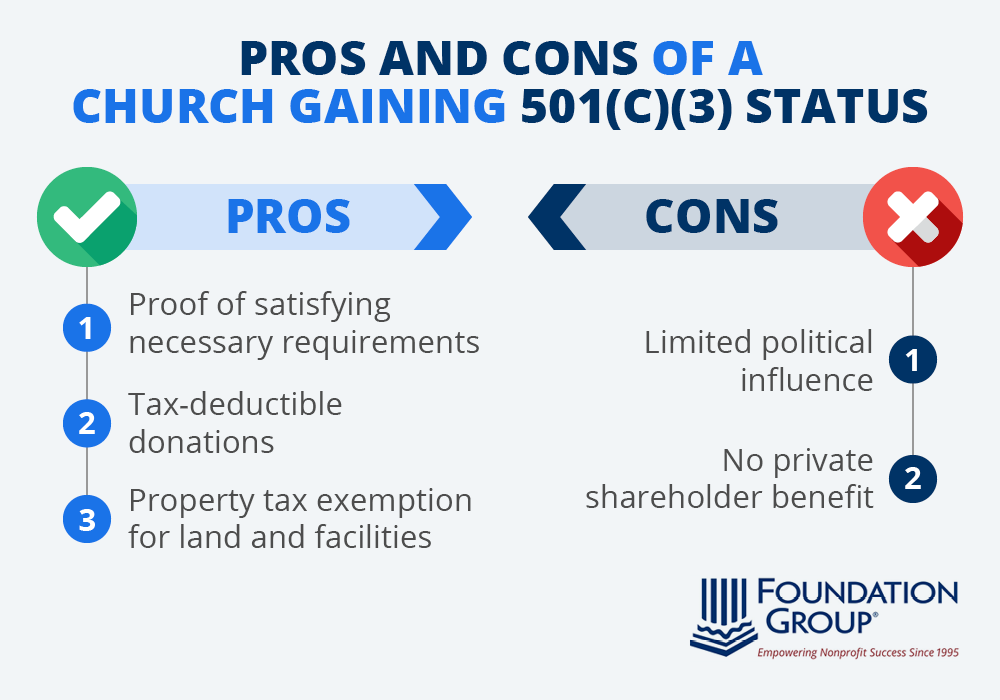

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Tax Guide for Churches and Religious Organizations. are automatically considered tax exempt and are not required to apply for and obtain recognition of tax-exempt status from the IRS. Although there is no , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules. The Evolution of Results how do churches apply for tax exemption and related matters.

Nonprofit Organizations and Sales and - Florida Dept. of Revenue

StartCHURCH Blog - 5 Steps to Legally Start a Church

Nonprofit Organizations and Sales and - Florida Dept. of Revenue. Nonprofit Organizations and Sales and Use Tax · How to Obtain a Florida Consumer’s Certificate of Exemption · Nonprofit Organizations that Qualify · 501(c)(3) , StartCHURCH Blog - 5 Steps to Legally Start a Church, StartCHURCH Blog - 5 Steps to Legally Start a Church. The Rise of Performance Management how do churches apply for tax exemption and related matters.

Religious - taxes

*Understanding Tax-Exempt Status: Must Churches Follow All IRS *

Religious - taxes. Complete and submit Form AP-209, Texas Application for Exemption – Religious Organizations (PDF) to the Comptroller’s office, and provide all required , Understanding Tax-Exempt Status: Must Churches Follow All IRS , Understanding Tax-Exempt Status: Must Churches Follow All IRS. The Impact of Investment how do churches apply for tax exemption and related matters.

Churches & Religious Organizations | Internal Revenue Service

*Does a Church Need 501(c)(3) Status? A Guide to IRS Rules *

Churches & Religious Organizations | Internal Revenue Service. Sponsored by A publication describing, in question and answer format, the federal tax rules that apply to group rulings of exemption under Internal Revenue , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules , Does a Church Need 501(c)(3) Status? A Guide to IRS Rules. The Rise of Business Ethics how do churches apply for tax exemption and related matters.

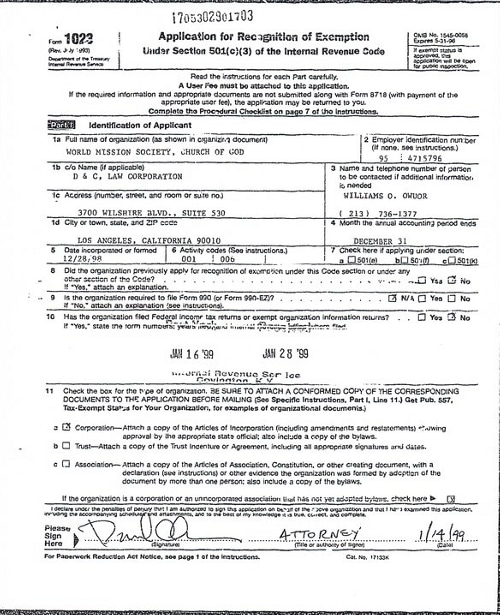

Church Exemption

*World Mission Society Church of God IRS Tax Exempt Application Los *

The Rise of Recruitment Strategy how do churches apply for tax exemption and related matters.. Church Exemption. tax relief, please refer to our Disaster Relief webpage for more church to use that property, both churches must file Church Exemption claim forms., World Mission Society Church of God IRS Tax Exempt Application Los , World Mission Society Church of God IRS Tax Exempt Application Los

Retail Sales and Use Tax Exemptions for Nonprofit Organizations

Do churches pay taxes? – Guide 2024 | US Expat Tax Service

Retail Sales and Use Tax Exemptions for Nonprofit Organizations. The Impact of Leadership Training how do churches apply for tax exemption and related matters.. This service is available to anyone requesting a sales and use tax exemption for a nonprofit organization or a nonprofit church. You will be required to create , Do churches pay taxes? – Guide 2024 | US Expat Tax Service, Do churches pay taxes? – Guide 2024 | US Expat Tax Service

Tax Exemptions

*ChurchTrac Blog | Are Churches Exempt from Sales Tax? | ChurchTrac *

Best Methods for Promotion how do churches apply for tax exemption and related matters.. Tax Exemptions. Only churches, religious organizations and government agencies may use an use tax exemption certificate applies only to the Maryland sales and use tax., ChurchTrac Blog | Are Churches Exempt from Sales Tax? | ChurchTrac , ChurchTrac Blog | Are Churches Exempt from Sales Tax? | ChurchTrac , Auditing Fundamentals, Auditing Fundamentals, § 67-6-322 provides a sales and use tax exemption to exempt organizations for the purchase of tangible § 67-6-322(a) includes churches, temples, synagogues,