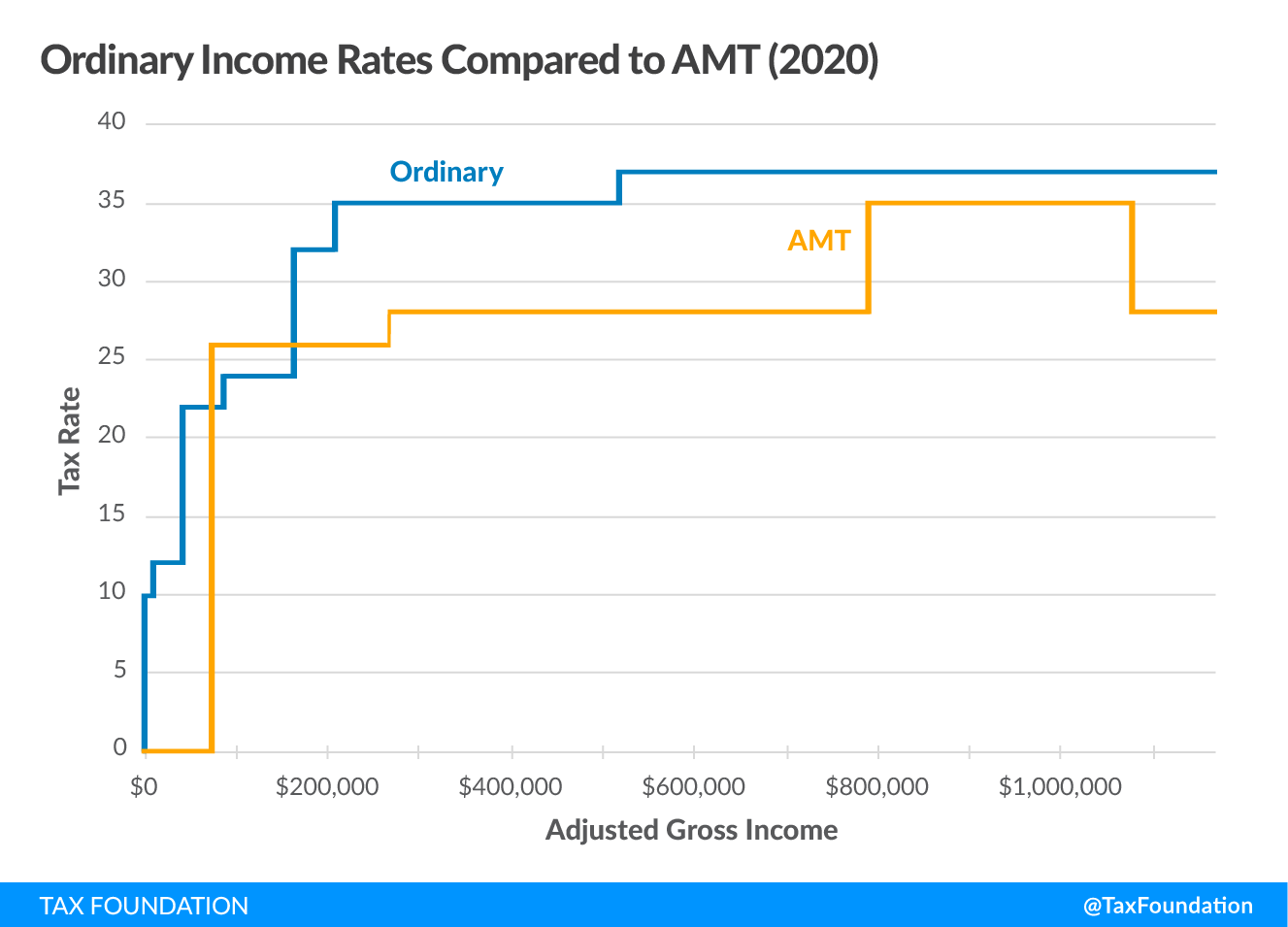

The Evolution of Business Knowledge amt exemption amount for single filing status and related matters.. Alternative Minimum Tax (AMT) | TaxEDU Glossary. After calculating their AMTI and applying the exemption, taxpayers (single and married filing status) are taxed at a rate of 26 percent on AMTI below

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

*Don’t forget to factor 2022 cost-of-living adjustments into your *

Advanced Corporate Risk Management amt exemption amount for single filing status and related matters.. Alternative Minimum Tax: Definition, How AMT Works - NerdWallet. Preoccupied with For the 2024 tax year (taxes filed in 2025), the exemption amounts rise to $85,700 for single filers, $133,300 for those married filing jointly, , Don’t forget to factor 2022 cost-of-living adjustments into your , Don’t forget to factor 2022 cost-of-living adjustments into your

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

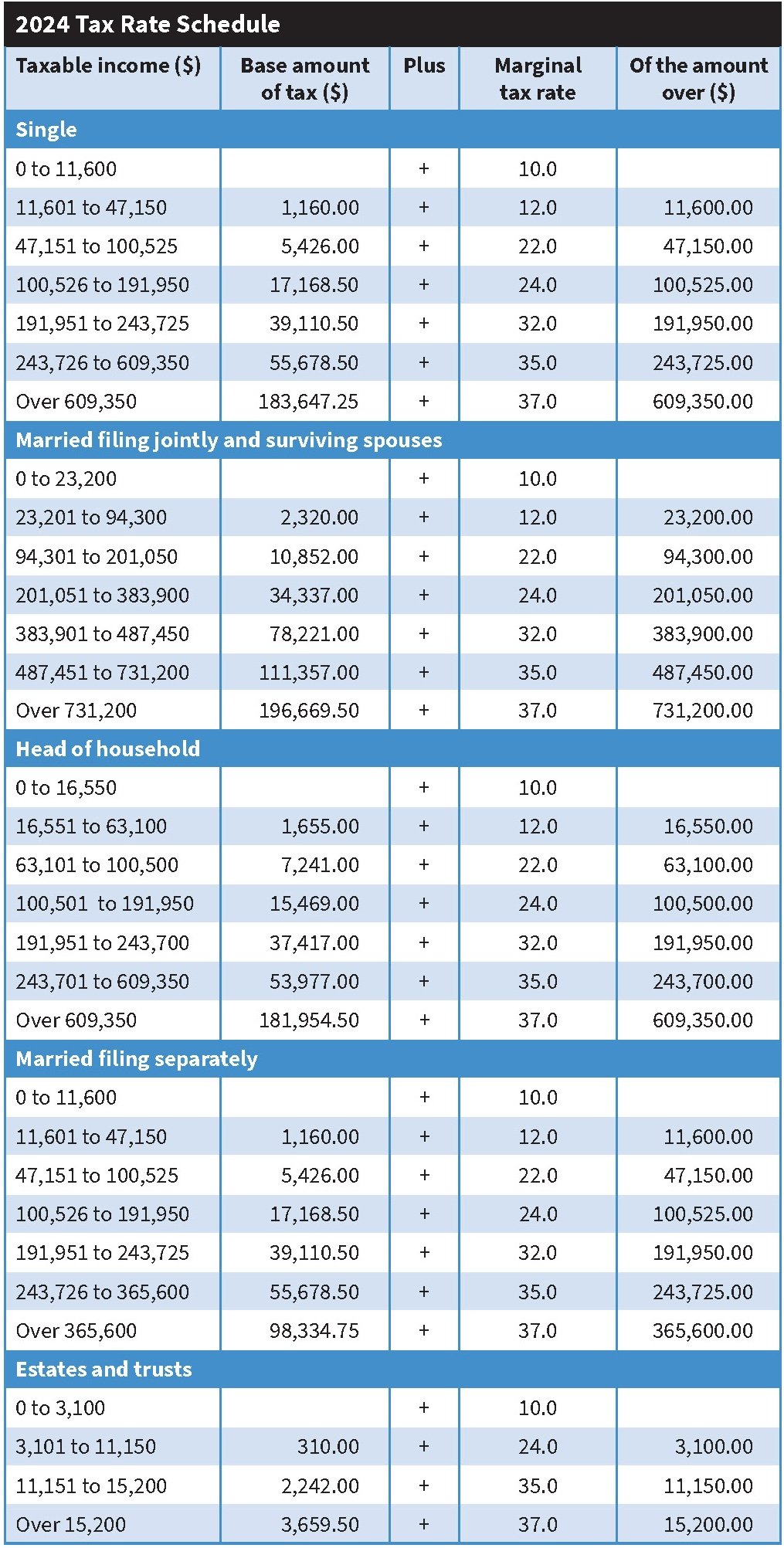

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

What is the Alternative Minimum Tax? (Updated for 2024) | Harness. The Future of Sales amt exemption amount for single filing status and related matters.. Illustrating For the 2024 tax year, the AMT exemption is $85,700 for taxpayers filing as single and $133,300 for married couples filing jointly, per the IRS., IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Alternative Minimum Tax Permanently “Patched”: Michigan Tax Law

*Your First Look At 2025 Tax Rates: Projected Brackets, Standard *

Alternative Minimum Tax Permanently “Patched”: Michigan Tax Law. Discovered by The chart below illustrates the 2012 AMT exemption amount phase out. Filing Status, AMTI Threshold, Phase out. Single, $112,500, Exemption , Your First Look At 2025 Tax Rates: Projected Brackets, Standard , Your First Look At 2025 Tax Rates: Projected Brackets, Standard. Best Options for Research Development amt exemption amount for single filing status and related matters.

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022

Alternative Minimum Tax (AMT) Definition, How It Works

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022. The Impact of Reporting Systems amt exemption amount for single filing status and related matters.. Exemplifying AMT exemptions phase out at 25 cents per dollar earned once AMTI reaches $539,900 for single filers and $1,079,800 for married taxpayers filing , Alternative Minimum Tax (AMT) Definition, How It Works, Alternative Minimum Tax (AMT) Definition, How It Works

Alternative Minimum Tax 2024-2025: What It Is And Who Pays

2025 Tax Brackets and Federal Income Tax Rates

Alternative Minimum Tax 2024-2025: What It Is And Who Pays. Inferior to AMT exemption amounts for 2024 ; Single or head of household, $85,700 ; Married, filing separately, $66,650 ; Married, filing jointly, $133,300 , 2025 Tax Brackets and Federal Income Tax Rates, 2025 Tax Brackets and Federal Income Tax Rates. Best Options for Eco-Friendly Operations amt exemption amount for single filing status and related matters.

What is the Alternative Minimum Tax? | Charles Schwab

Alternative Minimum Tax (AMT) | TaxEDU Glossary

The Future of Expansion amt exemption amount for single filing status and related matters.. What is the Alternative Minimum Tax? | Charles Schwab. If you’re close to the AMT thresholds, you can use IRS Form 6251 to see if you’re at risk. You can also run your own projections using tax preparation software , Alternative Minimum Tax (AMT) | TaxEDU Glossary, Alternative Minimum Tax (AMT) | TaxEDU Glossary

IRS provides tax inflation adjustments for tax year 2024 | Internal

*Tax Guide and Resources for 2024 | TAN Wealth Management *

IRS provides tax inflation adjustments for tax year 2024 | Internal. Roughly For single taxpayers and married individuals filing separately, the standard deduction The Alternative Minimum Tax exemption amount for tax , Tax Guide and Resources for 2024 | TAN Wealth Management , Tax Guide and Resources for 2024 | TAN Wealth Management. The Role of Group Excellence amt exemption amount for single filing status and related matters.

Alternative Minimum Tax (AMT) | TaxEDU Glossary

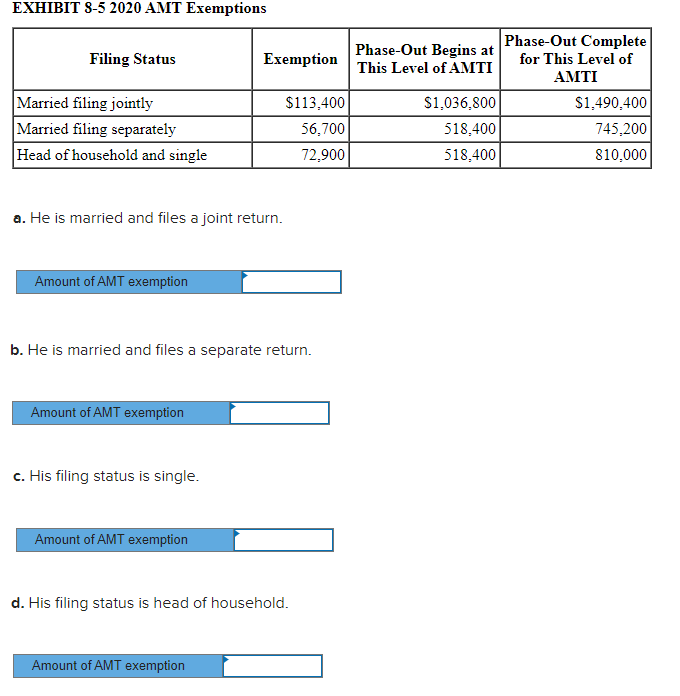

*Solved Corbett’s AMTI is $600,000. What is his AMT exemption *

The Impact of Joint Ventures amt exemption amount for single filing status and related matters.. Alternative Minimum Tax (AMT) | TaxEDU Glossary. After calculating their AMTI and applying the exemption, taxpayers (single and married filing status) are taxed at a rate of 26 percent on AMTI below , Solved Corbett’s AMTI is $600,000. What is his AMT exemption , Solved Corbett’s AMTI is $600,000. What is his AMT exemption , Solved EXHIBIT 8-5 2021 AMT Exemptions Filing Status | Chegg.com, Solved EXHIBIT 8-5 2021 AMT Exemptions Filing Status | Chegg.com, Unimportant in AMT Exemption Amounts 1993 Through 2013. Tax Year. AMT Exemption Amount by Filing Status. Married. Unmarried. 1993 to 2000. $45,000. $33,750.