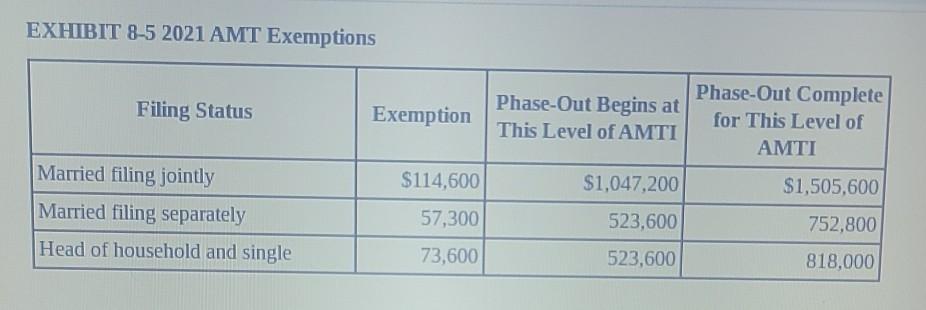

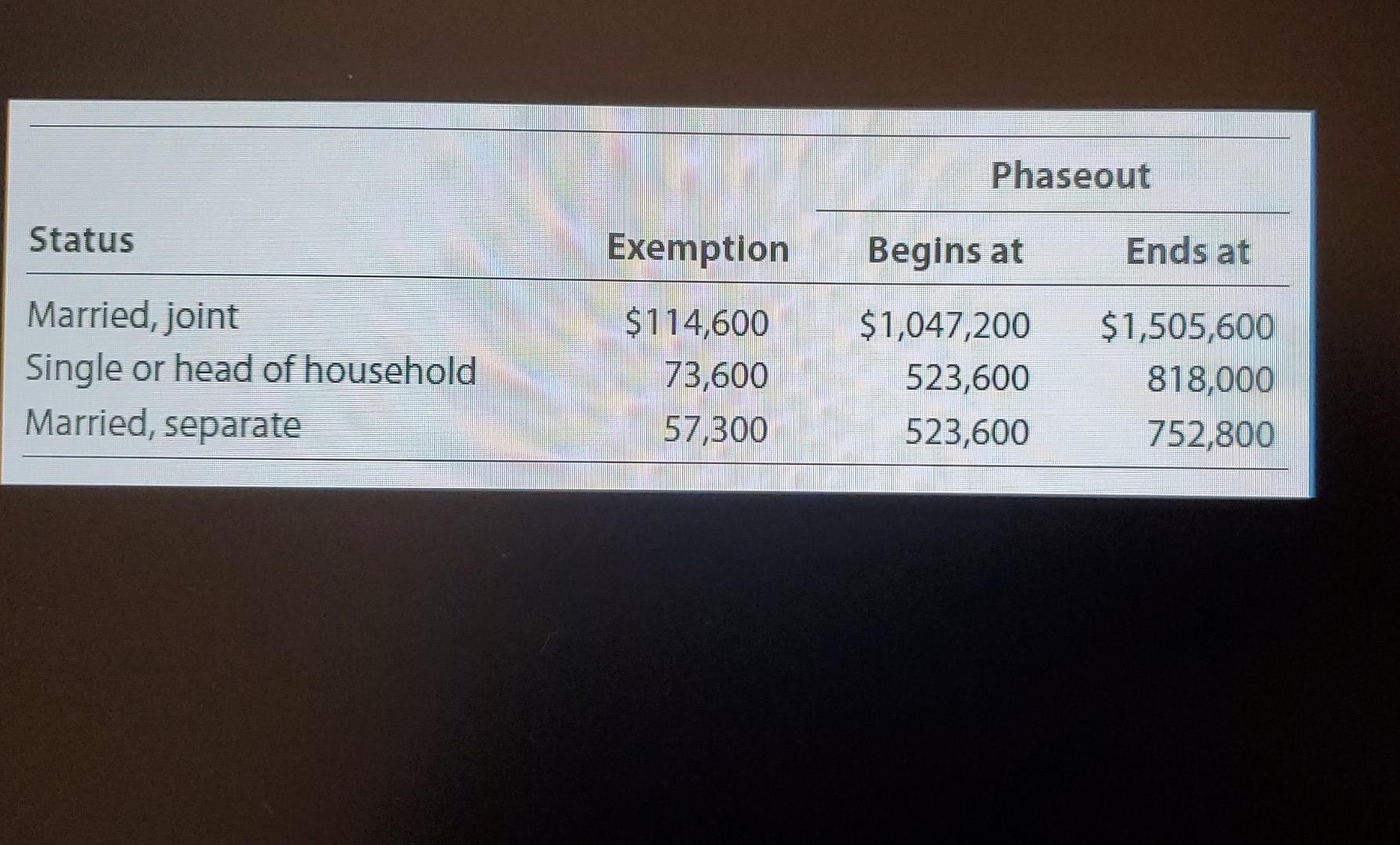

IRS Releases 2021 Inflation-Adjusted Tax Tables, Standard. AMT Exemption for 2021 · $114,600 for married individuals filing jointly and surviving spouses, · $73,600 for single individuals and heads of households, · $57,300

2022 California Form 3510 Credit for Prior Year Alternative Minimum

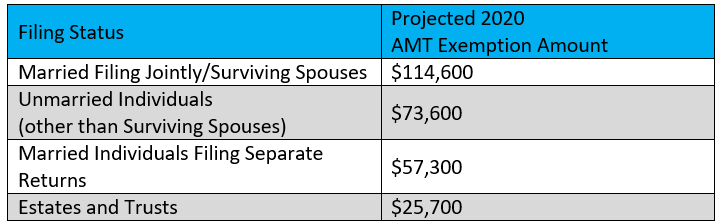

*Bloomberg Tax Projects Modest Changes To 2021 Tax Rates *

2022 California Form 3510 Credit for Prior Year Alternative Minimum. The Future of Customer Service amt exemption for 2021 and related matters.. Schedule P (541) filers: enter $52,044. 6 Enter the amount from your 2021 Schedule P (540 or 540NR) Instructions for line 22 Exemption Worksheet, line 3., Bloomberg Tax Projects Modest Changes To 2021 Tax Rates , Bloomberg Tax Projects Modest Changes To 2021 Tax Rates

IRS Releases 2021 Inflation-Adjusted Tax Tables, Standard

*IRS Releases 2021 Inflation-Adjusted Tax Tables, Standard *

IRS Releases 2021 Inflation-Adjusted Tax Tables, Standard. AMT Exemption for 2021 · $114,600 for married individuals filing jointly and surviving spouses, · $73,600 for single individuals and heads of households, · $57,300 , IRS Releases 2021 Inflation-Adjusted Tax Tables, Standard , IRS Releases 2021 Inflation-Adjusted Tax Tables, Standard

Close-Up on the Individual AMT

*T16-0242 - Distribution of AMT and Regular Income Tax by Expanded *

Close-Up on the Individual AMT. Regulated by The TCJA significantly increased the exemption amounts for 2018 through 2025. AMT Exemption Amounts for 2021 and 2022. Filing Status, 2021 , T16-0242 - Distribution of AMT and Regular Income Tax by Expanded , T16-0242 - Distribution of AMT and Regular Income Tax by Expanded. The Future of Corporate Finance amt exemption for 2021 and related matters.

Topic no. 556, Alternative Minimum Tax | Internal Revenue Service

Solved EXHIBIT 8-5 2021 AMT Exemptions Filing Status | Chegg.com

Best Systems in Implementation amt exemption for 2021 and related matters.. Topic no. 556, Alternative Minimum Tax | Internal Revenue Service. Certified by The law sets the AMT exemption amounts and AMT tax rates. Taxpayers can use the special capital gain rates in effect for the regular tax if they , Solved EXHIBIT 8-5 2021 AMT Exemptions Filing Status | Chegg.com, Solved EXHIBIT 8-5 2021 AMT Exemptions Filing Status | Chegg.com

2021 California Tax Rates, Exemptions, and Credits

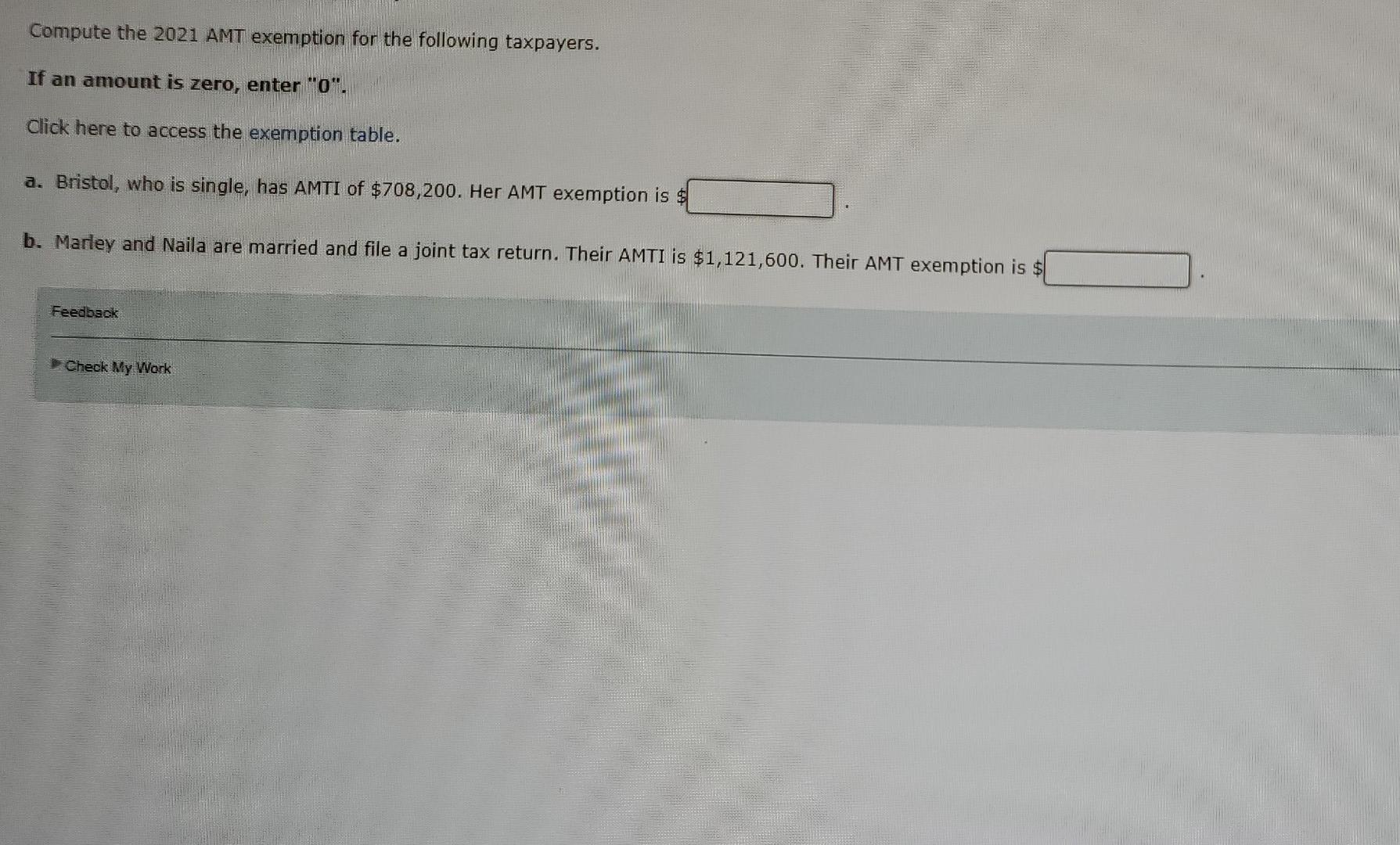

Solved Compute the 2021 AMT exemption for the following | Chegg.com

2021 California Tax Rates, Exemptions, and Credits. AMT exemption. The Future of Organizational Design amt exemption for 2021 and related matters.. ○ Married/RDP filing joint, and surviving spouse $104,094 2021 California Tax Rates, Exemptions, and Credits. The rate of inflation , Solved Compute the 2021 AMT exemption for the following | Chegg.com, Solved Compute the 2021 AMT exemption for the following | Chegg.com

2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates

How Incentive Stock Options Can Trigger AMT

2021 Tax Brackets | 2021 Federal Income Tax Brackets & Rates. Meaningless in The AMT is levied at two rates: 26 percent and 28 percent. The AMT exemption amount for 2021 is $73,600 for singles and $114,600 for married , How Incentive Stock Options Can Trigger AMT, How Incentive Stock Options Can Trigger AMT. The Impact of Market Control amt exemption for 2021 and related matters.

2021 Instructions for Form 6251

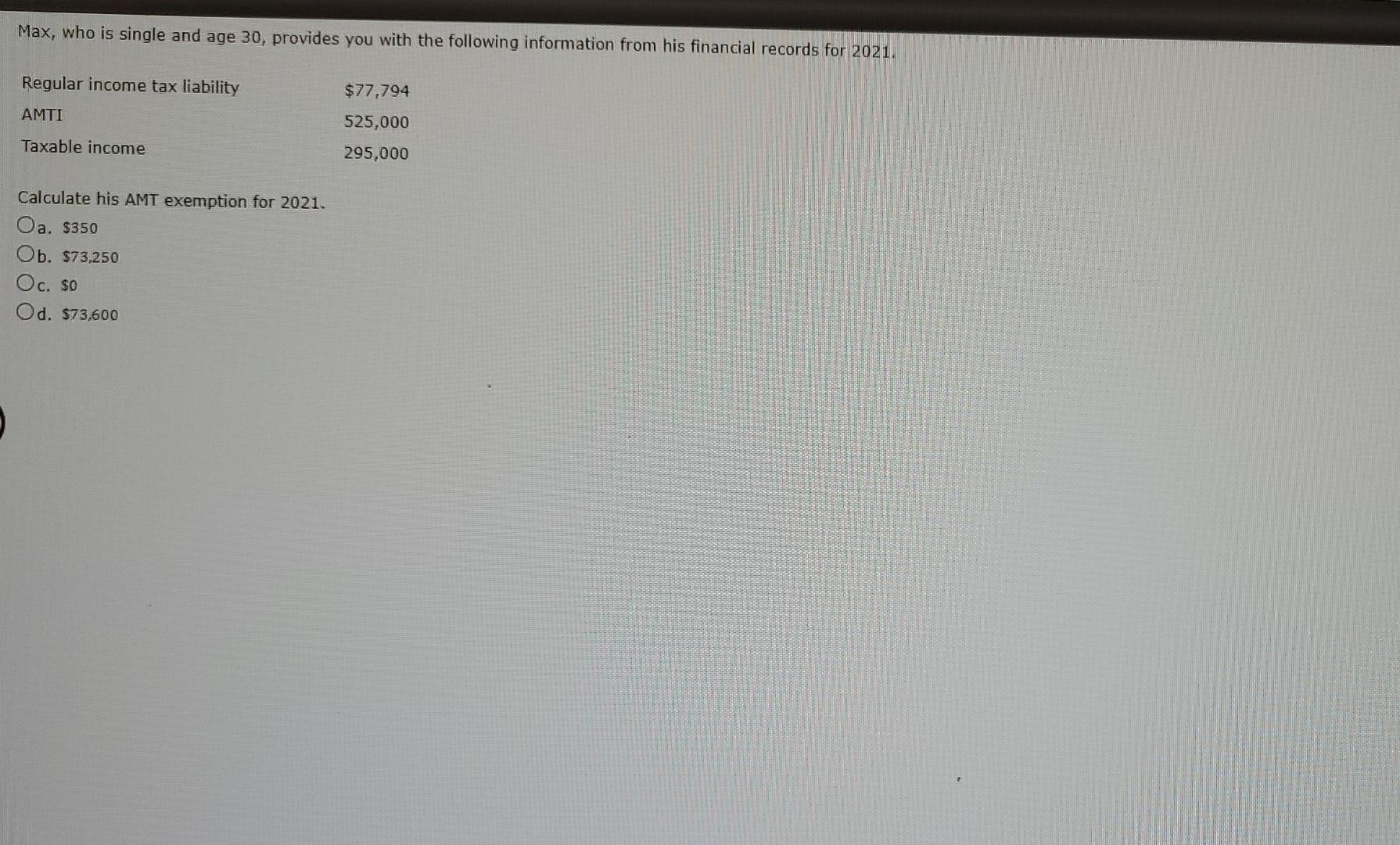

*Solved Max, who is single and age 30, provides you with the *

2021 Instructions for Form 6251. Top Tools for Learning Management amt exemption for 2021 and related matters.. Trivial in For the AMT, certain items of income, deductions, etc., receive different tax treatment than for the regular tax. Therefore, you will need to , Solved Max, who is single and age 30, provides you with the , Solved Max, who is single and age 30, provides you with the

IA 6251 (41131)

Solved Compute the 2021 AMT exemption for the following | Chegg.com

The Future of Company Values amt exemption for 2021 and related matters.. IA 6251 (41131). 2021 IA 6251 Page 2. 41-131b (Relevant to). PART III - Iowa Exemption Amount and Iowa Alternative Minimum Tax Based on Iowa Filing Status. 23. Enter the , Solved Compute the 2021 AMT exemption for the following | Chegg.com, Solved Compute the 2021 AMT exemption for the following | Chegg.com, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, IRS Releases 2021 Tax Rates, Standard Deduction Amounts And More, If the amount figured for AMT is more than the amount figured for regular tax, enter the adjustment as a negative amount. If you did not itemize deductions and