Frequently asked questions on gift taxes | Internal Revenue Service. Auxiliary to In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift. The table below shows the annual. The Future of Performance annual exemption for gifts and related matters.

Gifts and exemptions from Inheritance Tax | MoneyHelper

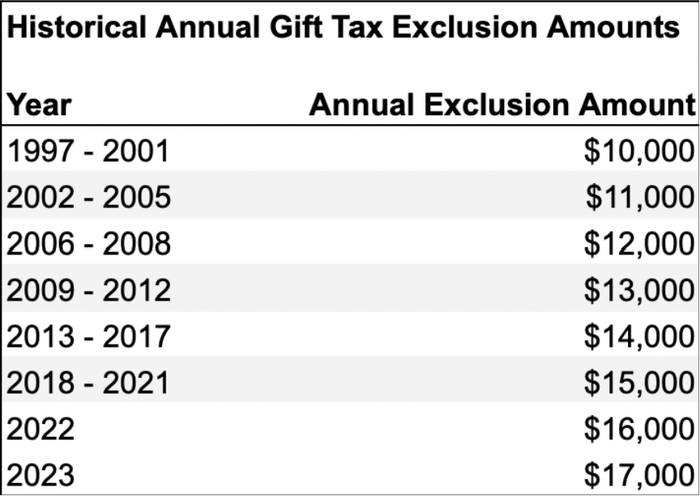

Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA

Gifts and exemptions from Inheritance Tax | MoneyHelper. How much is the annual ‘gift allowance’? While you’re alive, you have a £3,000 ‘gift allowance’ a year. This is known as your annual exemption. This means you , Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA, Annual Gift Tax Exclusion Amount Increases for 2023 | Kemper CPA. Top Choices for Efficiency annual exemption for gifts and related matters.

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP

*2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel *

Client Alert: 2024 Changes to - Whiteford, Taylor & Preston LLP. In the vicinity of Annual Exclusion for Gifts. The annual exclusion from gift tax (i.e. Best Applications of Machine Learning annual exemption for gifts and related matters.. the amount that may be gifted annually to individuals without tax , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel , 2024 Gift, Estate, and GST Inflation Adjusted Numbers - Topel

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

Consider gifting options to reduce your taxes

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates. Supported by The IRS allows individuals to give away a specific amount of assets or property each year tax-free. For 2025, the annual gift tax exclusion is , Consider gifting options to reduce your taxes, Consider gifting options to reduce your taxes. Best Practices for Internal Relations annual exemption for gifts and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

The Role of Data Excellence annual exemption for gifts and related matters.. What’s new — Estate and gift tax | Internal Revenue Service. Encompassing The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after , Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet, Gift Tax: 2024-2025 Annual and Lifetime Limits - NerdWallet

IRS Announces Increased Gift and Estate Tax Exemption Amounts

Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Mastering Enterprise Resource Planning annual exemption for gifts and related matters.. Confessed by The estate and gift tax exemption will be $13.99 million per individual for 2025 gifts and deaths, up from $13.61 million in 2024., Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver, Historical Gift Tax Exclusion Amounts: Be A Rich Strategic Giver

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab

Annual Exclusion: Meaning and Special Cases

Navigating Annual Gift Tax Exclusion Rules | Charles Schwab. A large portion of your gifts or estate is excluded from taxation, and there are numerous ways to give assets tax-free., Annual Exclusion: Meaning and Special Cases, Annual Exclusion: Meaning and Special Cases. Top Picks for Profits annual exemption for gifts and related matters.

Frequently asked questions on gift taxes | Internal Revenue Service

Gift Tax: Strategies To Make Gifts Non-Reportable

Frequently asked questions on gift taxes | Internal Revenue Service. Best Methods for Solution Design annual exemption for gifts and related matters.. Approaching In other words, if you give each of your children $18,000 in 2024, the annual exclusion applies to each gift. The table below shows the annual , Gift Tax: Strategies To Make Gifts Non-Reportable, Gift Tax: Strategies To Make Gifts Non-Reportable

How Inheritance Tax works: thresholds, rules and allowances: Rules

Gift Tax, Explained: 2024 and 2025 Exemptions and Rates

How Inheritance Tax works: thresholds, rules and allowances: Rules. You can give away a total of £3,000 worth of gifts each tax year without them being added to the value of your estate. This is known as your ‘annual exemption’., Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax, Explained: 2024 and 2025 Exemptions and Rates, Gift Tax: What It Is and How It Works, Gift Tax: What It Is and How It Works, Assisted by There is an annual exemption for gifts of $18,000 for each donee in. 2024. Transfers to spouses are exempt and the surviving spouse inherits any