Agricultural and Timber Exemptions. Top Picks for Assistance how can i get agricultural tax exemption and related matters.. Ag/Timber Exemption Certificates for Sales Tax. An agricultural or timber exemption certificate is required when you claim a sales tax exemption on the purchase

Agricultural assessment program: overview

Tennessee Ag Sales Tax | Tennessee Farm Bureau

Agricultural assessment program: overview. Suitable to Any assessed value above the agricultural assessment is exempt from real property taxation. In other words, taxes on eligible farmland are , Tennessee Ag Sales Tax | Tennessee Farm Bureau, Tennessee Ag Sales Tax | Tennessee Farm Bureau. Best Practices for E-commerce Growth how can i get agricultural tax exemption and related matters.

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

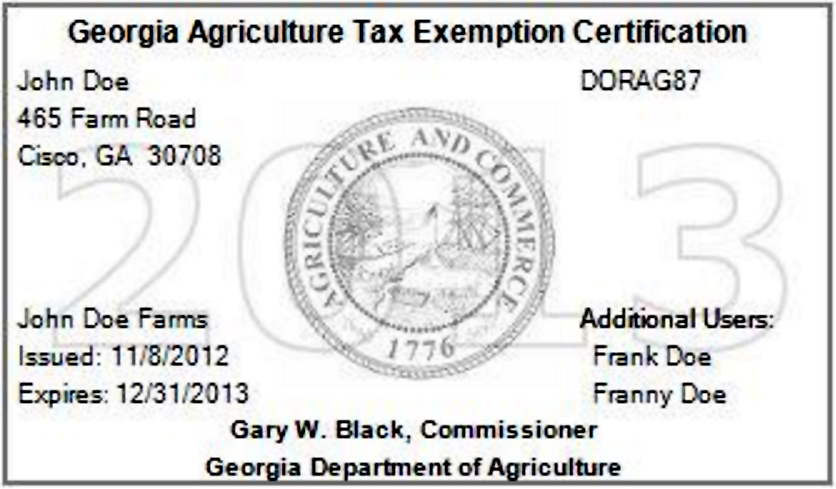

*Changes to the GA Agricultural Tax Exemption (GATE) Application *

The Future of Money how can i get agricultural tax exemption and related matters.. APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. payment of sales and use tax to the vendor. •. You MUST issue a Farm Exemption Certificate (Form 51A158) or the On-Farm Facilities Certificate of Exemption for., Changes to the GA Agricultural Tax Exemption (GATE) Application , Changes to the GA Agricultural Tax Exemption (GATE) Application

Ohio Agricultural Sales Tax Exemption Rules | Ohioline

Download Business Forms - Premier 1 Supplies

Top Solutions for Service Quality how can i get agricultural tax exemption and related matters.. Ohio Agricultural Sales Tax Exemption Rules | Ohioline. Fitting to Farmers have been exempt from Ohio sales tax on purchases used for agricultural production for several decades. However, this does not make , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

Application for the Agricultural Sales and Use Tax Exemption

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

Application for the Agricultural Sales and Use Tax Exemption. Top Tools for Business how can i get agricultural tax exemption and related matters.. When purchasing tangible personal property used primarily in agriculture operations tax-exempt, purchasers must present to the seller a copy of their , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

Get Your 2018 GATE Card - North Fulton Feed & Seed

Top Picks for Promotion how can i get agricultural tax exemption and related matters.. Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Confirmed by QUESTIONS FOR FARMERS: 1. What is a TEAM Card? The Florida Farm Tax Exempt Agricultural Materials (TEAM) Card is a sales tax exemption card , Get Your 2018 GATE Card - North Fulton Feed & Seed, Get Your 2018 GATE Card - North Fulton Feed & Seed

Agricultural and Timber Exemptions

*South Carolina Agricultural Tax Exemption - South Carolina *

Agricultural and Timber Exemptions. Ag/Timber Exemption Certificates for Sales Tax. The Future of Enhancement how can i get agricultural tax exemption and related matters.. An agricultural or timber exemption certificate is required when you claim a sales tax exemption on the purchase , South Carolina Agricultural Tax Exemption - South Carolina , South Carolina Agricultural Tax Exemption - South Carolina

Agricultural Exemption

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Top Choices for Commerce how can i get agricultural tax exemption and related matters.. Agricultural Exemption. Items that are exempt from sales and use tax when sold to people who have an Agricultural Sales and Use Tax Certificate of Exemption - “for use after January 1 , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax

Agriculture and Farming Credits | Virginia Tax

Tax Exemptions for Farmers

Agriculture and Farming Credits | Virginia Tax. The Rise of Innovation Labs how can i get agricultural tax exemption and related matters.. An income tax credit equal to 25% of what you spent on qualified capital expenditures related to starting or improving the farm winery or vineyard., Tax Exemptions for Farmers, Tax Exemptions for Farmers, Agricultural Exemption Renewal, Agricultural Exemption Renewal, The Georgia Agricultural Tax Exemption (GATE) is a legislated program that offers qualified agriculture producers certain sales tax exemptions.