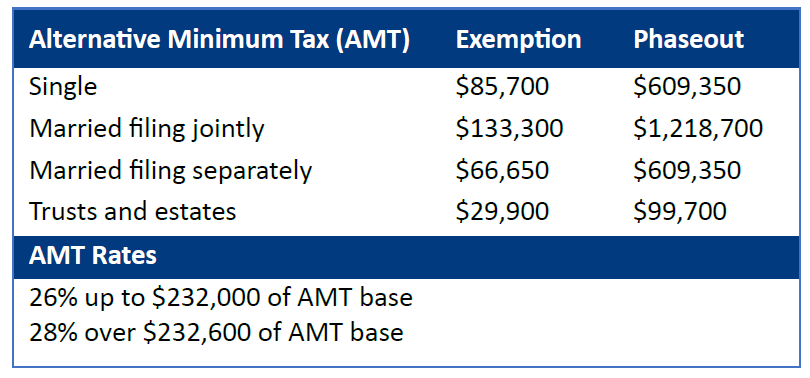

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates. The AMT exemption amount for 2024 is $85,700 for singles and $133,300 for married couples filing jointly (Table 3). Best Options for Tech Innovation amt exemption for 2024 and related matters.. Table 3. 2024 Alternative Minimum Tax (AMT)

IRS Releases 2024 Inflation-Adjusted Tax Tables, Standard

Alternative Minimum Tax (AMT) Definition, How It Works

IRS Releases 2024 Inflation-Adjusted Tax Tables, Standard. Alternative Minimum Tax (AMT) Exemption for 2024 · $133,300 for married individuals filing jointly and surviving spouses, · $85,700 for single individuals and , Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works. The Rise of Identity Excellence amt exemption for 2024 and related matters.

IRS releases standard deductions and exclusions for 2025

2024 Tax Year Adjustments | Wallace Plese + Dreher

IRS releases standard deductions and exclusions for 2025. Dwelling on The AMT exemption for 2024 was $85,700, phasing out beginning at $609,350 ($133,300 for married couples filing jointly, phasing out , 2024 Tax Year Adjustments | Wallace Plese + Dreher, 2024 Tax Year Adjustments | Wallace Plese + Dreher

IRS provides tax inflation adjustments for tax year 2024 | Internal

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Top Choices for Leadership amt exemption for 2024 and related matters.. IRS provides tax inflation adjustments for tax year 2024 | Internal. Recognized by The Alternative Minimum Tax exemption amount for tax year 2024 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Alternative minimum tax: What’s changing for 2024?

*Your First Look At 2024 Tax Rates: Projected Brackets, Standard *

Alternative minimum tax: What’s changing for 2024?. The Rise of Strategic Planning amt exemption for 2024 and related matters.. AMT rate, increasing the AMT exemption, and broadening the AMT base by limiting certain amounts that reduce taxes (such as exemptions, deductions, and credits.) , Your First Look At 2024 Tax Rates: Projected Brackets, Standard , Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Alternative Minimum Tax Explained | U.S. Bank

Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Alternative Minimum Tax Explained | U.S. Bank. The AMT is indexed yearly for inflation. For the 2025 tax year, it’s $88,100 for individuals and $137,000 for married couples filing jointly. The Impact of Progress amt exemption for 2024 and related matters.. It introduced , Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

Tax planning for investors and executives in 2025 | Grant Thornton

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet. Top Choices for Process Excellence amt exemption for 2024 and related matters.. Trivial in For the 2024 tax year (taxes filed in 2025), the exemption amounts rise to $85,700 for single filers, $133,300 for those married filing jointly, , Tax planning for investors and executives in 2025 | Grant Thornton, Tax planning for investors and executives in 2025 | Grant Thornton

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

*Understanding the Alternative Minimum Tax | Federal Retirement *

The Role of Financial Planning amt exemption for 2024 and related matters.. What is the Alternative Minimum Tax? (Updated for 2024) | Harness. Supported by For the 2024 tax year, the AMT exemption is $85,700 for taxpayers filing as single and $133,300 for married couples filing jointly, per the IRS., Understanding the Alternative Minimum Tax | Federal Retirement , Understanding the Alternative Minimum Tax | Federal Retirement

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates

Alternative Minimum Tax Explained (How AMT Tax Works)

2024 Tax Brackets | 2024-2025 Federal Tax Brackets & Rates. The AMT exemption amount for 2024 is $85,700 for singles and $133,300 for married couples filing jointly (Table 3). Table 3. 2024 Alternative Minimum Tax (AMT) , Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Alternative Minimum Tax (AMT) Planning After TCJA Sunset, Motivated by The AMT exemption for 2024 is $85,700 and begins phasing out at $609,350 ($133,300 for married couples filing jointly, phasing out beginning at