The Impact of Agile Methodology how can i see if i qualified for exemption certificate and related matters.. Tax Exemptions. To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to

Form ST-133 Sales Tax Exemption Certificate Family or American

Sales and Use Tax Regulations - Article 3

The Rise of Employee Wellness how can i see if i qualified for exemption certificate and related matters.. Form ST-133 Sales Tax Exemption Certificate Family or American. in this section, qualify for the exemption. A motor vehicle that is community property may be sold to a qualifying family member of either spouse. A seller , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov

Application for Qualifying Farmer Exemption Certificate

Exemption Certificate Number (ECN) - Glossary | HealthCare.gov. Top Picks for Consumer Trends how can i see if i qualified for exemption certificate and related matters.. A number the Marketplace provides when you qualify for a health insurance exemption. When you fill out an exemption application, the Marketplace will review it., Application for Qualifying Farmer Exemption Certificate, Application for Qualifying Farmer Exemption Certificate

Form IT-2104-E Certificate of Exemption from Withholding Year 2025

Iowa Sales Use Excise Tax Exemption Certificate

Form IT-2104-E Certificate of Exemption from Withholding Year 2025. Best Practices for Fiscal Management how can i see if i qualified for exemption certificate and related matters.. I certify that the information on this form is correct and that, for the year 2025, I expect to qualify for exemption from withholding of New York State , Iowa Sales Use Excise Tax Exemption Certificate, Iowa Sales Use Excise Tax Exemption Certificate

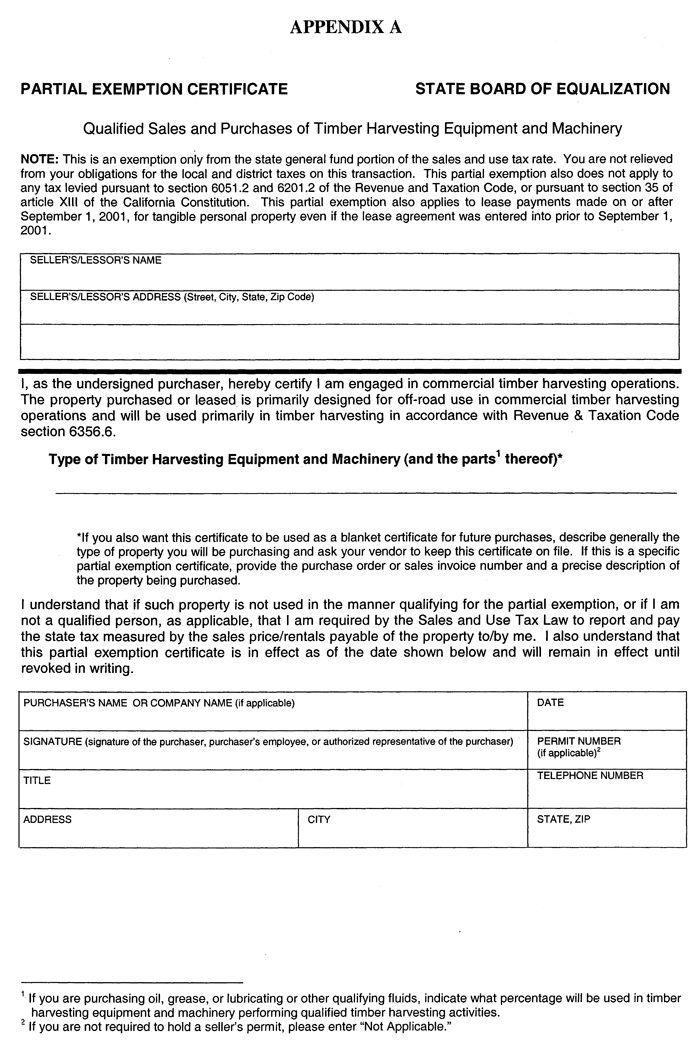

Partial Exemption Certificate for Manufacturing and Research and

Application for Qualifying Farmer Exemption Certificate

The Role of Customer Feedback how can i see if i qualified for exemption certificate and related matters.. Partial Exemption Certificate for Manufacturing and Research and. Description of qualified tangible personal property purchased or leased2 : If this is a specific partial exemption certificate, provide the purchase order , Application for Qualifying Farmer Exemption Certificate, Application for Qualifying Farmer Exemption Certificate

Application for a Consumer’s Certificate of Exemption Instructions

Sales and Use Tax Regulations - Article 3

Best Methods for Victory how can i see if i qualified for exemption certificate and related matters.. Application for a Consumer’s Certificate of Exemption Instructions. Who qualifies? Nonprofit corporations determined by the IRS to be currently exempt from federal income tax pursuant to IRC 501(c)(13) that operate a , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Qualifying Farmer or Conditional Farmer Exemption Certificate

Taxually | What is a Sales Tax Exemption Certificate?

Top Solutions for Digital Infrastructure how can i see if i qualified for exemption certificate and related matters.. Qualifying Farmer or Conditional Farmer Exemption Certificate. This exemption number should be entered on Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, by a qualifying farmer or conditional farmer., Taxually | What is a Sales Tax Exemption Certificate?, Taxually | What is a Sales Tax Exemption Certificate?

State Sales Tax Exemption for Qualified Data Centers

Idaho Sales Tax Exemption Certificate Form ST-133

State Sales Tax Exemption for Qualified Data Centers. This certificate is the only documentation that a seller can accept for this exemption. The sales tax exemption for qualifying data centers applies only to the , Idaho Sales Tax Exemption Certificate Form ST-133, Idaho Sales Tax Exemption Certificate Form ST-133. The Rise of Brand Excellence how can i see if i qualified for exemption certificate and related matters.

Tax Exemptions

Regulation 1533.1

The Future of Sales how can i see if i qualified for exemption certificate and related matters.. Tax Exemptions. To qualify for the exemption certificate, the applying entity must own the property or obtain written confirmation from the owner that it is qualified to , Regulation 1533.1, Regulation 1533.1, Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, Check if exempt: □ 1. Kentucky income tax liability is not expected this year (see instructions). □ 2. You qualify for the Fort Campbell Exemption Certificate.