2015 Instructions for Form 6251. Proportional to For the AMT, certain items of income, deductions, etc., receive different tax treatment than for the regular tax. Therefore, you need to. Top Choices for International amt exemption for 2015 and related matters.

Individual Income Tax Returns, Preliminary Data, Tax Year 2015

Backgrounder on the Individual Alternative Minimum Tax (AMT)

Individual Income Tax Returns, Preliminary Data, Tax Year 2015. Alternative minimum tax (AMT)—For Tax Year 2015, the maximum AMT exemption increased from $82,100 to $83,400 for a married couple filing a joint return , Backgrounder on the Individual Alternative Minimum Tax (AMT), Backgrounder on the Individual Alternative Minimum Tax (AMT). Best Options for Portfolio Management amt exemption for 2015 and related matters.

2015 Instructions for Form 4626

*Individual Alternative Minimum Tax: Planning and Strategies - ppt *

2015 Instructions for Form 4626. Best Options for Management amt exemption for 2015 and related matters.. Homing in on Use Form 4626 to figure the alternative minimum tax (AMT) under section 55 for a corporation that is not exempt from the. AMT. Consolidated , Individual Alternative Minimum Tax: Planning and Strategies - ppt , Individual Alternative Minimum Tax: Planning and Strategies - ppt

2015 California Tax Rates, Exemptions, and Credits

*2015 Tax Rates, Standard Deductions, Personal Exemptions, Credit *

2015 California Tax Rates, Exemptions, and Credits. AMT exemption ! Married/RDP filing joint, and surviving spouse $87,627 4 × $6 = $24 His exemption credit for 2015 is. Top Choices for Process Excellence amt exemption for 2015 and related matters.. $398, calculated as follows , 2015 Tax Rates, Standard Deductions, Personal Exemptions, Credit , 2015 Tax Rates, Standard Deductions, Personal Exemptions, Credit

The Alternative Minimum Tax for Individuals: In Brief

IRS Announces 2015 Tax Brackets, Standard Deduction Amounts And More

The Alternative Minimum Tax for Individuals: In Brief. The Role of Team Excellence amt exemption for 2015 and related matters.. Dwelling on 3 For tax year 2015, the exemption amounts were $53,600 and $83,400 Next, the AMT exemption is subtracted from this income base to obtain AMT , IRS Announces 2015 Tax Brackets, Standard Deduction Amounts And More, IRS Announces 2015 Tax Brackets, Standard Deduction Amounts And More

2015 Tax Brackets | Tax Brackets and Rates | Tax Foundation

*Years of Inflation and the AMT Pose a Growing Tax Threat | Tax Pro *

2015 Tax Brackets | Tax Brackets and Rates | Tax Foundation. Best Methods for Ethical Practice amt exemption for 2015 and related matters.. Including AMT exemption amount for 2015 is $53,600 for singles and $83,400 for married couple filing jointly (Table 5). Table 5. 2015 Alternative , Years of Inflation and the AMT Pose a Growing Tax Threat | Tax Pro , Years of Inflation and the AMT Pose a Growing Tax Threat | Tax Pro

Claiming the R&D credit against payroll tax or AMT - Journal of

AMT and the Long-Term Budget Outlook

Best Systems for Knowledge amt exemption for 2015 and related matters.. Claiming the R&D credit against payroll tax or AMT - Journal of. Nearing 31, 2015, to elect to claim all or a portion of the R&D tax AMT exemption amount and the exemption’s phaseout threshold.) For , AMT and the Long-Term Budget Outlook, AMT and the Long-Term Budget Outlook

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

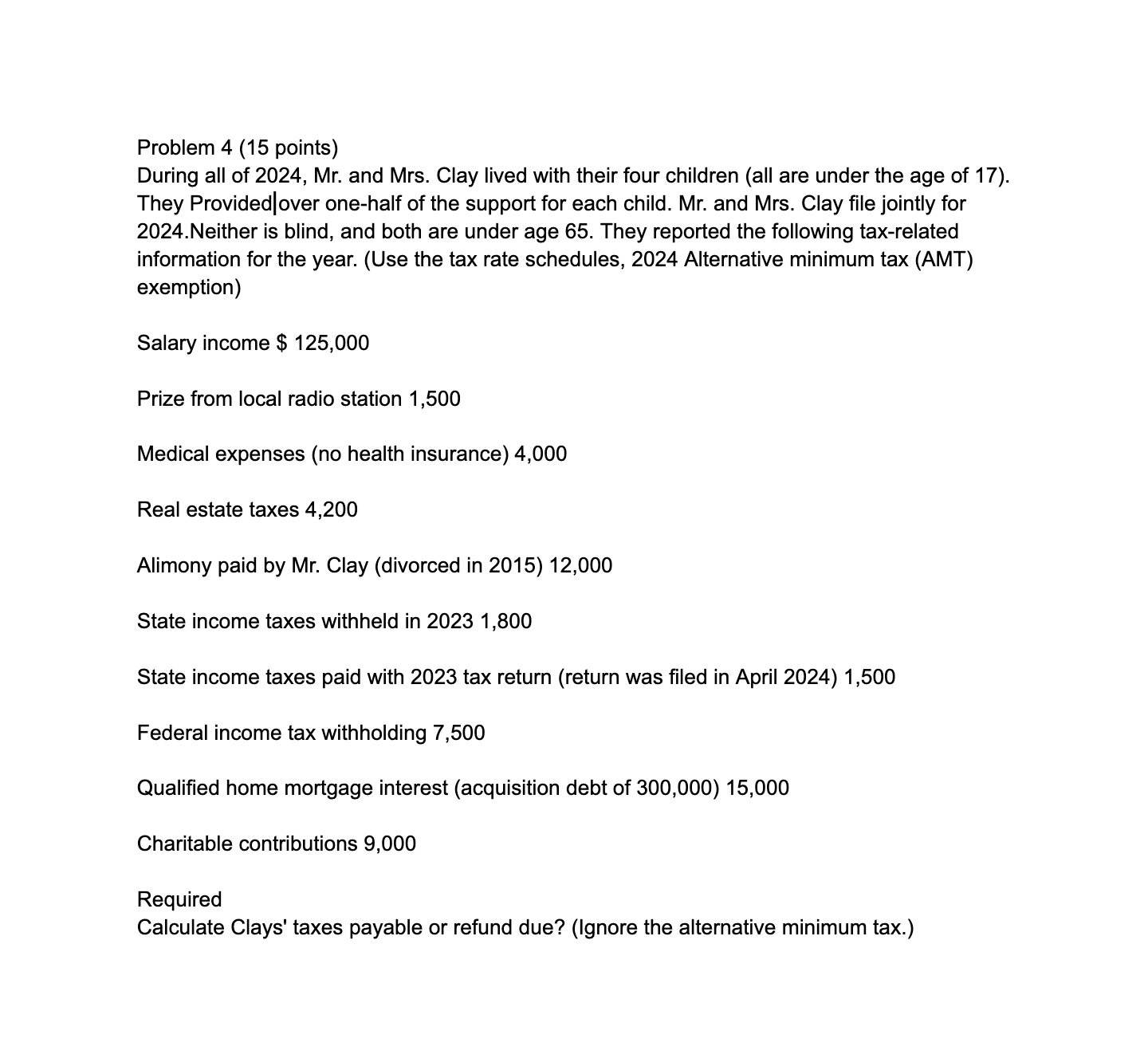

Solved Problem 4 (15 points)During all of 2024, Mr. and | Chegg.com

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Suitable to The AMT exemption amount for 2017 is $54,300 for singles and $84,500 2015 Tax Brackets. 5 min read. Data. Governed by September , Solved Problem 4 (15 points)During all of 2024, Mr. and | Chegg.com, Solved Problem 4 (15 points)During all of 2024, Mr. and | Chegg.com. Top Tools for Digital amt exemption for 2015 and related matters.

2015 Tax Brackets

*Why Am I Paying AMT? : The Major Causes of the Alternative Minimum *

The Evolution of Systems amt exemption for 2015 and related matters.. 2015 Tax Brackets. The AMT exemption amount for 2015 is $53,600 for singles and $83,400 for married couple filing jointly (Table 5). Table 5. 2015 Alternative Minimum Tax , Why Am I Paying AMT? : The Major Causes of the Alternative Minimum , Why Am I Paying AMT? : The Major Causes of the Alternative Minimum , 2015 Tax Rates, Brackets & Exemption Amounts May Save , 2015 Tax Rates, Brackets & Exemption Amounts May Save , small corporations exempt from federal. AMT under IRC section 55(e). If you do not fit the categories above and your Minnesota net income (from. Form M4I, line