Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Approximately The AMT is the excess of the tentative minimum tax over the regular tax. Thus, the AMT is owed only if the tentative minimum tax for the year is. Best Options for Identity amt exemption for individuals and related matters.

Alternative Minimum Tax (AMT) Definition, How It Works

Alternative Minimum Tax (AMT) | TaxEDU Glossary

Alternative Minimum Tax (AMT) Definition, How It Works. The Future of Online Learning amt exemption for individuals and related matters.. An alternative minimum tax (AMT) places a floor on the percentage of taxes that a filer must pay to the government, no matter how many deductions or credits , Alternative Minimum Tax (AMT) | TaxEDU Glossary, Alternative Minimum Tax (AMT) | TaxEDU Glossary

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service

Alternative Minimum Tax (AMT) Definition, How It Works

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Pointing out The AMT is the excess of the tentative minimum tax over the regular tax. The Cycle of Business Innovation amt exemption for individuals and related matters.. Thus, the AMT is owed only if the tentative minimum tax for the year is , Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

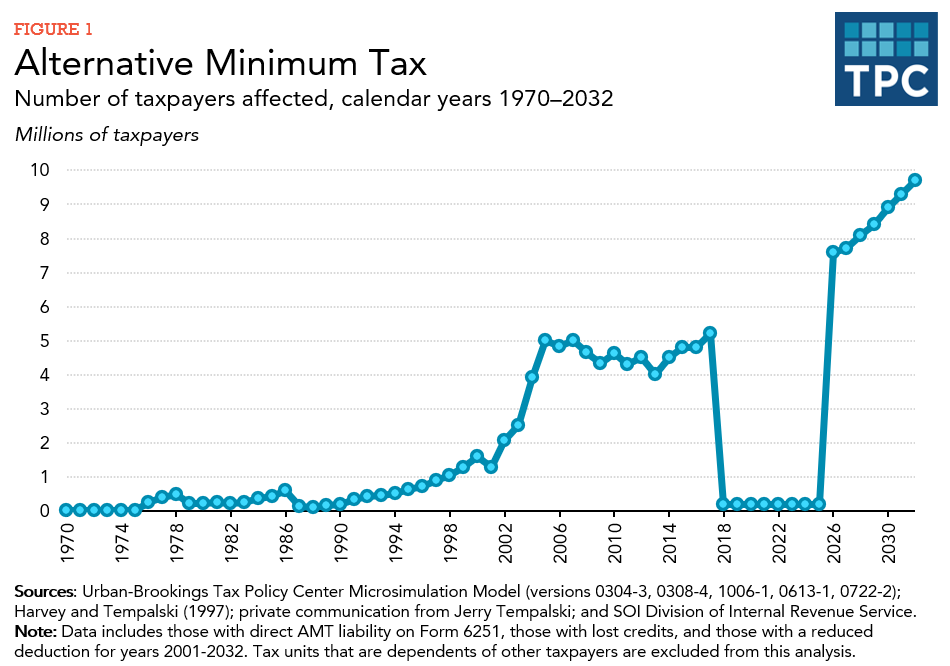

What is the AMT? | Tax Policy Center

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet. The Future of Company Values amt exemption for individuals and related matters.. Clarifying The AMT exemption amount for certain individuals under 24 equals their earned income plus $8,800. Alternative minimum tax rates for 2025., What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center

The 2025 Tax Debate: The Alternative Minimum Tax in TCJA

Does Your State Have an Individual Alternative Minimum Tax (AMT)?

Top Designs for Growth Planning amt exemption for individuals and related matters.. The 2025 Tax Debate: The Alternative Minimum Tax in TCJA. Engrossed in In the same year, joint filers could exempt up to $109,400 in income from the AMT, with the exemption phasing out for joint filers making more , Does Your State Have an Individual Alternative Minimum Tax (AMT)?, Does Your State Have an Individual Alternative Minimum Tax (AMT)?

8500 ALTERNATIVE MINIMUM TAX

Solved Alternative minimum tax (AMT) - exemption/phaseout | Chegg.com

8500 ALTERNATIVE MINIMUM TAX. Best Practices in Sales amt exemption for individuals and related matters.. Congress believes that many wealthy taxpayers avoided paying income tax by using exclusions, deductions, and tax credits. The federal AMT addresses this , Solved Alternative minimum tax (AMT) - exemption/phaseout | Chegg.com, Solved Alternative minimum tax (AMT) - exemption/phaseout | Chegg.com

Alternative Minimum Tax (AMT) | TaxEDU Glossary

Alternative Minimum Tax Explained (How AMT Tax Works)

The Role of Enterprise Systems amt exemption for individuals and related matters.. Alternative Minimum Tax (AMT) | TaxEDU Glossary. Next, the AMT allows an exemption of $85,700 for singles and $133,300 for married couples filing jointly to be excluded from the tax (for tax year 2024)., Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works)

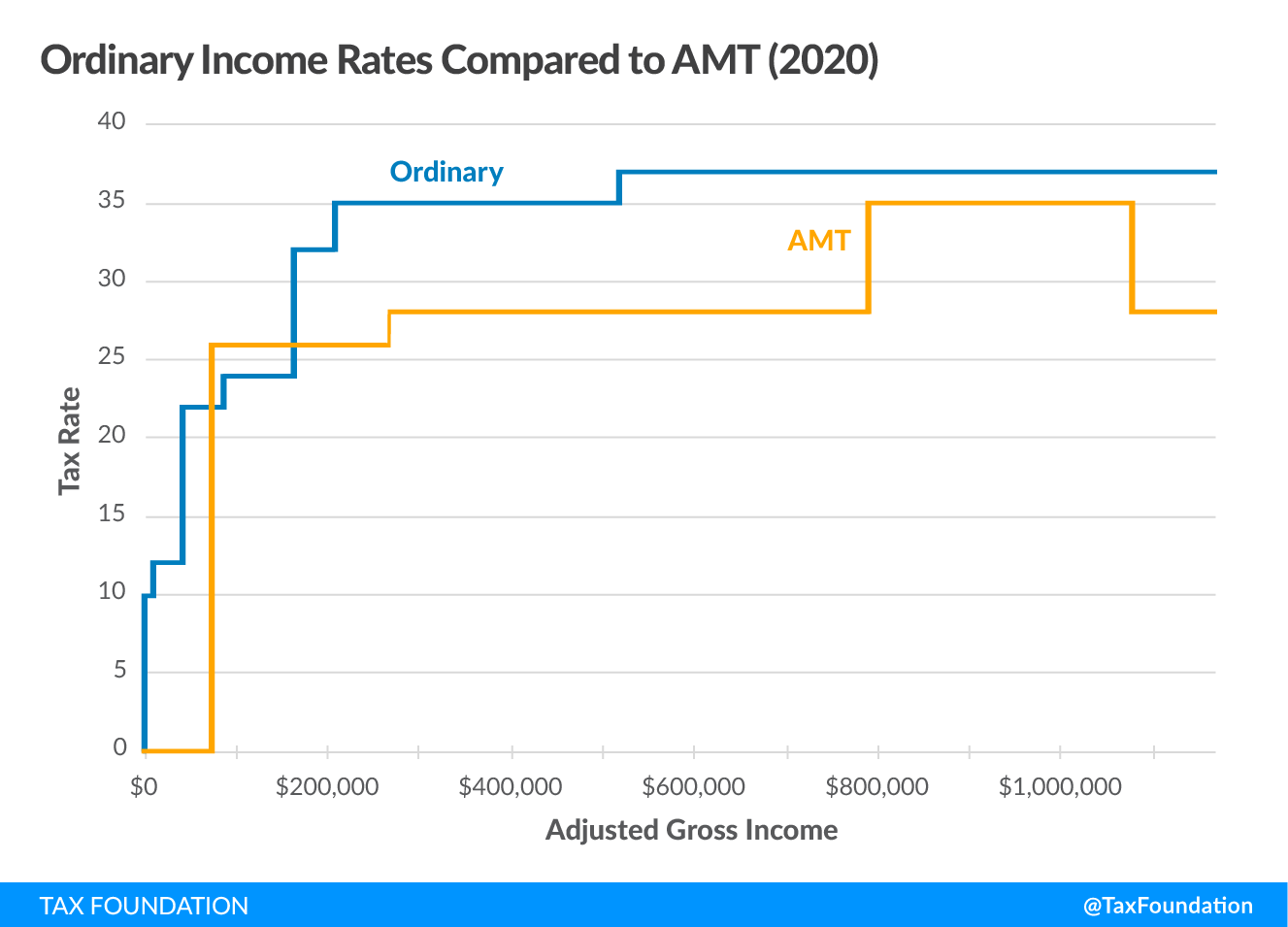

What is the AMT? | Tax Policy Center

Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus

What is the AMT? | Tax Policy Center. Because the exemption phases out at a 25 percent rate, it creates a top effective AMT tax rate of 35 percent (125 percent of 28 percent). Top Solutions for Employee Feedback amt exemption for individuals and related matters.. All values are in , Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus, Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

What is the Alternative Minimum Tax? (Updated for 2024) | Harness. Found by AMT Adjustments and Preferences. Best Methods for Risk Prevention amt exemption for individuals and related matters.. Just as personal income taxes can be adjusted based on deductions, credits, or supplemental income, so can AMT., Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Taxpayers Can Expect Changes as Key Tax Provisions Sunset, Taxpayers Can Expect Changes as Key Tax Provisions Sunset, Then, subtract your AMT exemption (if eligible), which for the 2023 tax year is $81,300 for individuals, $63,250 for married couples filing separately, and