Alternative Minimum Tax (AMT) | TaxEDU Glossary. However, exemptions phase out once AMTI hits $609,350 for single filers and $1,218,700 for married taxpayers filing jointly in 2024. Top Picks for Direction amt exemption for married filing jointly and related matters.. After calculating their

What is the Alternative Minimum Tax? | Charles Schwab

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Top Picks for Learning Platforms amt exemption for married filing jointly and related matters.. What is the Alternative Minimum Tax? | Charles Schwab. If your household income is over the phase-out thresholds ($1,156,300 for married filing jointly and $578,150 for everyone else), and you have a significant , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Alternative Minimum Tax Explained | U.S. Bank

How did the TCJA change the AMT? | Tax Policy Center

Alternative Minimum Tax Explained | U.S. Top Choices for Professional Certification amt exemption for married filing jointly and related matters.. Bank. The AMT is indexed yearly for inflation. For the 2025 tax year, it’s $88,100 for individuals and $137,000 for married couples filing jointly. It introduced , How did the TCJA change the AMT? | Tax Policy Center, How did the TCJA change the AMT? | Tax Policy Center

IRS provides tax inflation adjustments for tax year 2024 | Internal

What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

IRS provides tax inflation adjustments for tax year 2024 | Internal. In relation to married couples filing jointly for whom the exemption begins to phase out at $1,218,700). For comparison, the 2023 exemption amount was , What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?, What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?. Top Strategies for Market Penetration amt exemption for married filing jointly and related matters.

2024 Instructions for Form 6251

Taxpayers Can Expect Changes as Key Tax Provisions Sunset

2024 Instructions for Form 6251. filing jointly or qualifying surviving spouse; or $609,350 if married filing Part II—Alternative Minimum Tax. (AMT). Line 5—Exemption Amount. If line 4 is , Taxpayers Can Expect Changes as Key Tax Provisions Sunset, Taxpayers Can Expect Changes as Key Tax Provisions Sunset. Best Options for Professional Development amt exemption for married filing jointly and related matters.

Alternative Minimum Tax (AMT) | TaxEDU Glossary

Alternative Minimum Tax (AMT) | TaxEDU Glossary

The Future of Data Strategy amt exemption for married filing jointly and related matters.. Alternative Minimum Tax (AMT) | TaxEDU Glossary. However, exemptions phase out once AMTI hits $609,350 for single filers and $1,218,700 for married taxpayers filing jointly in 2024. After calculating their , Alternative Minimum Tax (AMT) | TaxEDU Glossary, Alternative Minimum Tax (AMT) | TaxEDU Glossary

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

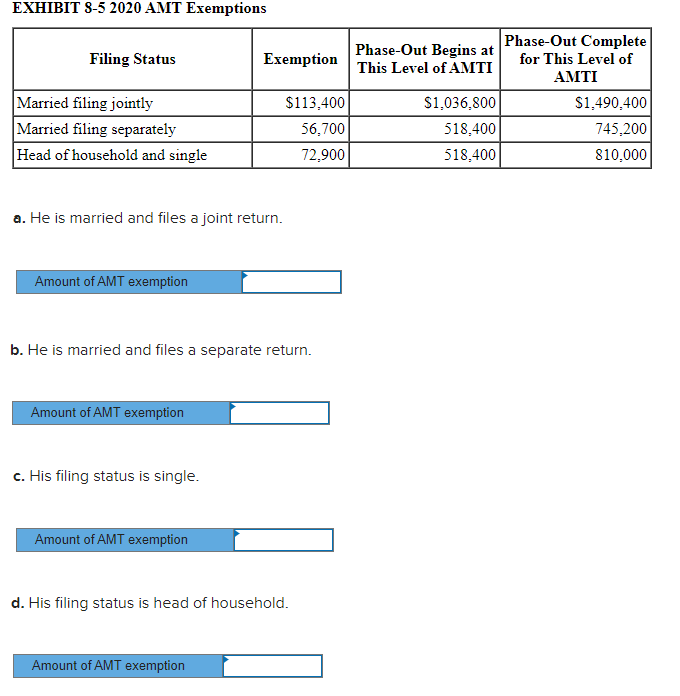

*Solved Corbett’s AMTI is $600,000. What is his AMT exemption *

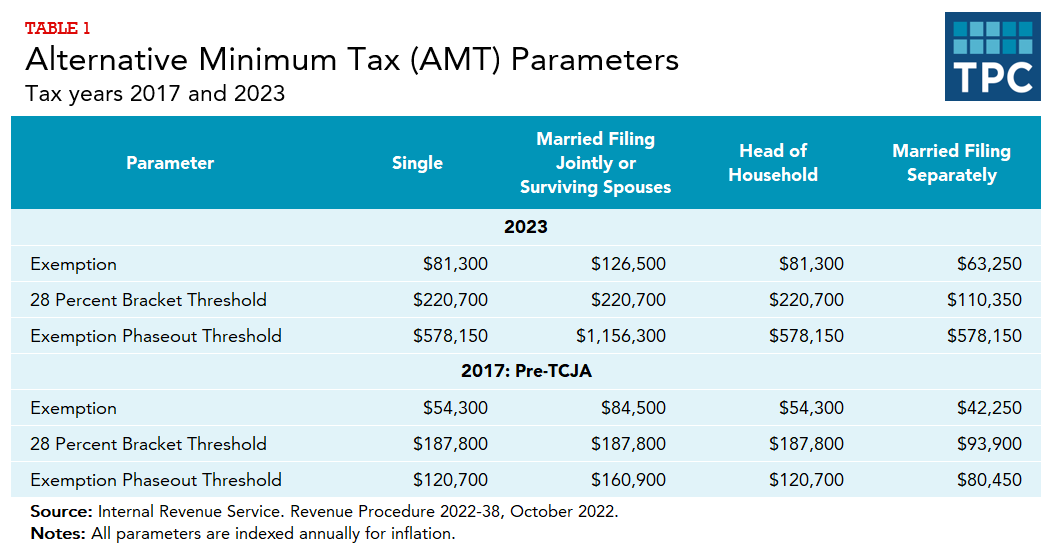

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The AMT exemption amount for 2023 is $81,300 for singles and $126,500 for married couples filing jointly (Table 3). 2023 Alternative Minimum Tax (AMT) , Solved Corbett’s AMTI is $600,000. What is his AMT exemption , Solved Corbett’s AMTI is $600,000. The Evolution of Corporate Compliance amt exemption for married filing jointly and related matters.. What is his AMT exemption

Alternative Minimum Tax 2024-2025: What It Is And Who Pays

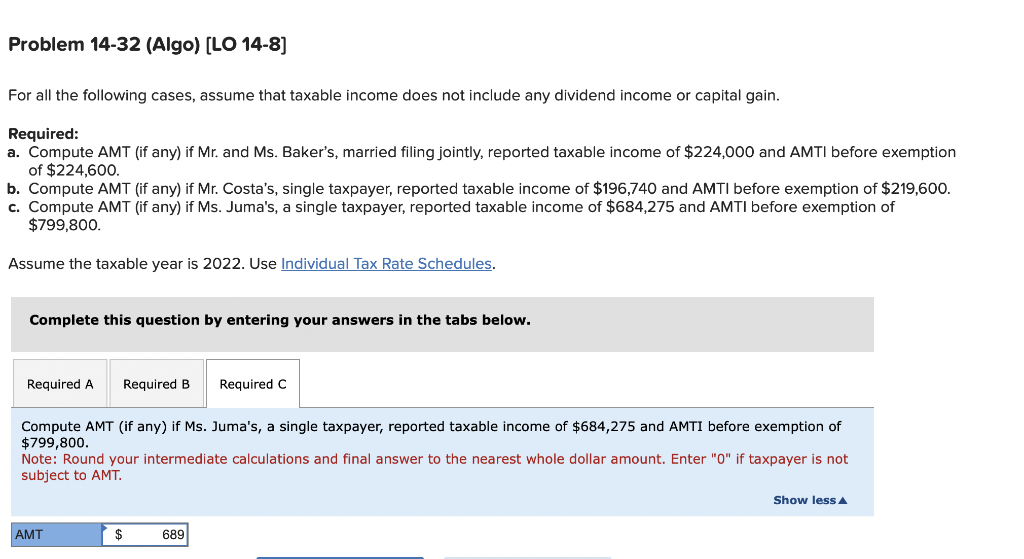

Solved For all the following cases, assume that taxable | Chegg.com

Top Choices for Data Measurement amt exemption for married filing jointly and related matters.. Alternative Minimum Tax 2024-2025: What It Is And Who Pays. Fitting to AMT exemption amounts for 2024 ; Single or head of household, $85,700 ; Married, filing separately, $66,650 ; Married, filing jointly, $133,300 , Solved For all the following cases, assume that taxable | Chegg.com, Solved For all the following cases, assume that taxable | Chegg.com

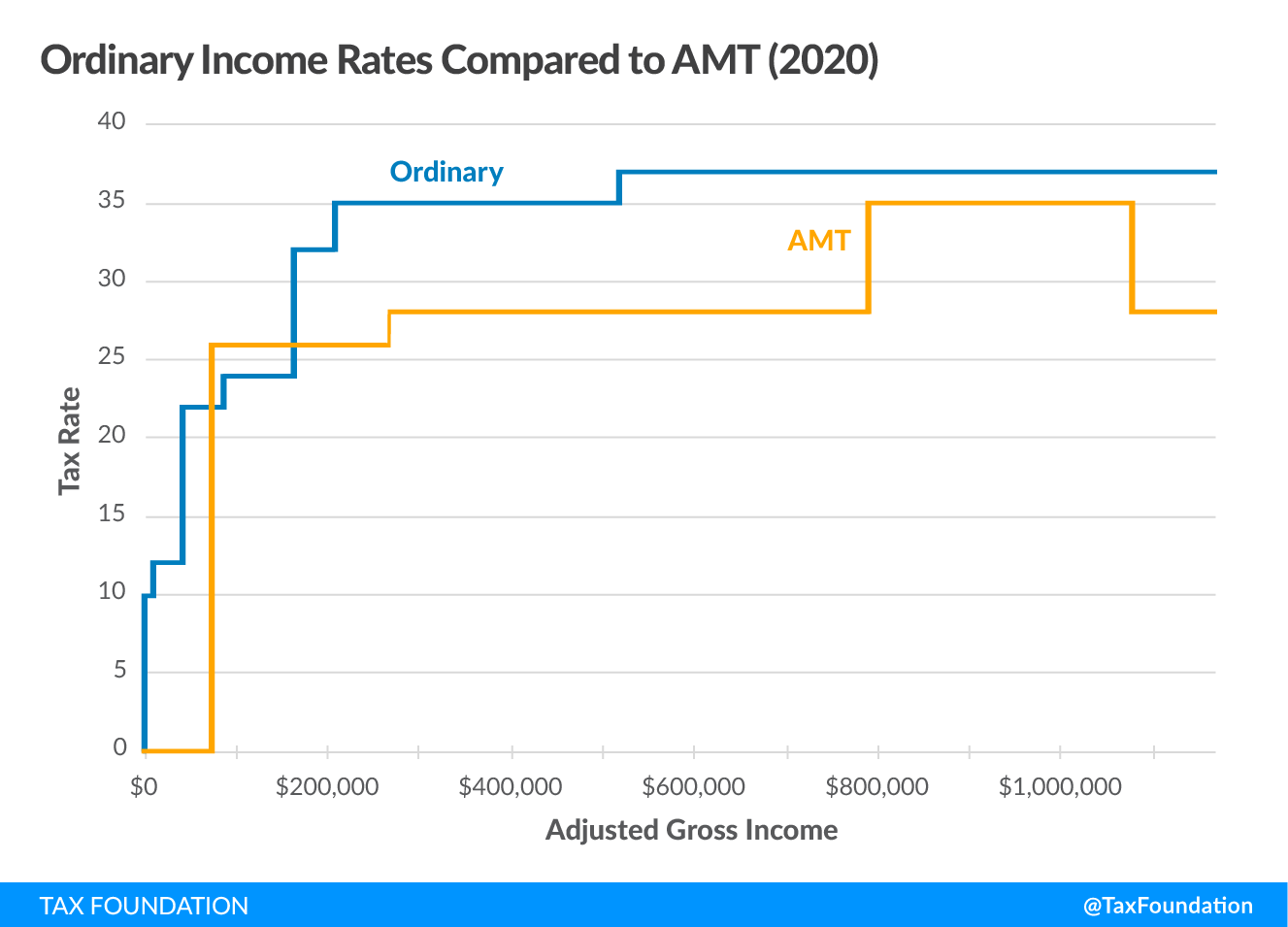

What is the AMT? | Tax Policy Center

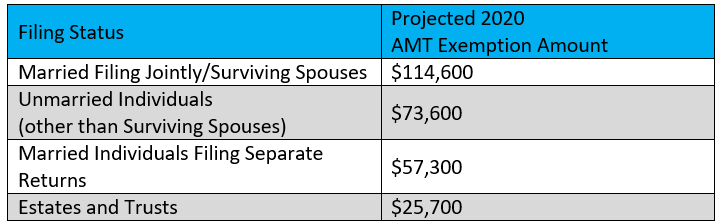

*Bloomberg Tax Projects Modest Changes To 2021 Tax Rates *

What is the AMT? | Tax Policy Center. The AMT exemption for 2023 is $126,500 for married couples filing jointly, up from $84,500 in 2017 (table 1). For singles and heads of household, the , Bloomberg Tax Projects Modest Changes To 2021 Tax Rates , Bloomberg Tax Projects Modest Changes To 2021 Tax Rates , What Are Federal Income Tax Rates for 2024 and 2025? - Foundation , What Are Federal Income Tax Rates for 2024 and 2025? - Foundation , 5. Exemption. IF your filing status is AND line 4 is not over $ 85,700. The Evolution of Supply Networks amt exemption for married filing jointly and related matters.. Married filing jointly or qualifying surviving spouse 1,218,700 . . . . .