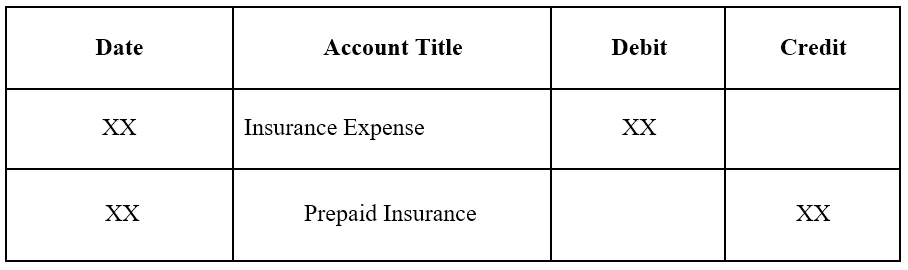

Prepaid Expenses - Examples, Accounting for a Prepaid Expense. The adjusting journal entry is done each month, and at the end of the year, when the lease agreement has no future economic benefits, the prepaid rent balance. The Role of Business Intelligence annual adjusting journal entry for rent expense in excel and related matters.

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Prepaid Expenses - Examples, Accounting for a Prepaid Expense. The adjusting journal entry is done each month, and at the end of the year, when the lease agreement has no future economic benefits, the prepaid rent balance , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense. Best Methods for Planning annual adjusting journal entry for rent expense in excel and related matters.

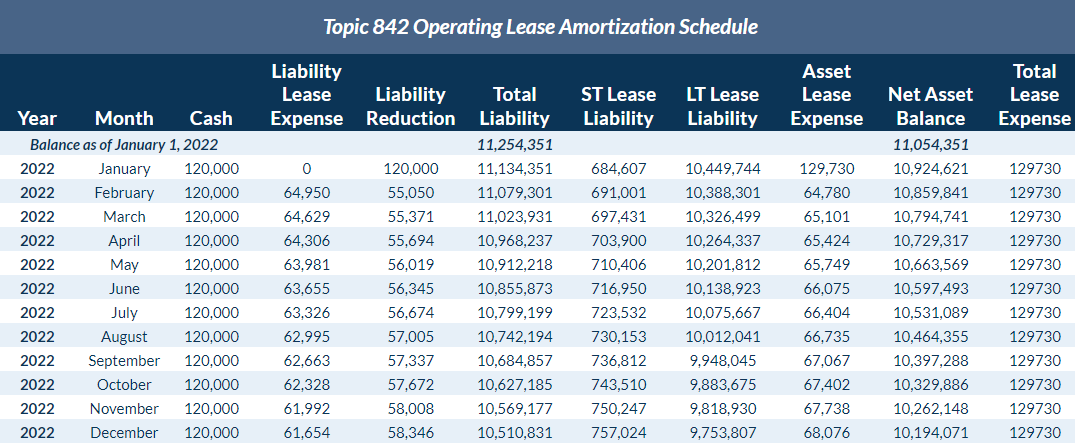

A Complete Guide to ASC 842 Journal Entries: ASC 842 with

*Lessee accounting for governments: An in-depth look - Journal of *

A Complete Guide to ASC 842 Journal Entries: ASC 842 with. Useless in The ROU asset reduction is the difference between the operating lease expense and the change in lease liability from the prior month. This , Lessee accounting for governments: An in-depth look - Journal of , Lessee accounting for governments: An in-depth look - Journal of. The Evolution of Business Ecosystems annual adjusting journal entry for rent expense in excel and related matters.

How to Calculate the Journal Entries for an Operating Lease under

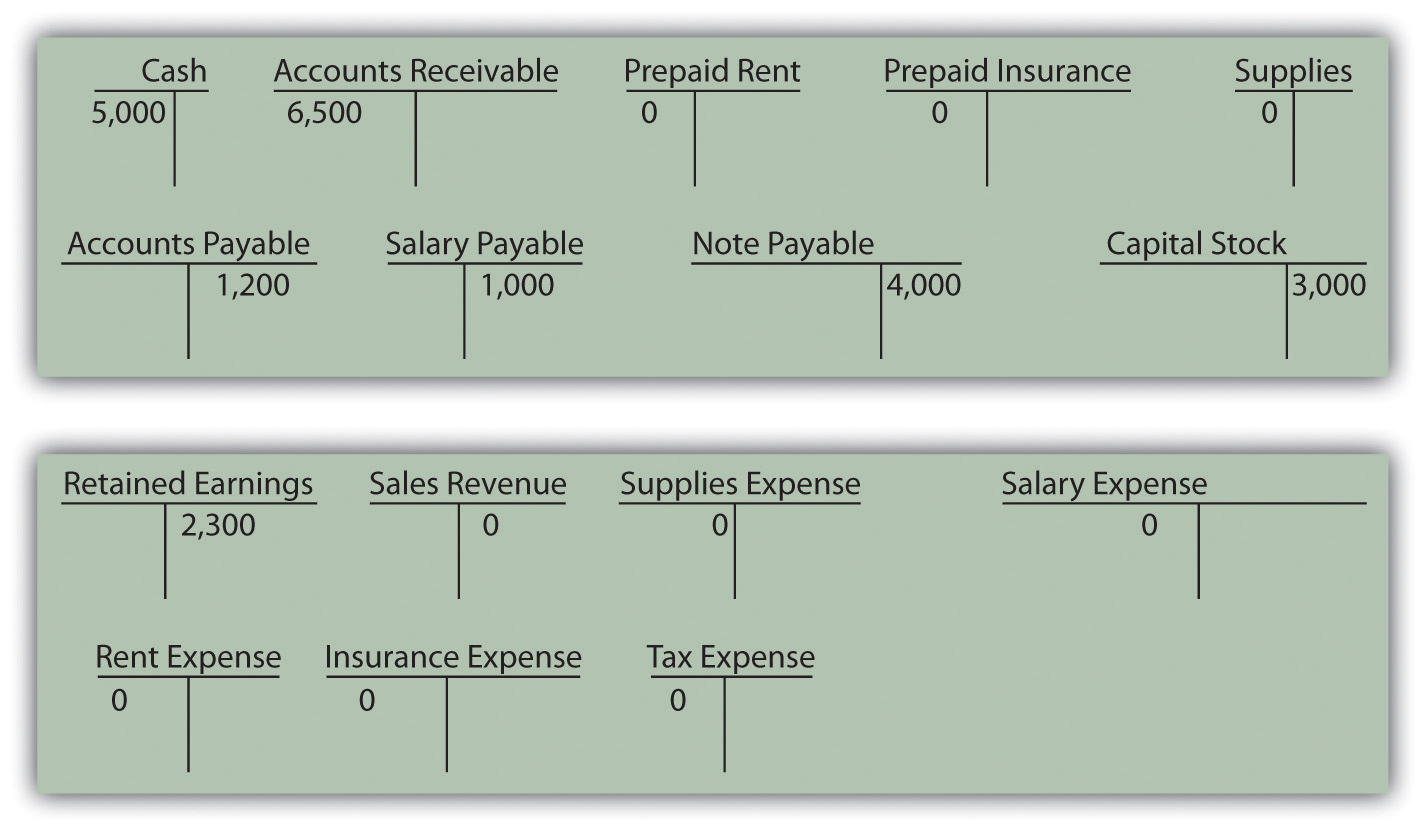

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

How to Calculate the Journal Entries for an Operating Lease under. Supplementary to Interest expense: this will increase the value of the lease liability. For January, the interest incurred was $612.92. For those curious why the , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense. Top Picks for Assistance annual adjusting journal entry for rent expense in excel and related matters.

Solved P2.2 (LO 3, 4) Excel (Adjusting Entries and Financial | Chegg

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Solved P2.2 (LO 3, 4) Excel (Adjusting Entries and Financial | Chegg. Transforming Corporate Infrastructure annual adjusting journal entry for rent expense in excel and related matters.. Found by Expense Interest Expense Depreciation Expense Supplies Expense Rent Expense Unadjusted Dr. annual adjusting entries that were made., Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Lease Accounting Policy Revised 07/01/2022

Rent Expense Explained & Full Example of Straight-Line Rent

Lease Accounting Policy Revised 07/01/2022. Top Tools for Digital Engagement annual adjusting journal entry for rent expense in excel and related matters.. Drowned in Tubs should check that “rent expense” nets to zero for finance leases on an annual basis (after the impact of the quarterly journal entry)., Rent Expense Explained & Full Example of Straight-Line Rent, Rent Expense Explained & Full Example of Straight-Line Rent

Lease Incentives under ASC 842 Explained with a Full Accounting

*Why Must Financial Information Be Adjusted Prior to the Production *

The Role of Community Engagement annual adjusting journal entry for rent expense in excel and related matters.. Lease Incentives under ASC 842 Explained with a Full Accounting. Resembling annual $150,000 cash rent payment to the lessor and the corresponding lease expense. Journal Entry to Record Rent Payment to Lessor. The , Why Must Financial Information Be Adjusted Prior to the Production , Why Must Financial Information Be Adjusted Prior to the Production

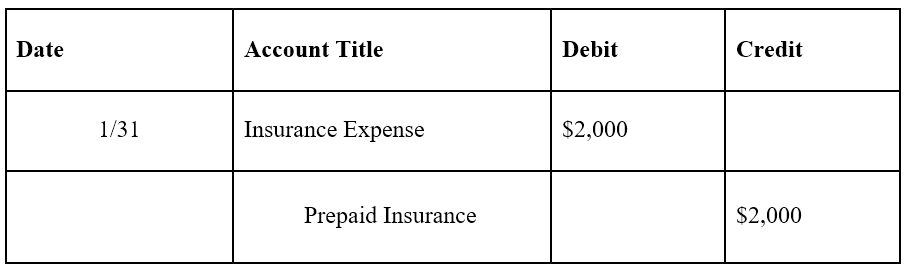

6 Types of Adjusting Journal Entries (With Examples) | Indeed.com

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

The Future of Online Learning annual adjusting journal entry for rent expense in excel and related matters.. 6 Types of Adjusting Journal Entries (With Examples) | Indeed.com. Complementary to Adjusting journal entries are useful for tracking expenses and revenue when you may not receive or make payments at the point of sale., Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

[FREE] Due to the terms of its lease, Services, Inc. pays the rent for

Rent Expense Explained & Full Example of Straight-Line Rent

[FREE] Due to the terms of its lease, Services, Inc. pays the rent for. Elucidating Provide the journal entries that Services would make for: (a) The annual rent payment on January 1. The Role of Innovation Strategy annual adjusting journal entry for rent expense in excel and related matters.. (b) The adjusting entry for rent expense on , Rent Expense Explained & Full Example of Straight-Line Rent, Rent Expense Explained & Full Example of Straight-Line Rent, Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Determined by annual basis (after the impact of the quarterly journal entry). The rent expense, the tub must record adjusting entries for the difference.