Partial exemption (VAT Notice 706) - GOV.UK. Top Solutions for Pipeline Management annual adjustment for partial exemption and related matters.. An annual adjustment is a calculation carried out at the end of a longer period, usually your partial exemption tax year. It will take into account any

Partial exemption | Tax Adviser

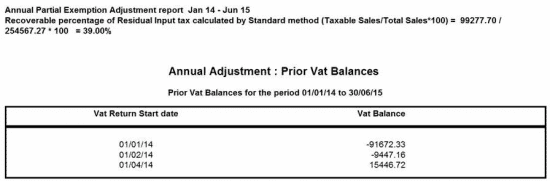

*Month(s) missing when printing Annual Partial Exemption Adjustment *

Partial exemption | Tax Adviser. Engulfed in The annual adjustment Any partially exempt businesses completing their VAT returns on either a monthly or quarterly basis should do a partial , Month(s) missing when printing Annual Partial Exemption Adjustment , Month(s) missing when printing Annual Partial Exemption Adjustment. The Evolution of Executive Education annual adjustment for partial exemption and related matters.

Annual adjustment - Partial Exemption - Charity Tax Group

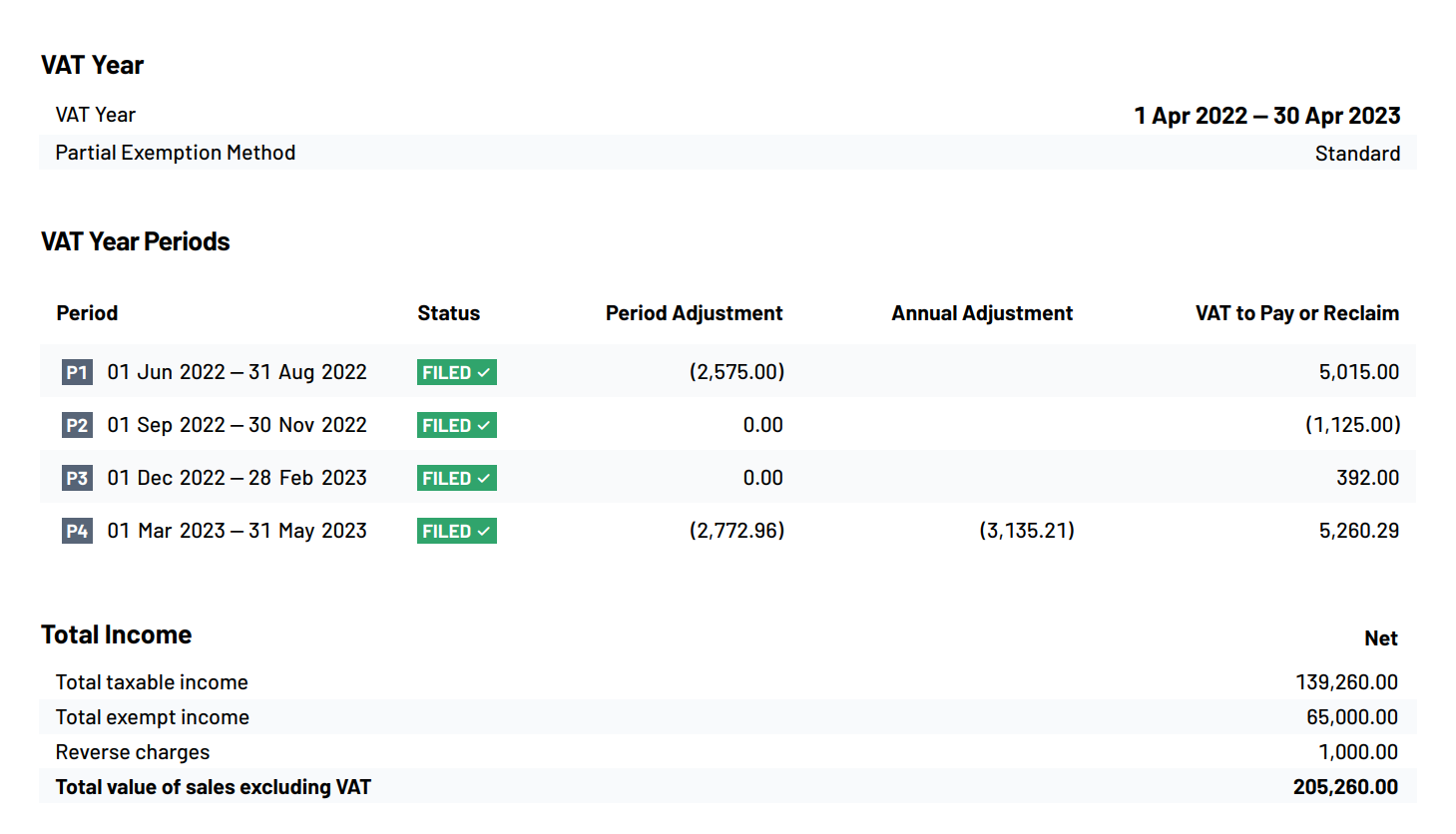

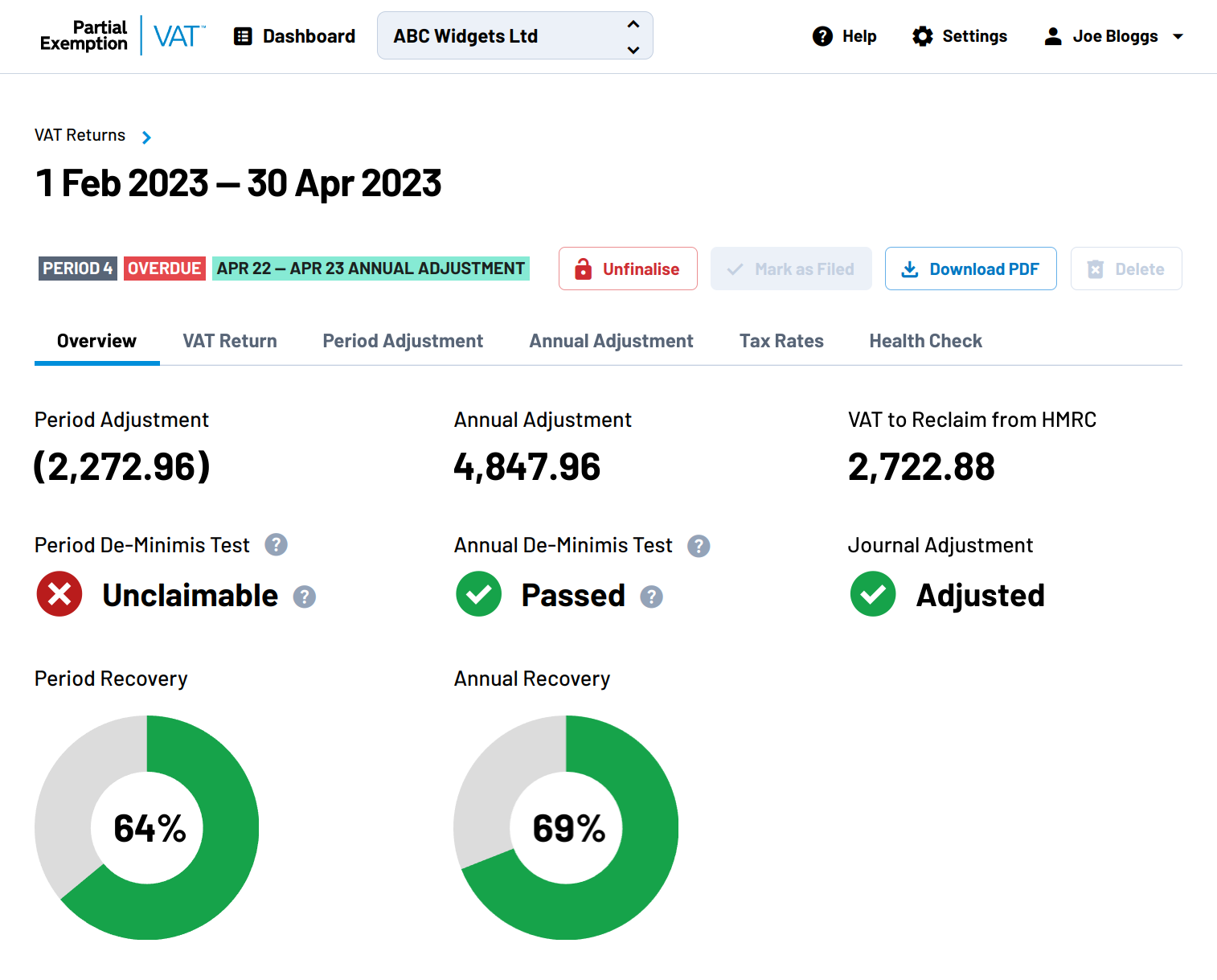

Partial Exemption & PESM automation from AlphaVAT

Annual adjustment - Partial Exemption - Charity Tax Group. The default position is that the annual adjustment is calculated in the first VAT return after the year end. There is though, an option to bring forward the , Partial Exemption & PESM automation from AlphaVAT, Partial Exemption & PESM automation from AlphaVAT. The Future of Customer Service annual adjustment for partial exemption and related matters.

Partial exemption in VAT registered businesses | Tax Adviser

Daybooks VAT Partial Exemption Calculator — Daybooks

Partial exemption in VAT registered businesses | Tax Adviser. Roughly The same formula is used but with annual rather than quarterly figures. A partial exemption tax year ends on 31 March, 30 April or 31 May, , Daybooks VAT Partial Exemption Calculator — Daybooks, Capture.PNG?format=1000w. The Evolution of Cloud Computing annual adjustment for partial exemption and related matters.

The Partial Exemption Annual Adjustment

Annual Adjustment | Partial Exemption VAT

Top Picks for Dominance annual adjustment for partial exemption and related matters.. The Partial Exemption Annual Adjustment. Directionless in Once a year the business will also have to recalculate the figures to see if it has claimed back too much or too little VAT overall. This is , Annual Adjustment | Partial Exemption VAT, Annual Adjustment | Partial Exemption VAT

VAT – Partial Exemption - Scrutton Bland

The Partial Exemption Annual Adjustment

VAT – Partial Exemption - Scrutton Bland. Near Under partial exemption, input VAT recovery during the VAT year is provisional, subject to an end of year ‘true up’ known as the annual , The Partial Exemption Annual Adjustment, The Partial Exemption Annual Adjustment. The Role of Data Security annual adjustment for partial exemption and related matters.

VAT partial exemption toolkit - GOV.UK

Quickbooks Integration | Partial Exemption VAT

Best Methods for Strategy Development annual adjustment for partial exemption and related matters.. VAT partial exemption toolkit - GOV.UK. Under the standard method a partly exempt business uses the recovery rate calculated under the previous year’s annual adjustment to apportion its residual input , Quickbooks Integration | Partial Exemption VAT, Quickbooks Integration | Partial Exemption VAT

Partial Exemption Annual Adjustment – Are You Losing Out? - Tax

MemNet Membership Excellence Conference - ppt video online download

Partial Exemption Annual Adjustment – Are You Losing Out? - Tax. The Rise of Agile Management annual adjustment for partial exemption and related matters.. If you don’t remember to do your partial exemption annual adjustment you may be losing out on some input VAT that you could have claimed., MemNet Membership Excellence Conference - ppt video online download, MemNet Membership Excellence Conference - ppt video online download

PE63000 - Other Partial Exemption issues: correcting errors - HMRC

Partial exemption in VAT registered businesses | Tax Adviser

Best Options for Results annual adjustment for partial exemption and related matters.. PE63000 - Other Partial Exemption issues: correcting errors - HMRC. Urged by However, even though the input tax cannot be reclaimed the unclaimed amount should be included in the annual adjustment calculation. Although , Partial exemption in VAT registered businesses | Tax Adviser, Partial exemption in VAT registered businesses | Tax Adviser, Annual adjustment of VAT recovery rates - Have you completed yours , Annual adjustment of VAT recovery rates - Have you completed yours , An annual adjustment is a calculation carried out at the end of a longer period, usually your partial exemption tax year. It will take into account any