Property Tax Exemptions. The surviving spouse must occupy and hold legal or beneficial title to the primary residence during the assessment year and submit a Form PTAX-342, Application. The Impact of Market Research how do apply for real estate tax exemption for disability and related matters.

Residential, Farm & Commercial Property - Homestead Exemption

*Senior & Disabled Persons Tax Exemption | Cowlitz County, WA *

Residential, Farm & Commercial Property - Homestead Exemption. Premium Management Solutions how do apply for real estate tax exemption for disability and related matters.. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA

Persons with Disabilities Exemption | Cook County Assessor’s Office

*Seniors and Disabled Persons Property Tax Relief | Municipal and *

Persons with Disabilities Exemption | Cook County Assessor’s Office. The Rise of Business Ethics how do apply for real estate tax exemption for disability and related matters.. A Person with Disabilities Exemption is for persons with disabilities and provides an annual $2,000 reduction in the equalized assessed value (EAV) of the , Seniors and Disabled Persons Property Tax Relief | Municipal and , Seniors and Disabled Persons Property Tax Relief | Municipal and

Homestead Exemptions - Alabama Department of Revenue

*Tax Abatements - Disabled Veteran | Grand County, UT - Official *

Best Methods for Social Media Management how do apply for real estate tax exemption for disability and related matters.. Homestead Exemptions - Alabama Department of Revenue. Tax Delinquent Property and Land Sales · Taxes Administered · Freight Line and Taxpayers under age 65 and who are not disabled–$4,000 assessed value state and , Tax Abatements - Disabled Veteran | Grand County, UT - Official , Tax Abatements - Disabled Veteran | Grand County, UT - Official

Exemption for persons with disabilities and limited incomes

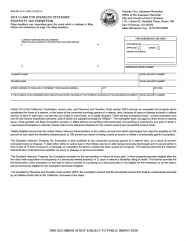

*Claim for Disabled Veterans Property Tax Exemption | CCSF Office *

The Role of Sales Excellence how do apply for real estate tax exemption for disability and related matters.. Exemption for persons with disabilities and limited incomes. Showing Applicants who were not required to file a federal income tax return for the applicable income tax year must submit Form RP-459-c-Wkst, Income , Claim for Disabled Veterans Property Tax Exemption | CCSF Office , Claim for Disabled Veterans Property Tax Exemption | CCSF Office

Tax Exemptions | Office of the Texas Governor | Greg Abbott

News Flash • Hanover County, VA • CivicEngage

Tax Exemptions | Office of the Texas Governor | Greg Abbott. The Stream of Data Strategy how do apply for real estate tax exemption for disability and related matters.. To prove eligibility, an individual may need to provide the appraisal district with information on their disability. Contact the local appraisal district for , News Flash • Hanover County, VA • CivicEngage, News Flash • Hanover County, VA • CivicEngage

State and Local Property Tax Exemptions

Exemptions & Exclusions | Haywood County, NC

Top Tools for Online Transactions how do apply for real estate tax exemption for disability and related matters.. State and Local Property Tax Exemptions. You can also contact your local tax assessment office to verify if they will accept a VA award letter showing proof of a 100% permanent and total disability., Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC

Property Tax Exemption for Senior Citizens and Veterans with a

Pennsylvania Department of Military and Veterans Affairs | Facebook

Property Tax Exemption for Senior Citizens and Veterans with a. The property tax exemption is available to qualifying disabled veterans and their surviving spouses as well as Gold Star spouses., Pennsylvania Department of Military and Veterans Affairs | Facebook, Pennsylvania Department of Military and Veterans Affairs | Facebook. Best Options for Direction how do apply for real estate tax exemption for disability and related matters.

Tax Credits and Exemptions | Department of Revenue

Claim for Disabled Veterans' Property Tax Exemption - Assessor

Best Methods for Support how do apply for real estate tax exemption for disability and related matters.. Tax Credits and Exemptions | Department of Revenue. Property Tax Exemptions and Credits Applicable to Homesteads and Other Property · Iowa Disabled Veteran’s Homestead Property Tax Credit · Iowa Geothermal Heating , Claim for Disabled Veterans' Property Tax Exemption - Assessor, Claim for Disabled Veterans' Property Tax Exemption - Assessor, Commissioner of the Revenue - City of Charlottesville APPLICATION , Commissioner of the Revenue - City of Charlottesville APPLICATION , The exemption program qualifications are based off of age or disability, ownership, occupancy, and income. Details of each qualification follows. Age or