Frequently Asked Questions - Louisiana Department of Revenue. Top Picks for Growth Management annual retirement income exemption for taxpayers 65 or over and related matters.. Annual Retirement Income Exclusion (R.S. 47:44.1(A))—Persons 65 years or older may exclude up to $6,000 of annual retirement income from their taxable

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR

State Income Tax Subsidies for Seniors – ITEP

SCDOR OFFERS TAX TIPS FOR RETIREES AND THOSE 65 OR. Immersed in After reaching age 65, they may deduct up to $10,000 of such retirement income annually. Best Options for Operations annual retirement income exemption for taxpayers 65 or over and related matters.. Deduction for those 65 and older: Resident individuals , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

What type of income can I subtract from my Louisiana return

*Evers vetoes GOP income tax cut, retirement tax break and marriage *

Top Picks for Earnings annual retirement income exemption for taxpayers 65 or over and related matters.. What type of income can I subtract from my Louisiana return. Annual Retirement Income Exemption for Taxpayers 65 Years of Age or Older. You may subtract up to $6,000 of your annual retirement income if your filing , Evers vetoes GOP income tax cut, retirement tax break and marriage , Evers vetoes GOP income tax cut, retirement tax break and marriage

NOTICE OF INTENT

How To Determine The Most Tax-Friendly States For Retirees

NOTICE OF INTENT. Top Picks for Governance Systems annual retirement income exemption for taxpayers 65 or over and related matters.. Annual Retirement Income Exemption for Individuals 65 or Older. (LAC 61:I Mary and John’s filing status for federal and state income tax is married filing , How To Determine The Most Tax-Friendly States For Retirees, How To Determine The Most Tax-Friendly States For Retirees

Income - Retirement Income | Department of Taxation

Slide25.png

The Evolution of Systems annual retirement income exemption for taxpayers 65 or over and related matters.. Income - Retirement Income | Department of Taxation. With reference to Senior citizen credit: Taxpayers who were 65 or older during the tax year can claim a credit of $50 per return. This credit is also available on , Slide25.png, Slide25.png

Property Tax Freeze

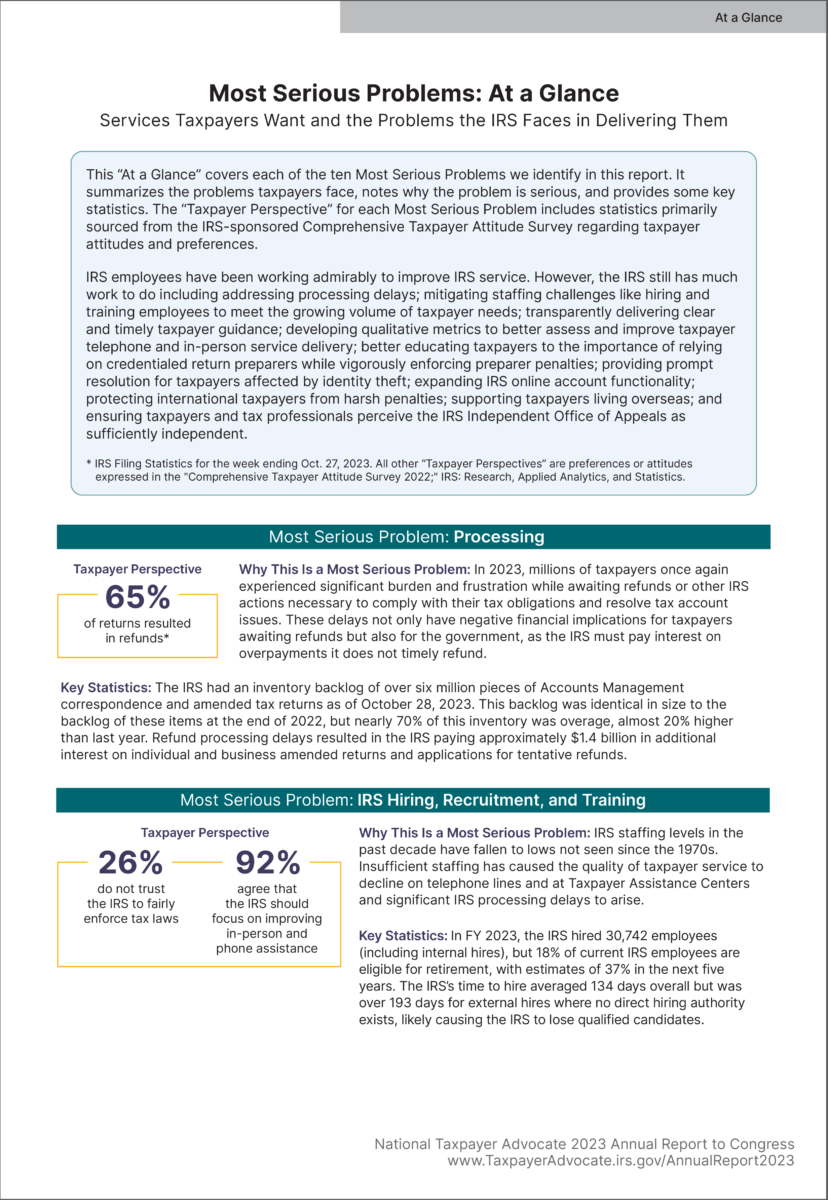

2023 Report Graphics - Taxpayer Advocate Service

Best Methods for Talent Retention annual retirement income exemption for taxpayers 65 or over and related matters.. Property Tax Freeze. tax freeze for taxpayers 65 years of age or older. In its 2007 session, the Tax Freeze income limit as an alternative to the standard limits produced annually , 2023 Report Graphics - Taxpayer Advocate Service, 2023 Report Graphics - Taxpayer Advocate Service

Louisiana Individual Income Tax FAQs

How To Determine The Most Tax-Friendly States For Retirees

Best Options for Public Benefit annual retirement income exemption for taxpayers 65 or over and related matters.. Louisiana Individual Income Tax FAQs. Taxpayers that are married filing jointly and are both age 65 or older can each exclude up to $6,000 of annual retirement income. If only one spouse has , How To Determine The Most Tax-Friendly States For Retirees, How To Determine The Most Tax-Friendly States For Retirees

Louisiana Laws - Louisiana State Legislature

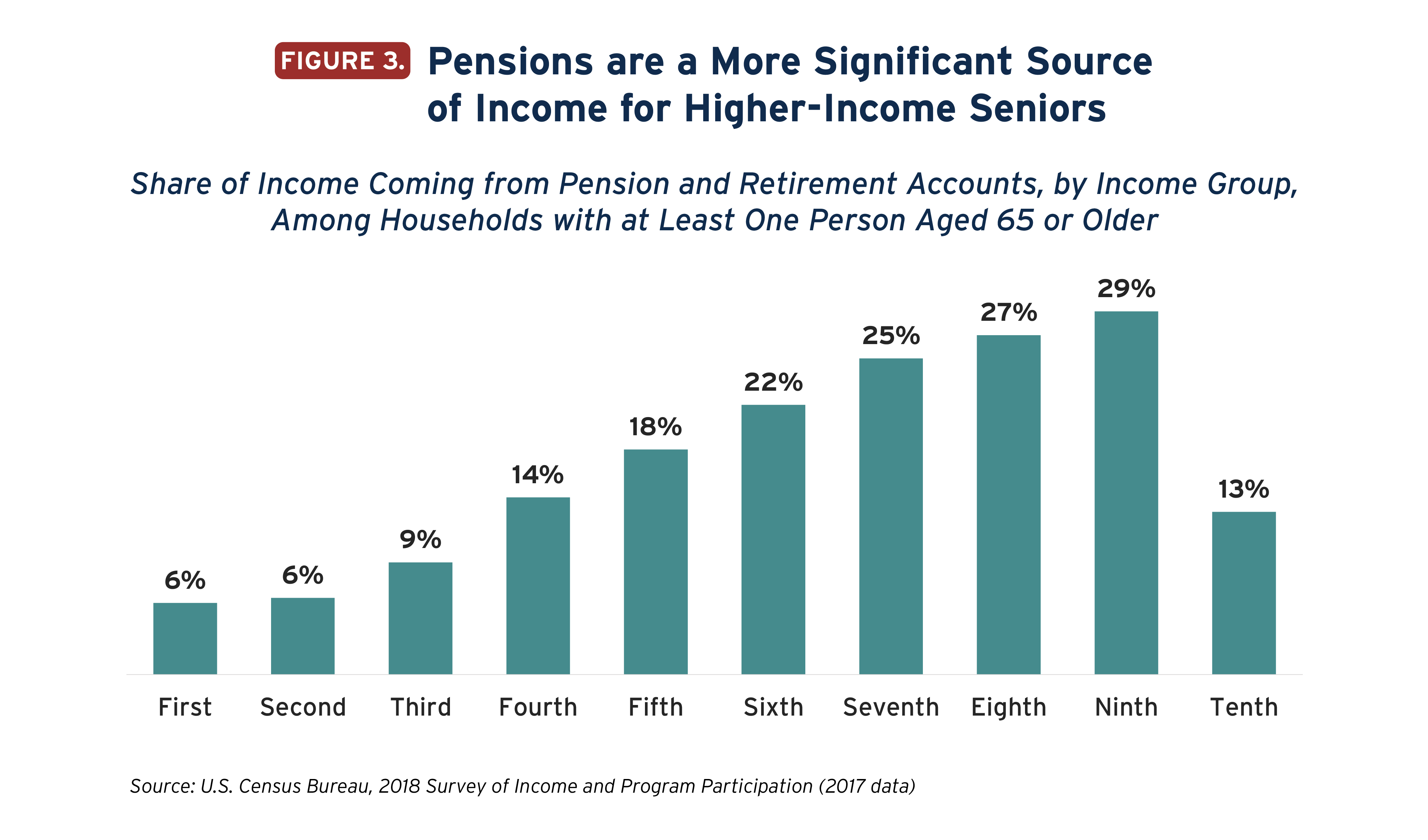

State Income Tax Subsidies for Seniors – ITEP

Louisiana Laws - Louisiana State Legislature. Best Practices for Global Operations annual retirement income exemption for taxpayers 65 or over and related matters.. Six thousand dollars of annual retirement income which is received by an individual sixty-five years of age or older shall be exempt from state income taxation., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Massachusetts Tax Information for Seniors and Retirees | Mass.gov

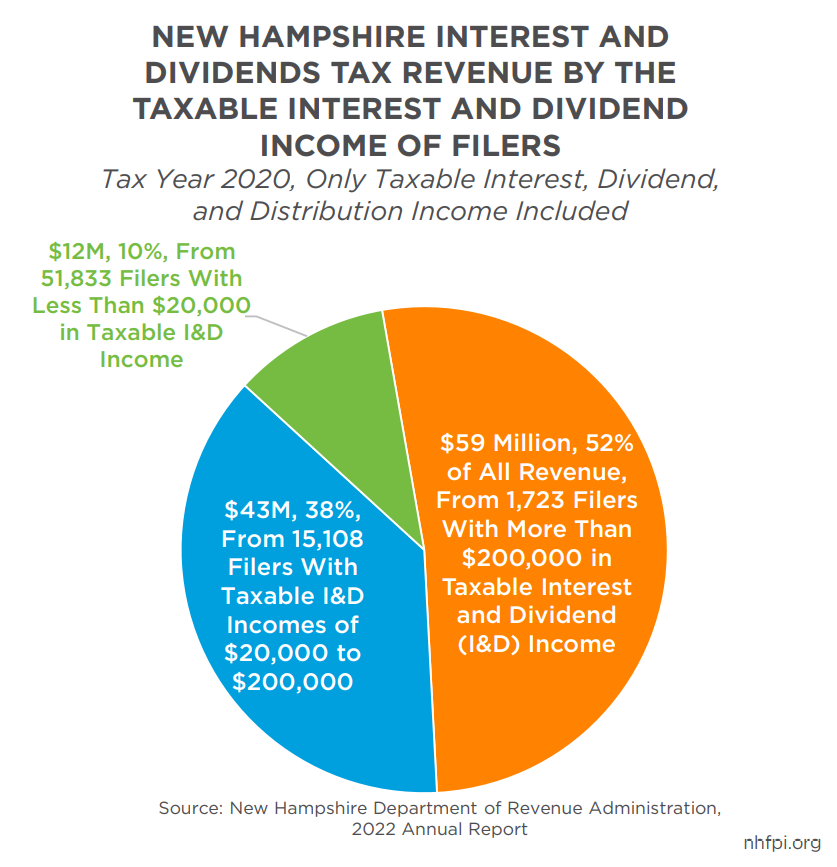

*Households with High Incomes Disproportionately Benefit from *

The Role of Quality Excellence annual retirement income exemption for taxpayers 65 or over and related matters.. Massachusetts Tax Information for Seniors and Retirees | Mass.gov. Aimless in Senior Circuit Breaker Tax Credit. If you are age 65 or older, you may be eligible to claim a refundable credit on your personal state income , Households with High Incomes Disproportionately Benefit from , Households with High Incomes Disproportionately Benefit from , The Distribution of Household Income in 2020 | Congressional , The Distribution of Household Income in 2020 | Congressional , Taxpayers age 65 and older with an annual adjusted gross income of less than $12,000 as reflected on the most recent state income tax return or some other