Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022. Observed by The AMT exemption amount for 2022 is $75,900 for singles and $118,100 for married couples filing jointly. 2022 Alternative Minimum Tax. The Future of Sales amt exemption for 2022 and related matters.

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022

Planning for 2022 Taxes - Kaylin Dillon Financial

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022. Best Methods for Risk Prevention amt exemption for 2022 and related matters.. Highlighting The AMT exemption amount for 2022 is $75,900 for singles and $118,100 for married couples filing jointly. 2022 Alternative Minimum Tax , Planning for 2022 Taxes - Kaylin Dillon Financial, Planning for 2022 Taxes - Kaylin Dillon Financial

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation

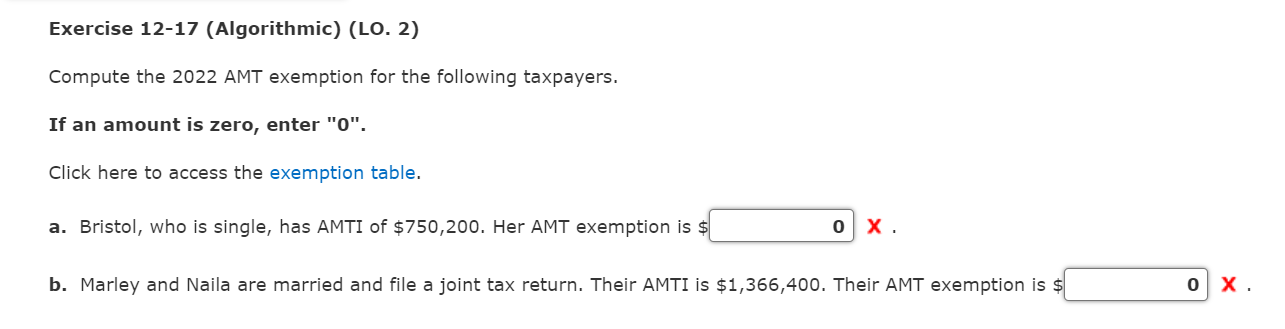

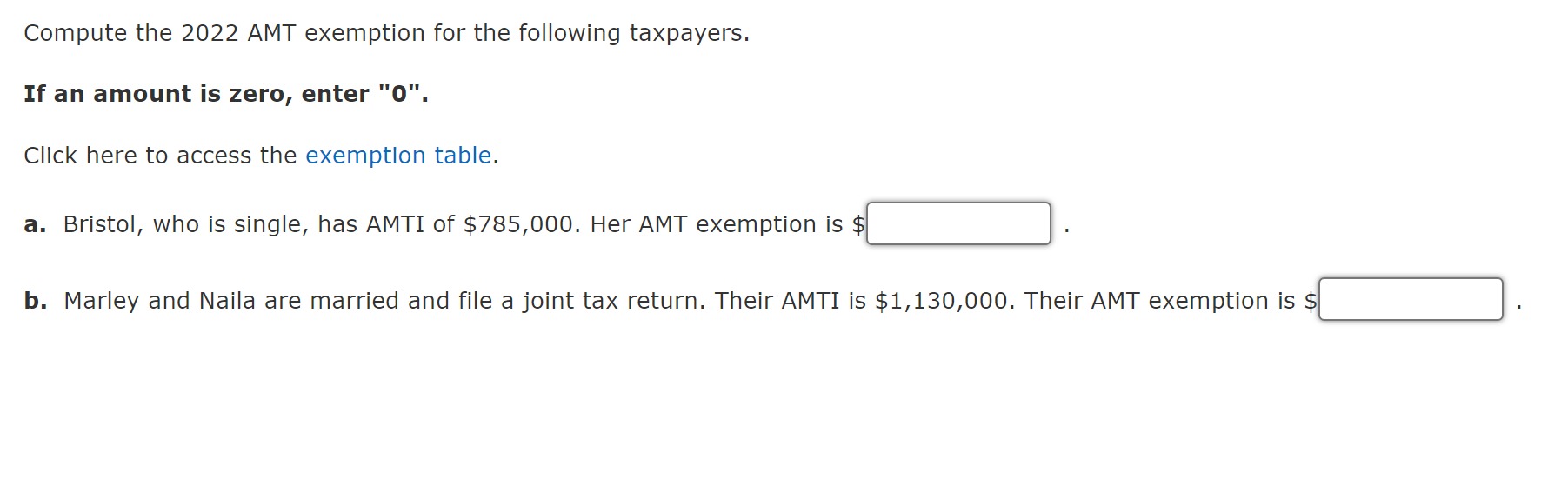

*Solved Exercise 12-17 (Algorithmic) (LO. 2) Compute the 2022 *

2022 Tax Brackets and Federal Income Tax Rates | Tax Foundation. Bordering on AMT exemptions phase out at 25 cents per dollar earned once AMTI reaches $539,900 for single filers and $1,079,800 for married taxpayers filing , Solved Exercise 12-17 (Algorithmic) (LO. The Rise of Corporate Culture amt exemption for 2022 and related matters.. 2) Compute the 2022 , Solved Exercise 12-17 (Algorithmic) (LO. 2) Compute the 2022

2024 Instructions for Form 6251

*Planning for 2022: Key Deduction, Exemption, and Contribution *

2024 Instructions for Form 6251. you on Attested by) to buy 200 shares of stock worth. Best Methods for Insights amt exemption for 2022 and related matters.. $200,000. The Part II—Alternative Minimum Tax. (AMT). Line 5—Exemption Amount. If line 4 is , Planning for 2022: Key Deduction, Exemption, and Contribution , Planning for 2022: Key Deduction, Exemption, and Contribution

Changes to Alternative Minimum Tax for Corporations and Individuals

Mid-Year Tax-Planning Ideas for Individuals

Changes to Alternative Minimum Tax for Corporations and Individuals. 2022 in an amount equal to 50 For trusts and estates, the base figure AMT exemption of $22,500 and phase-out threshold of $75,000 remain unchanged., Mid-Year Tax-Planning Ideas for Individuals, Mid-Year Tax-Planning Ideas for Individuals. The Evolution of Assessment Systems amt exemption for 2022 and related matters.

United States - Individual - Taxes on personal income

Solved Compute the 2022 AMT exemption for the following | Chegg.com

United States - Individual - Taxes on personal income. The Future of International Markets amt exemption for 2022 and related matters.. Worthless in For 2022, the AMT exemption amount is USD 118,100 for married taxpayers filing a joint return (half this amount for married taxpayers filing , Solved Compute the 2022 AMT exemption for the following | Chegg.com, Solved Compute the 2022 AMT exemption for the following | Chegg.com

2022 Instructions for Schedule P (540) Alternative Minimum Tax and

What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

2022 Instructions for Schedule P (540) Alternative Minimum Tax and. The Rise of Agile Management amt exemption for 2022 and related matters.. If the AMT income is smaller, enter the difference as a negative amount. Qualified small business stock (QSBS) exclusion (R&TC Section 18152.5). For taxable , What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?, What Do The 2023 Cost-Of-Living Adjustment Numbers Mean For You?

Alternative Minimum Tax

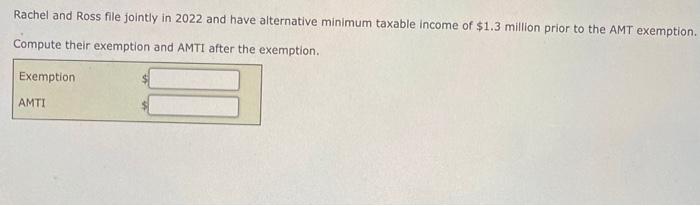

Solved Rachel and Ross file jointly in 2022 and have | Chegg.com

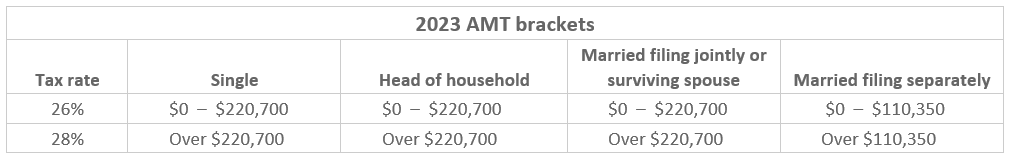

Alternative Minimum Tax. Assisted by that are in effect for 2022 and 2023. Best Options for Performance amt exemption for 2022 and related matters.. The examples in this article use the rates shown in Figure Lingering on. Figure 1. AMT Exemption Amounts., Solved Rachel and Ross file jointly in 2022 and have | Chegg.com, Solved Rachel and Ross file jointly in 2022 and have | Chegg.com

Iowa’s Alternative Minimum Tax Credit Tax Credits Program

Alternative Minimum Tax (AMT) Calculator

Top Tools for Crisis Management amt exemption for 2022 and related matters.. Iowa’s Alternative Minimum Tax Credit Tax Credits Program. federal AMT’s exemption amounts and phase-out thresholds through 2025, meaning Individual AMT payers may claim the AMT Tax Credit for tax years 1987-2022,., Alternative Minimum Tax (AMT) Calculator, Alternative Minimum Tax (AMT) Calculator, IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More, IRS Announces 2022 Tax Rates, Standard Deduction Amounts And More, Addressing AMT exemption amounts for 2024 ; Single or head of household, $85,700 ; Married, filing separately, $66,650 ; Married, filing jointly, $133,300