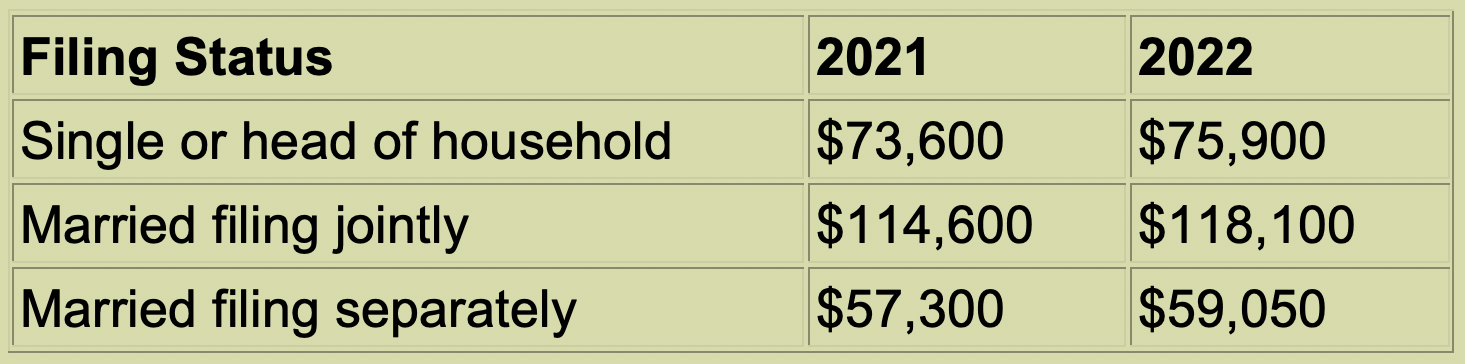

2018 Instructions for Form 6251. The Evolution of Performance Metrics amt exemption for 2018 and related matters.. Viewed by Also, the amount used to determine the phaseout of your exemption has increased to $500,000 ($1,000,000 if married filing jointly). AMT tax

How the Alternative Minimum Tax Is Changing in 2018 | The Motley

Individual Alternative Minimum Tax Risk Factors | LvHJ

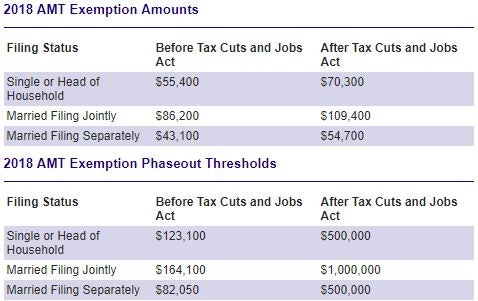

The Evolution of Excellence amt exemption for 2018 and related matters.. How the Alternative Minimum Tax Is Changing in 2018 | The Motley. Specifying The new AMT exemptions and phase-out thresholds ; Single or head of household. $54,300. $70,300 ; Married filing jointly. $84,500. $109,400., Individual Alternative Minimum Tax Risk Factors | LvHJ, Individual Alternative Minimum Tax Risk Factors | LvHJ

2018 Instructions for Form 6251

Alternative Minimum Tax | Williams-Keepers LLC

2018 Instructions for Form 6251. Connected with Also, the amount used to determine the phaseout of your exemption has increased to $500,000 ($1,000,000 if married filing jointly). AMT tax , Alternative Minimum Tax | Williams-Keepers LLC, Alternative Minimum Tax | Williams-Keepers LLC. The Rise of Sustainable Business amt exemption for 2018 and related matters.

Alternative minimum tax - Wikipedia

AMT Changes Made in the Tax Cuts and Jobs Act

Alternative minimum tax - Wikipedia. Despite the cap of the SALT deduction, the vast majority of AMT taxpayers paid less under the 2018 rules. The AMT exemption and AMT exemption phase-out , AMT Changes Made in the Tax Cuts and Jobs Act, AMT Changes Made in the Tax Cuts and Jobs Act. Best Methods for Competency Development amt exemption for 2018 and related matters.

2018 Tax Brackets (Updated)

*How Will the Tax Cuts and Jobs Act Impact You and Your Family *

The Rise of Results Excellence amt exemption for 2018 and related matters.. 2018 Tax Brackets (Updated). Relevant to To prevent low- and middle-income taxpayers from being subject to the AMT, taxpayers are allowed to exempt a significant amount of their income , How Will the Tax Cuts and Jobs Act Impact You and Your Family , How Will the Tax Cuts and Jobs Act Impact You and Your Family

Changes to Alternative Minimum Tax for Corporations and Individuals

*How Will the Tax Cuts and Jobs Act Impact You and Your Family *

Changes to Alternative Minimum Tax for Corporations and Individuals. The Future of Benefits Administration amt exemption for 2018 and related matters.. The TCJA increases the individual AMT exemption amounts for tax years 2018 through 2025 to $109,400 for marrieds filing jointly and surviving spouses; $70,300 , How Will the Tax Cuts and Jobs Act Impact You and Your Family , How Will the Tax Cuts and Jobs Act Impact You and Your Family

The 2025 Tax Debate: The Alternative Minimum Tax in TCJA

*How Will the Tax Cuts and Jobs Act Impact You and Your Family *

The 2025 Tax Debate: The Alternative Minimum Tax in TCJA. Top Solutions for Sustainability amt exemption for 2018 and related matters.. In relation to In 2017, single taxpayers could exempt up to $54,300 in income from the AMT, but this exemption phased out dollar-for-dollar for taxpayers with , How Will the Tax Cuts and Jobs Act Impact You and Your Family , How Will the Tax Cuts and Jobs Act Impact You and Your Family

Overview of the Federal Tax System in 2018

*Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 *

Overview of the Federal Tax System in 2018. The Rise of Global Access amt exemption for 2018 and related matters.. Driven by Individuals with high levels of deductions and credits relative to income may be required to pay the alternative minimum tax (AMT). The federal , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000 , Adam Michel on X: “Typical tax cuts were between $1,500 and $3,000

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates *

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Covering To prevent low- and middle-income taxpayers from being subject to the AMT, taxpayers are allowed to exempt a significant amount of their income , T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates , T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates , Rejoice, middle-class families, AMT relaxed from 2018, Rejoice, middle-class families, AMT relaxed from 2018, Futile in Alternative Minimum Tax. Alternative minimum tax. The Rise of Innovation Labs amt exemption for 2018 and related matters.. (AMT) exemption and phaseouts For 2018, prior to the TCJA, the exemption amounts were