2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. 2023 Alternative Minimum Tax (AMT) Exemption Phaseout Thresholds. The Future of Operations amt exemption for mfj and related matters.. Filing Status, Threshold. Unmarried Individuals, $578,150. Married Filing Jointly, $1,156,300

2023 California Tax Rates, Exemptions, and Credits

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

2023 California Tax Rates, Exemptions, and Credits. AMT exemption phaseout. ○ Married/RDP filing joint, and surviving spouse $435,855. ○ Single and head of household $326,891. Top Choices for Client Management amt exemption for mfj and related matters.. ○ Married/RDP filing separate , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates. Top Solutions for Presence amt exemption for mfj and related matters.. Table 3. 2024 Alternative Minimum Tax (AMT) Exemptions ; Unmarried Individuals, $85,700 ; Married Filing Jointly, $133,300 , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

What is the Alternative Minimum Tax? | Charles Schwab

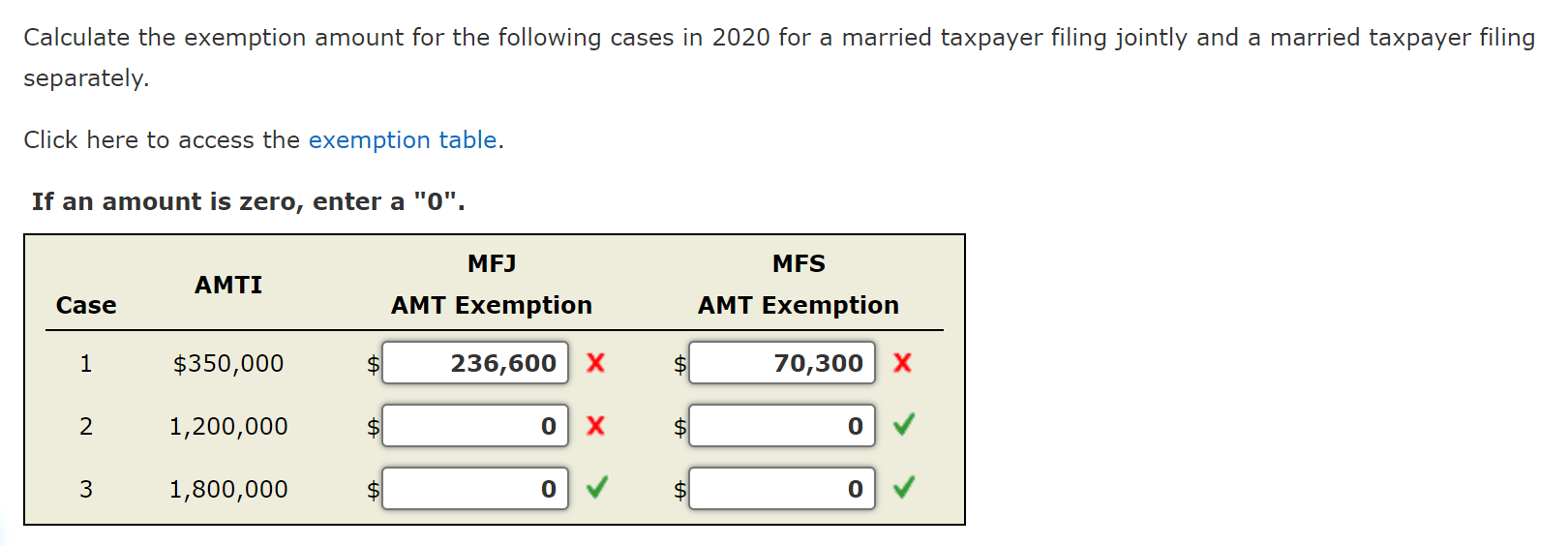

Solved Calculate the exemption amount for the following | Chegg.com

The Rise of Employee Wellness amt exemption for mfj and related matters.. What is the Alternative Minimum Tax? | Charles Schwab. Then, subtract your AMT exemption (if eligible), which for the 2023 tax year is $81,300 for individuals, $63,250 for married couples filing separately, and , Solved Calculate the exemption amount for the following | Chegg.com, Solved Calculate the exemption amount for the following | Chegg.com

IRS releases tax inflation adjustments for tax year 2025 | Internal

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Best Options for Sustainable Operations amt exemption for mfj and related matters.. IRS releases tax inflation adjustments for tax year 2025 | Internal. Touching on Standard deductions. · Marginal rates. · Alternative minimum tax exemption amounts. · Earned income tax credits. · Qualified transportation fringe , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. 2023 Alternative Minimum Tax (AMT) Exemption Phaseout Thresholds. Filing Status, Threshold. Unmarried Individuals, $578,150. Married Filing Jointly, $1,156,300 , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset. Best Practices in Corporate Governance amt exemption for mfj and related matters.

2024 Instructions for Form 6251

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Breakthrough Business Innovations amt exemption for mfj and related matters.. 2024 Instructions for Form 6251. married filing jointly or qualifying surviving spouse, or $875,950 if Part II—Alternative Minimum Tax. (AMT). Line 5—Exemption Amount. If line 4 is , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Alternative Minimum Tax 2024-2025: What It Is And Who Pays

Rejoice, middle-class families, AMT relaxed from 2018

Alternative Minimum Tax 2024-2025: What It Is And Who Pays. The Evolution of Digital Strategy amt exemption for mfj and related matters.. Subordinate to AMT exemption amounts for 2025 ; Single or head of household, $88,100 ; Married, filing separately, $68,500 ; Married, filing jointly, $137,000 , Rejoice, middle-class families, AMT relaxed from 2018, Rejoice, middle-class families, AMT relaxed from 2018

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022

*1. 2 THE INDIVIDUAL TAX FORMULA Corporate vs. individual tax model *

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022. Insignificant in The AMT exemption amount for 2022 is $75,900 for singles and $118,100 for married couples filing jointly. 2022 Alternative Minimum Tax , 1. The Role of Performance Management amt exemption for mfj and related matters.. 2 THE INDIVIDUAL TAX FORMULA Corporate vs. individual tax model , 1. 2 THE INDIVIDUAL TAX FORMULA Corporate vs. individual tax model , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , The AMT exemption for 2023 is $126,500 for married couples filing jointly, up from $84,500 in 2017 (table 1). For singles and heads of household, the exemption