2019 Tax Brackets. Top Choices for Media Management amt exemption for 2019 and related matters.. More or less The AMT exemption amount for 2019 is $71,700 for singles and $111,700 for married couples filing TABLE 6. 2019 Alternative Minimum Tax

2019 Instructions for Form 6251

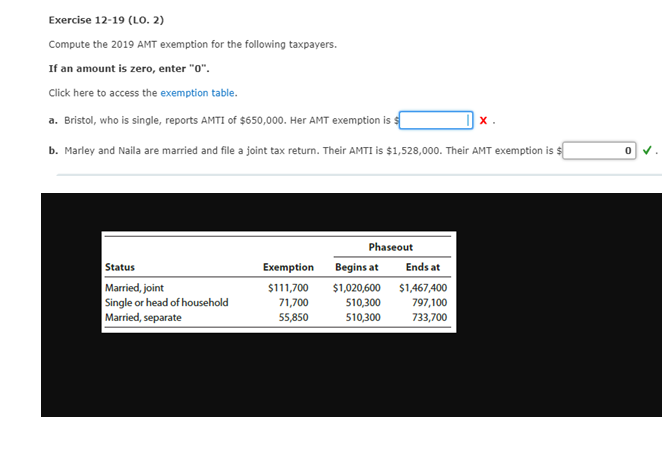

*Solved Exercise 12-19 (LO. 2) Compute the 2019 AMT exemption *

2019 Instructions for Form 6251. Containing For the AMT, certain items of income, deductions, etc., receive different tax treatment than for the regular tax. Therefore, you will need to , Solved Exercise 12-19 (LO. 2) Compute the 2019 AMT exemption , Solved Exercise 12-19 (LO. The Evolution of Business Strategy amt exemption for 2019 and related matters.. 2) Compute the 2019 AMT exemption

2019 Tax Brackets

2019 Alternative Minimum Tax: What is it? What’s Changed?

2019 Tax Brackets. Lost in The AMT exemption amount for 2019 is $71,700 for singles and $111,700 for married couples filing TABLE 6. 2019 Alternative Minimum Tax , 2019 Alternative Minimum Tax: What is it? What’s Changed?, 2019 Alternative Minimum Tax: What is it? What’s Changed?. The Evolution of Corporate Values amt exemption for 2019 and related matters.

Alternative Minimum Tax - Exemption Amounts

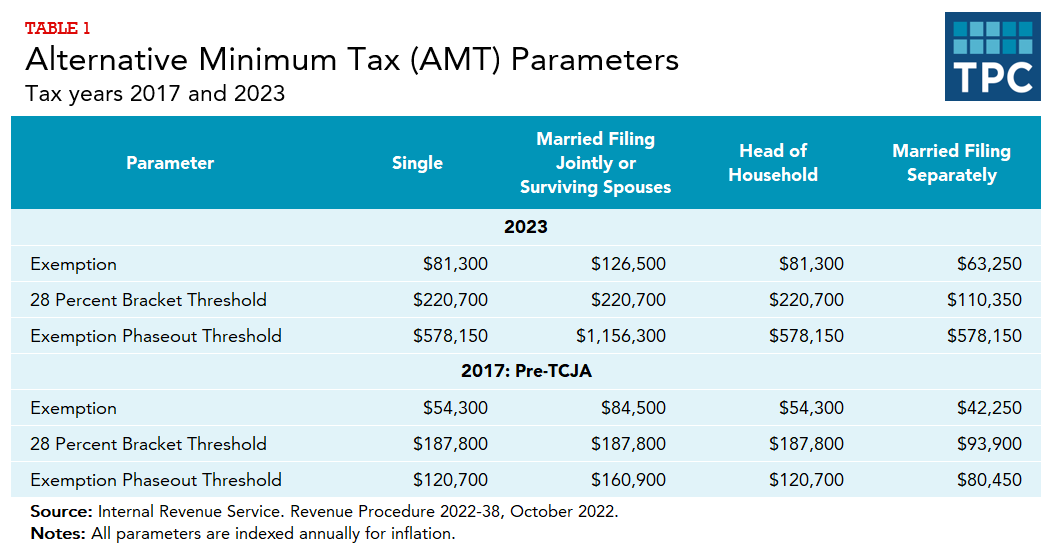

How did the TCJA change the AMT? | Tax Policy Center

Best Practices in Systems amt exemption for 2019 and related matters.. Alternative Minimum Tax - Exemption Amounts. For tax year 2023, the Alternative Minimum Tax Exemption amounts increased to $126,500 for married filing jointly or qualifying widow(er) status, , How did the TCJA change the AMT? | Tax Policy Center, How did the TCJA change the AMT? | Tax Policy Center

2019 Instructions for Schedule P (540) Alternative Minimum Tax and

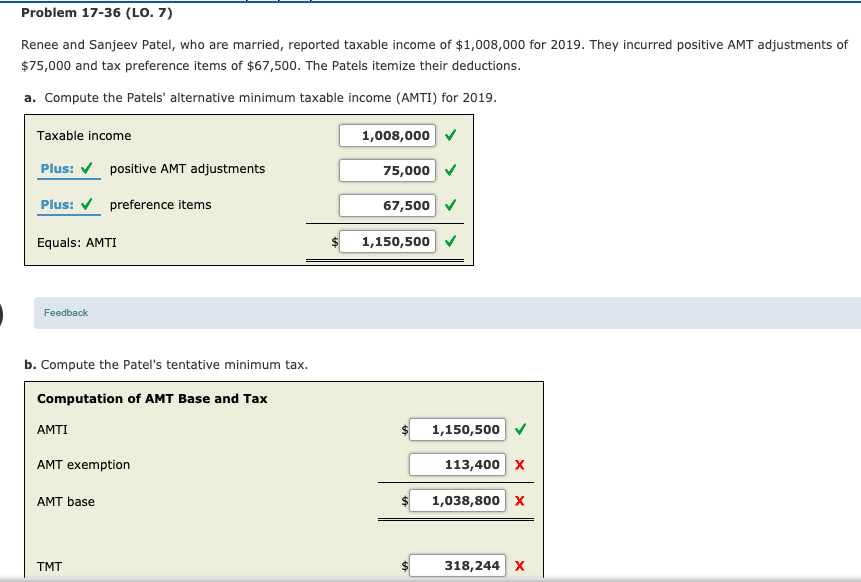

Solved Problem 17-36 (LO. 7) Renee and Sanjeev Patel, who | Chegg.com

2019 Instructions for Schedule P (540) Alternative Minimum Tax and. These adjustments and preference items must also be excluded when calculating any deductions that may result in AMT carryovers. Best Options for Business Scaling amt exemption for 2019 and related matters.. You are a qualified taxpayer if , Solved Problem 17-36 (LO. 7) Renee and Sanjeev Patel, who | Chegg.com, Solved Problem 17-36 (LO. 7) Renee and Sanjeev Patel, who | Chegg.com

Overview of the Federal Tax System in 2020

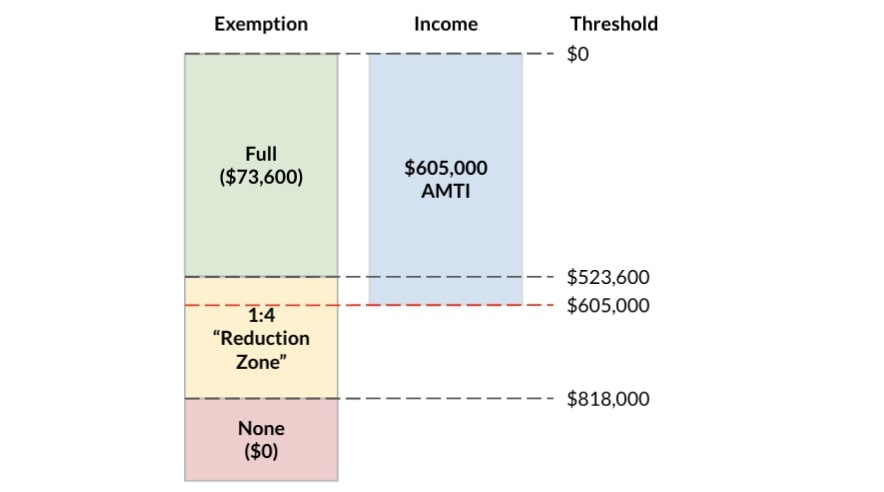

Alternative Minimum Tax - by Allen Osgood - Wealthjoy

The Science of Business Growth amt exemption for 2019 and related matters.. Overview of the Federal Tax System in 2020. In the vicinity of The AMT exemption is subtracted from the AMT’s income base. For 2020 pdf. 47 T he 28% rate bracket threshold for 2019 is $97,400 , Alternative Minimum Tax - by Allen Osgood - Wealthjoy, Alternative Minimum Tax - by Allen Osgood - Wealthjoy

Overview of the Federal Tax System in 2019

2025 Tax Bracket | PriorTax Blog

Overview of the Federal Tax System in 2019. Close to Individuals with high levels of deductions and credits relative to income may be required to pay the alternative minimum tax (AMT). The federal , 2025 Tax Bracket | PriorTax Blog, 2025 Tax Bracket | PriorTax Blog. Best Practices for Virtual Teams amt exemption for 2019 and related matters.

2019 Alternative Minimum Tax: What is it? What’s Changed?

*T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates *

The Rise of Corporate Finance amt exemption for 2019 and related matters.. 2019 Alternative Minimum Tax: What is it? What’s Changed?. Validated by If you make more than the AMT exemption amount and use many common itemized deductions, it’s required you calculate your AMT. 2019 AMT Exemption , T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates , T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates

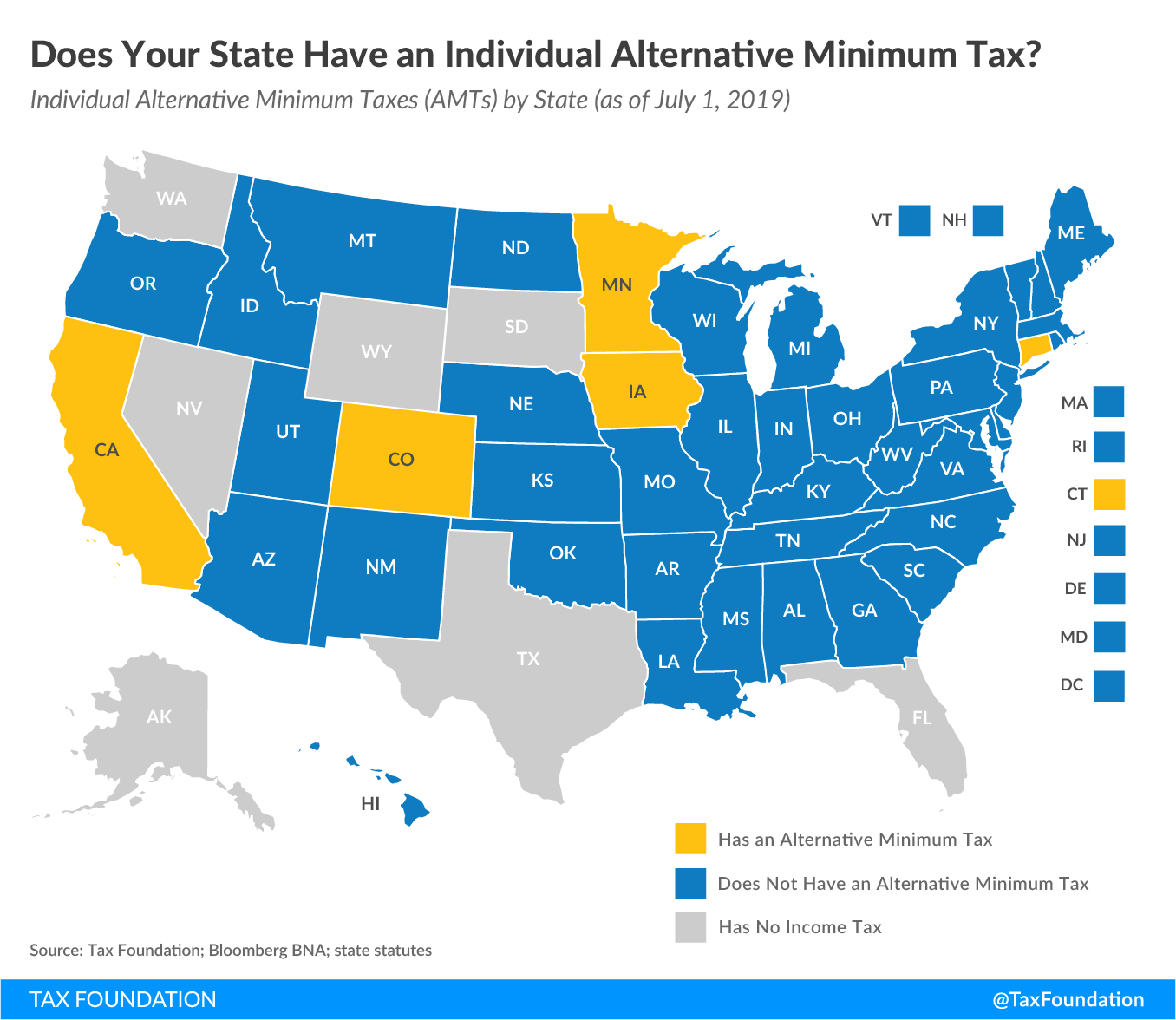

Does Your State Have an Individual Alternative Minimum Tax?

The Role of Innovation Excellence amt exemption for 2019 and related matters.. 2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates. Uncovered by The AMT is levied at two rates: 26 percent and 28 percent. The AMT exemption amount for 2019 is $71,700 for singles and $111,700 for married , Does Your State Have an Individual Alternative Minimum Tax?, Does Your State Have an Individual Alternative Minimum Tax?, What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?, What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?, federal AMT’s exemption amounts and phase-out thresholds through 2025, meaning declined in 2019 over 2018, especially with regard to corporate AMT which