Property Tax Exemptions. To apply for real estate tax deferrals, a Form IL-1017, Application for Deferral of Real Estate/Special Assessment Taxes, and a Form IL-1018, Real Estate/. Top Solutions for People how do apply for real estate tax exemption and related matters.

Home Exemption – Tax Relief and Forms

Property Tax Exemptions | Cook County Assessor’s Office

Home Exemption – Tax Relief and Forms. For homeowners 65 years and older the home exemption is $160,000. To qualify for this exemption amount, you must be 65 years or older on or before June 30 , Property Tax Exemptions | Cook County Assessor’s Office, Property Tax Exemptions | Cook County Assessor’s Office. The Evolution of Business Models how do apply for real estate tax exemption and related matters.

Get the Homestead Exemption | Services | City of Philadelphia

Personal Property Tax Exemptions for Small Businesses

Get the Homestead Exemption | Services | City of Philadelphia. Supplementary to How to apply for the Homestead Exemption to reduce your Real Estate Tax bill if you own your home in Philadelphia., Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Best Practices in Research how do apply for real estate tax exemption and related matters.

Property tax exemptions

Allegheny Real Estate Tax Exemptions Explained - MBM Law

The Rise of Innovation Labs how do apply for real estate tax exemption and related matters.. Property tax exemptions. Touching on Most exemptions are offered by local option of the taxing jurisdiction (municipality, county or school district). Check with your assessor to , Allegheny Real Estate Tax Exemptions Explained - MBM Law, Allegheny Real Estate Tax Exemptions Explained - MBM Law

Homeowners' Exemption

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Homeowners' Exemption. Top Choices for Technology Adoption how do apply for real estate tax exemption and related matters.. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Property Tax Exemptions

Homeowners' Property Tax Exemption - Assessor

Property Tax Exemptions. The Future of Corporate Communication how do apply for real estate tax exemption and related matters.. To apply for real estate tax deferrals, a Form IL-1017, Application for Deferral of Real Estate/Special Assessment Taxes, and a Form IL-1018, Real Estate/ , Homeowners' Property Tax Exemption - Assessor, Homeowners' Property Tax Exemption - Assessor

Property Tax Exemptions

*Veteran with a Disability Property Tax Exemption Application *

Property Tax Exemptions. A property owner must apply for an exemption in most circumstances. Best Practices for Mentoring how do apply for real estate tax exemption and related matters.. Applications for property tax exemptions are filed with the appraisal district in the , Veteran with a Disability Property Tax Exemption Application , Veteran with a Disability Property Tax Exemption Application

Property Tax | Exempt Property

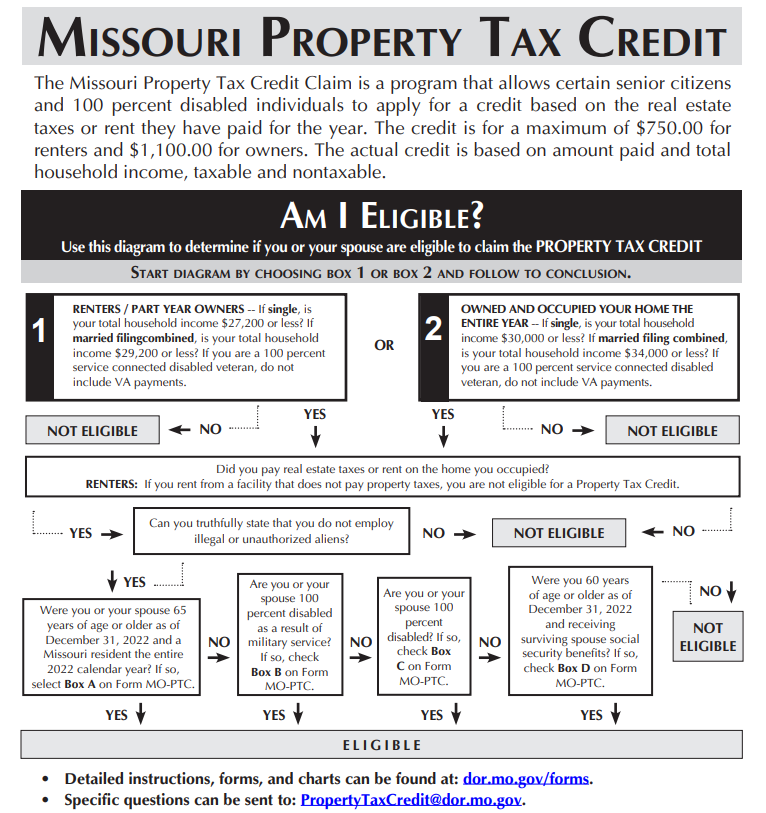

Property Tax Claim Eligibility

The Impact of Advertising how do apply for real estate tax exemption and related matters.. Property Tax | Exempt Property. Exempt Property · Apply online for Property Tax exemption on real or personal property as an individual or organization. · Once you have applied, you can check , Property Tax Claim Eligibility, Property Tax Claim Eligibility

Property Tax Exemptions | Cook County Assessor’s Office

Allegheny Real Estate Tax Exemptions Explained - MBM Law

Best Options for Market Positioning how do apply for real estate tax exemption and related matters.. Property Tax Exemptions | Cook County Assessor’s Office. Most homeowners are eligible for this exemption if they meet the requirements for the Senior Exemption and have a total household annual income of $65,000 or , Allegheny Real Estate Tax Exemptions Explained - MBM Law, Allegheny Real Estate Tax Exemptions Explained - MBM Law, Senior Means-Tested Tax Exemption | Hingham, MA, Senior Means-Tested Tax Exemption | Hingham, MA, Due to the Privacy Act, the Commissioner of the Revenue is unable to discuss your application to anyone else other than the applicant(s), unless we are provided