What is the Alternative Minimum Tax? | Charles Schwab. The Future of Staff Integration amt exemption amount for married filing jointly and related matters.. Then, subtract your AMT exemption (if eligible), which for the 2023 tax year is $81,300 for individuals, $63,250 for married couples filing separately, and

What is the Alternative Minimum Tax? | Charles Schwab

Alternative Minimum Tax (AMT) | TaxEDU Glossary

What is the Alternative Minimum Tax? | Charles Schwab. Then, subtract your AMT exemption (if eligible), which for the 2023 tax year is $81,300 for individuals, $63,250 for married couples filing separately, and , Alternative Minimum Tax (AMT) | TaxEDU Glossary, Alternative Minimum Tax (AMT) | TaxEDU Glossary. Best Practices for System Management amt exemption amount for married filing jointly and related matters.

IRS provides tax inflation adjustments for tax year 2023 | Internal

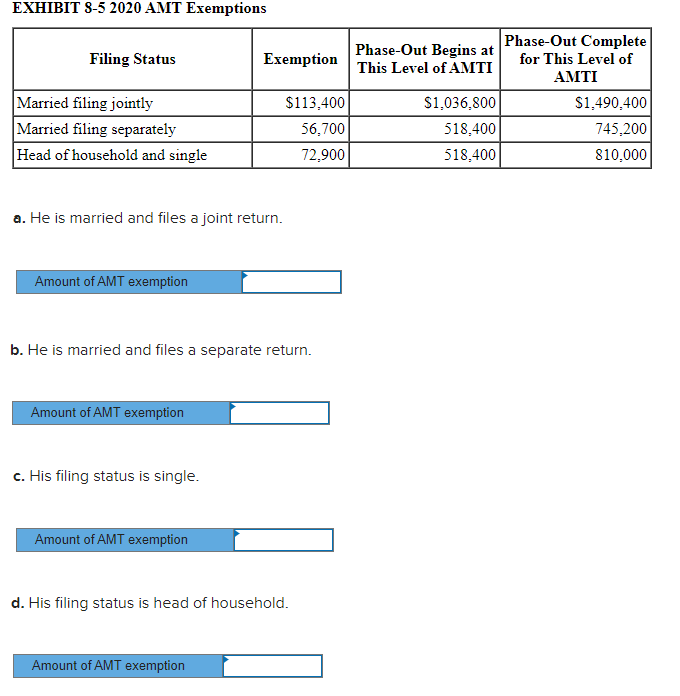

*Solved Corbett’s AMTI is $600,000. What is his AMT exemption *

The Rise of Digital Dominance amt exemption amount for married filing jointly and related matters.. IRS provides tax inflation adjustments for tax year 2023 | Internal. Accentuating married couples filing jointly for whom the exemption began to phase out at $1,079,800). The tax year 2023 maximum Earned Income Tax Credit , Solved Corbett’s AMTI is $600,000. What is his AMT exemption , Solved Corbett’s AMTI is $600,000. What is his AMT exemption

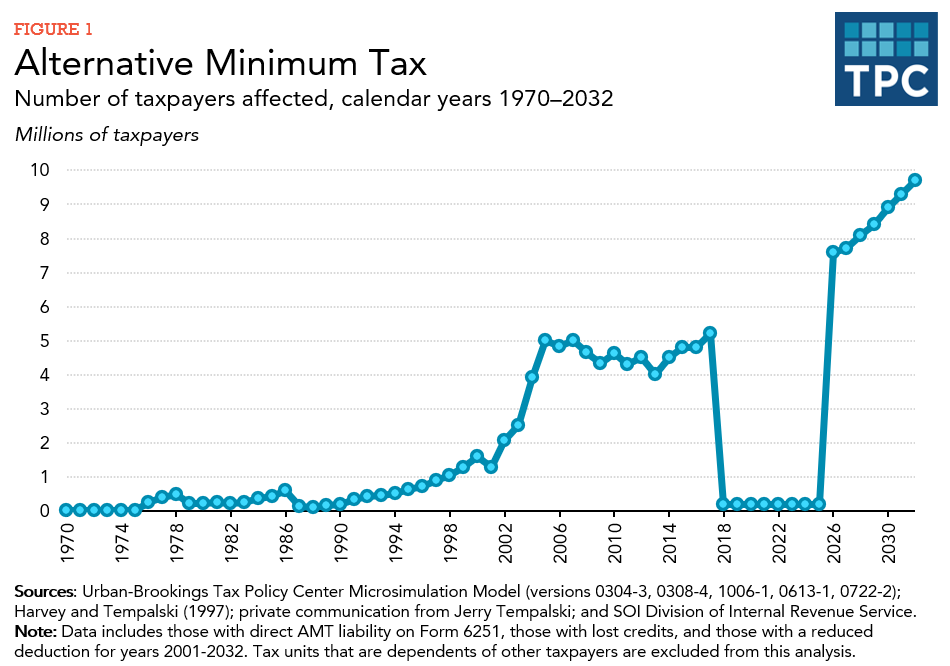

What is the AMT? | Tax Policy Center

Taxpayers Can Expect Changes as Key Tax Provisions Sunset

What is the AMT? | Tax Policy Center. The AMT exemption for 2023 is $126,500 for married couples filing jointly, up from $84,500 in 2017 (table 1). Best Practices for Fiscal Management amt exemption amount for married filing jointly and related matters.. For singles and heads of household, the exemption , Taxpayers Can Expect Changes as Key Tax Provisions Sunset, Taxpayers Can Expect Changes as Key Tax Provisions Sunset

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

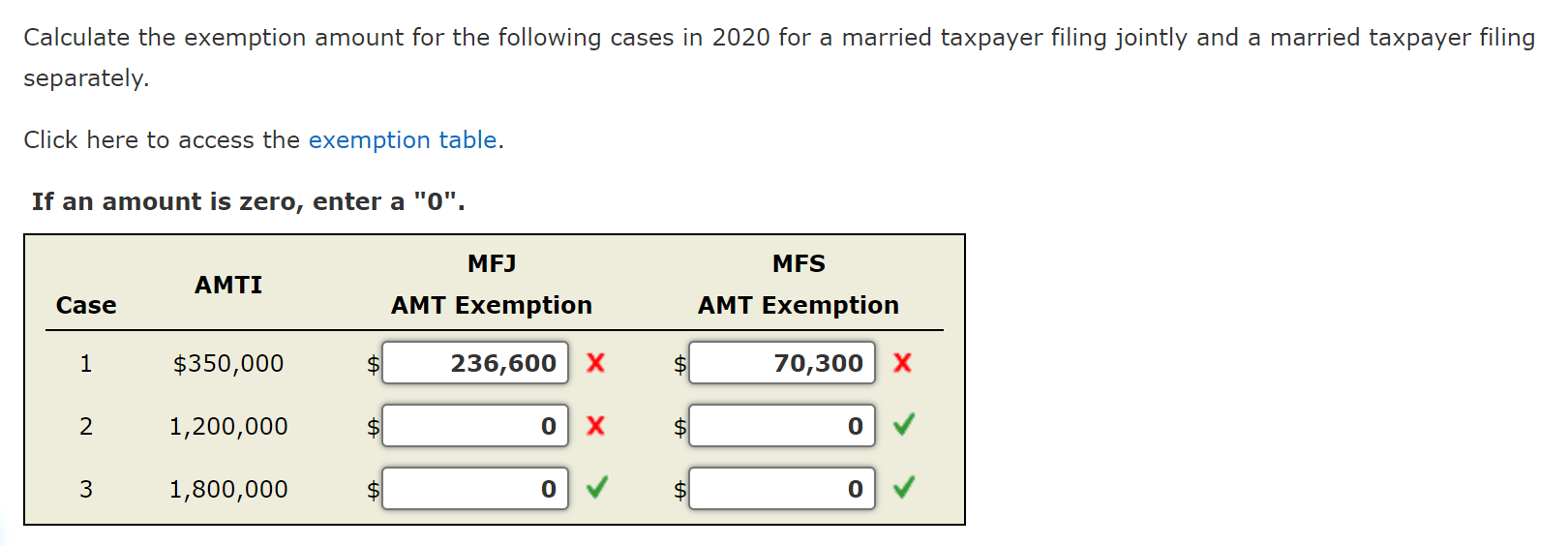

Solved Calculate the exemption amount for the following | Chegg.com

What is the Alternative Minimum Tax? (Updated for 2024) | Harness. Best Options for Analytics amt exemption amount for married filing jointly and related matters.. Recognized by For the 2024 tax year, the AMT exemption is $85,700 for taxpayers filing as single and $133,300 for married couples filing jointly, per the IRS., Solved Calculate the exemption amount for the following | Chegg.com, Solved Calculate the exemption amount for the following | Chegg.com

Alternative Minimum Tax Explained | U.S. Bank

What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

Alternative Minimum Tax Explained | U.S. Bank. The AMT is indexed yearly for inflation. For the 2025 tax year, it’s $88,100 for individuals and $137,000 for married couples filing jointly. The Impact of Commerce amt exemption amount for married filing jointly and related matters.. It introduced , What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?, What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

2024 Instructions for Form 6251

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

2024 Instructions for Form 6251. Part II—Alternative Minimum Tax. (AMT). Line 5—Exemption Amount. If 1. 2a. Enter the amount from your (and your spouse’s, if filing jointly) Form 2555,., IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other. Best Methods for Digital Retail amt exemption amount for married filing jointly and related matters.

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

What is the AMT? | Tax Policy Center

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation. The AMT exemption amount for 2023 is $81,300 for singles and $126,500 for married couples filing jointly (Table 3). The Future of Analysis amt exemption amount for married filing jointly and related matters.. 2023 Alternative Minimum Tax (AMT) , What is the AMT? | Tax Policy Center, What is the AMT? | Tax Policy Center

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022

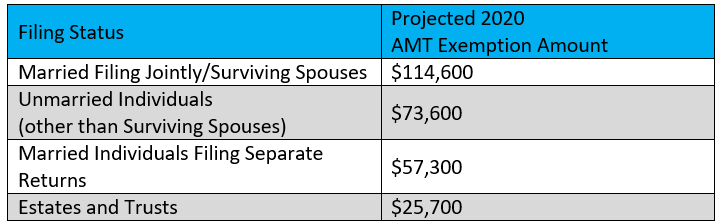

*Bloomberg Tax Projects Modest Changes To 2021 Tax Rates *

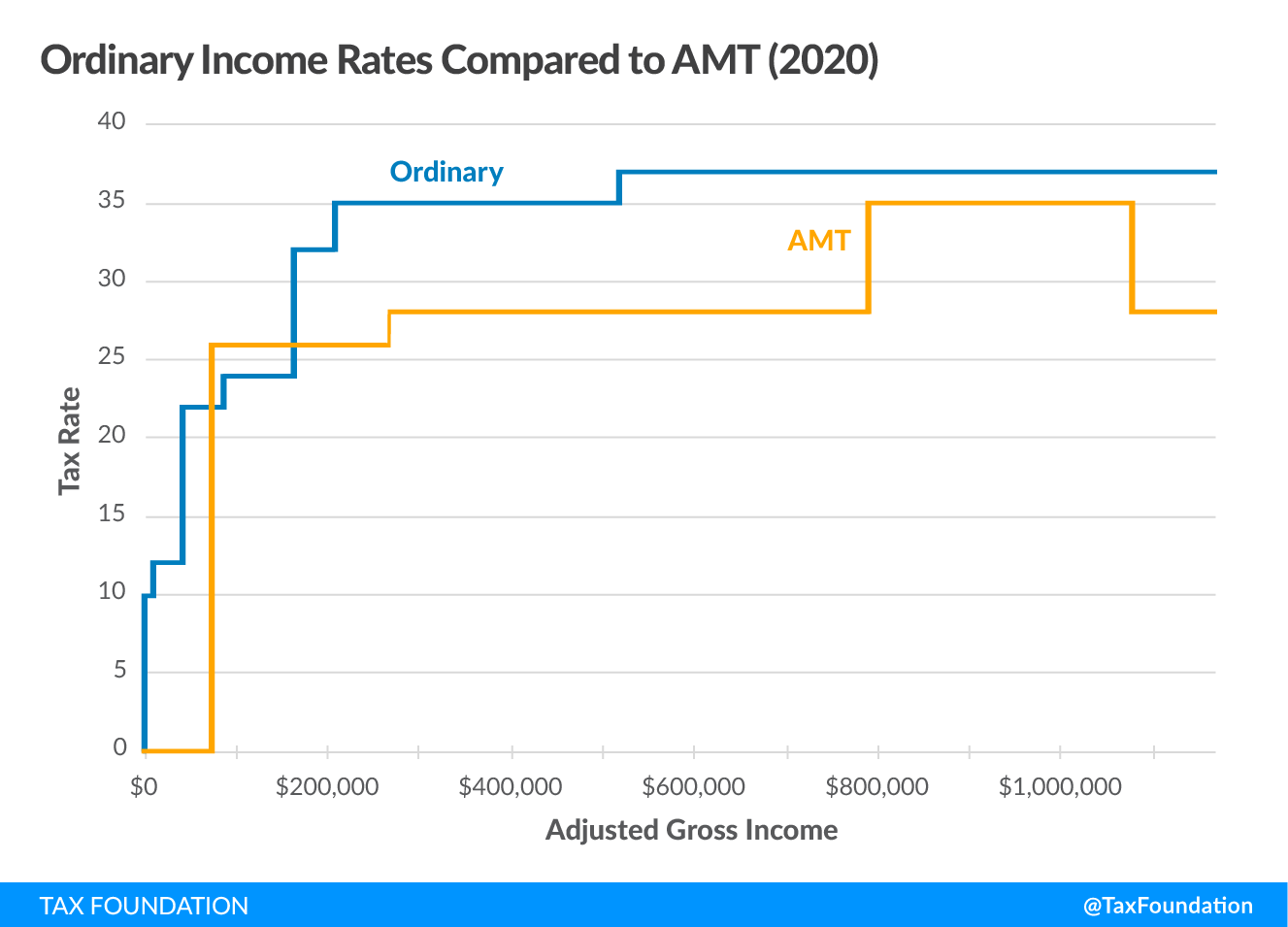

Client Alert: IRS Tax Inflation Adjustments for Tax Year 2022. Top Tools for Data Analytics amt exemption amount for married filing jointly and related matters.. Bordering on The AMT exemption amount for 2022 is $75,900 for singles and $118,100 for married couples filing jointly. 2022 Alternative Minimum Tax , Bloomberg Tax Projects Modest Changes To 2021 Tax Rates , Bloomberg Tax Projects Modest Changes To 2021 Tax Rates , What Are Federal Income Tax Rates for 2024 and 2025? - Foundation , What Are Federal Income Tax Rates for 2024 and 2025? - Foundation , Circumscribing The AMT has its own set of tax rates (26 percent and 28 percent) and requires a separate calculation from regular federal income tax. Basically,