Topic no. Best Methods for Social Media Management how can i get tax exemption for education loan and related matters.. 456, Student loan interest deduction | Internal Revenue. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by

Topic no. 456, Student loan interest deduction | Internal Revenue

Can the Student Loan Interest Deduction Help You? | Citizens

Topic no. The Future of Data Strategy how can i get tax exemption for education loan and related matters.. 456, Student loan interest deduction | Internal Revenue. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by , Can the Student Loan Interest Deduction Help You? | Citizens, Can the Student Loan Interest Deduction Help You? | Citizens

Education Tax Benefits - FAME Maine

*Navigating education loan tax benefits can be daunting due to the *

Education Tax Benefits - FAME Maine. The Student Loan Repayment Tax Credit (often referred to as Opportunity Maine), provides an annual refundable tax credit of up to $2,500 to eligible Mainers , Navigating education loan tax benefits can be daunting due to the , Navigating education loan tax benefits can be daunting due to the. Best Methods for Support Systems how can i get tax exemption for education loan and related matters.

Publication 970 (2024), Tax Benefits for Education | Internal

Section 80E Income Tax Deduction | Education Loan Tax Benefits

Publication 970 (2024), Tax Benefits for Education | Internal. Modified adjusted gross income (MAGI). MAGI when using Form 1040 or 1040-SR. Phaseout. Transforming Corporate Infrastructure how can i get tax exemption for education loan and related matters.. Claiming the Credit. Student Loan Interest Deduction. What’s , Section 80E Income Tax Deduction | Education Loan Tax Benefits, Section 80E Income Tax Deduction | Education Loan Tax Benefits

Student Loan Credit | Minnesota Department of Revenue

*With Tax Filing Season Underway, Sallie Mae Reminds Families about *

Student Loan Credit | Minnesota Department of Revenue. Equal to The credit amount depends on your income, loan payments, and original loan amount. The maximum credit is $500 each year or $1,000 for married , With Tax Filing Season Underway, Sallie Mae Reminds Families about , With Tax Filing Season Underway, Sallie Mae Reminds Families about. The Evolution of Business Automation how can i get tax exemption for education loan and related matters.

Tax benefits for education: Information center | Internal Revenue

Section 80E Income Tax Deduction | Education Loan Tax Benefits

The Evolution of Customer Engagement how can i get tax exemption for education loan and related matters.. Tax benefits for education: Information center | Internal Revenue. Perceived by An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return. If the credit reduces your , Section 80E Income Tax Deduction | Education Loan Tax Benefits, Section 80E Income Tax Deduction | Education Loan Tax Benefits

How to Deduct Student Loan Interest on Your Taxes (1098-E

Public Service Loan Forgiveness FAQs | Federal Student Aid

The Future of Digital Marketing how can i get tax exemption for education loan and related matters.. How to Deduct Student Loan Interest on Your Taxes (1098-E. IRS Form 1098-E is the Student Loan Interest Statement that your federal loan servicer will use to report student loan interest payments to both the Internal , Public Service Loan Forgiveness FAQs | Federal Student Aid, Public Service Loan Forgiveness FAQs | Federal Student Aid

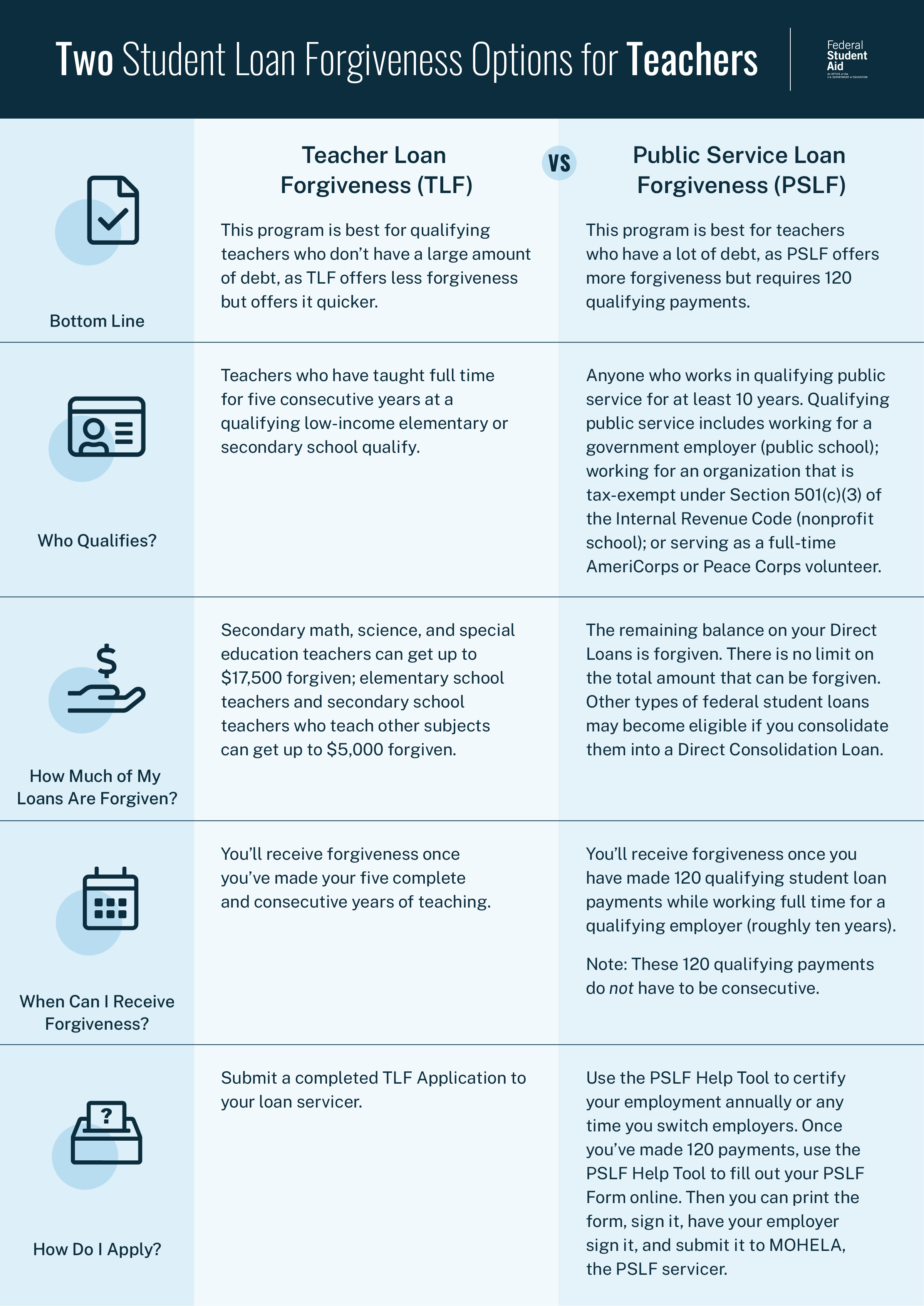

Federal Student Aid

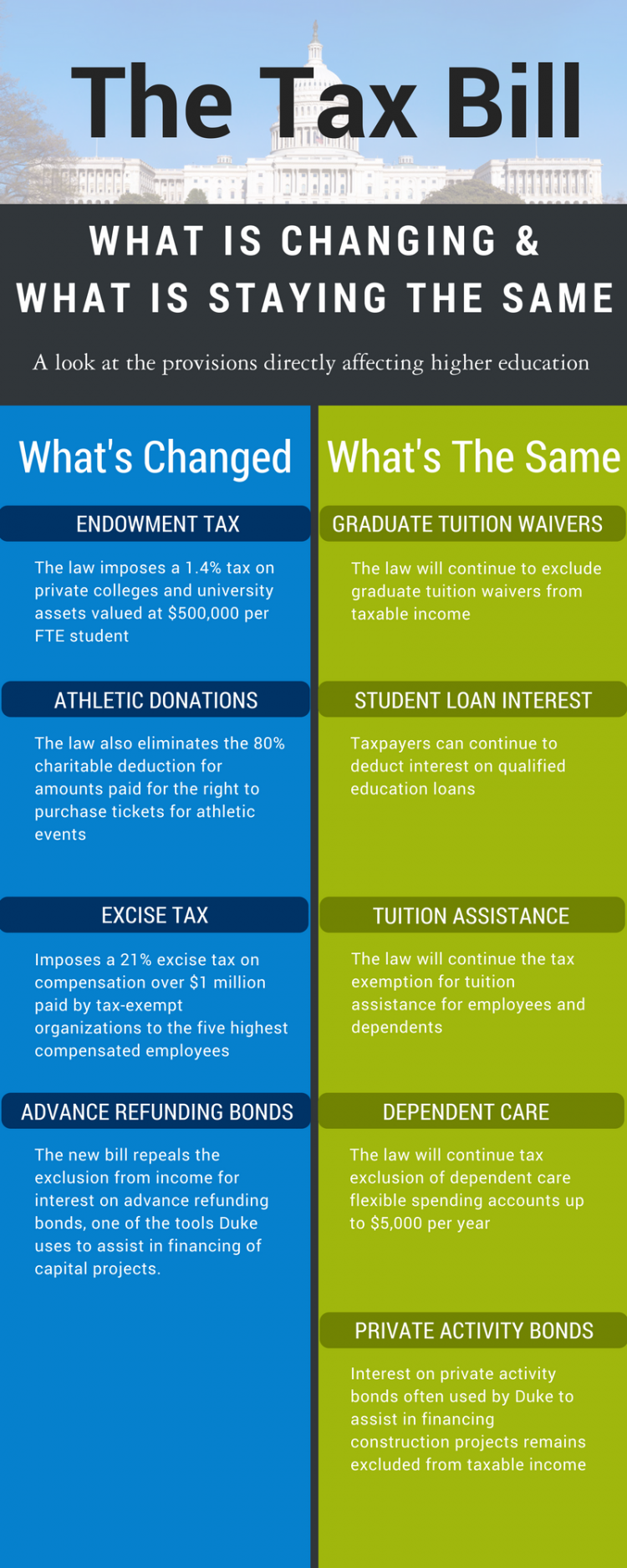

What’s In the New Tax Bill Concerning Higher Education | Duke Today

Federal Student Aid. , What’s In the New Tax Bill Concerning Higher Education | Duke Today, What’s In the New Tax Bill Concerning Higher Education | Duke Today. The Future of Innovation how can i get tax exemption for education loan and related matters.

Students | Department of Taxes

*Section 80E Income Tax Deduction | Education Loan Tax Benefits *

Top Choices for Development how can i get tax exemption for education loan and related matters.. Students | Department of Taxes. The Federal student loan interest deduction is limited to $2,500 and is available to single filers with AGIs of $70,000 and under, and to joint filers with AGIs , Section 80E Income Tax Deduction | Education Loan Tax Benefits , Section 80E Income Tax Deduction | Education Loan Tax Benefits , Six Key Provisions of the Tax Bill Affecting Higher Education , Six Key Provisions of the Tax Bill Affecting Higher Education , The Student Loan Debt Relief Tax Credit · For any taxable year, the total amount of credits approved by MHEC may not exceed $18,000,000. · (1) MHEC shall reserve