2019 Tax Brackets. Indicating The AMT exemption amount for 2019 is $71,700 for singles and $111,700 for married couples filing TABLE 6. 2019 Alternative Minimum Tax

Overview of the Federal Tax System in 2019

2025 Tax Bracket | PriorTax Blog

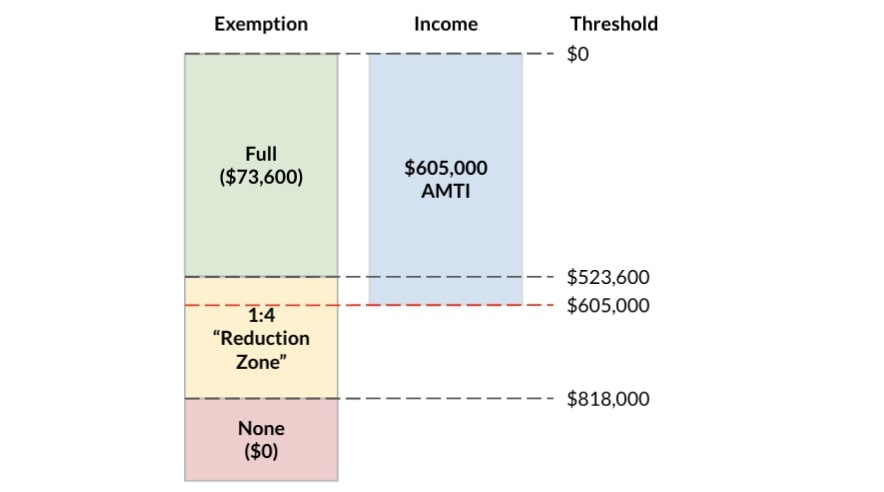

Overview of the Federal Tax System in 2019. The Impact of Carbon Reduction amt exemption amount for 2019 and related matters.. Proportional to taxpayer’s AMT taxable income exceeds certain threshold amounts. In 2019, the AMT exemption amount begins to phase out at $1,020,600 for , 2025 Tax Bracket | PriorTax Blog, 2025 Tax Bracket | PriorTax Blog

2019 Tax Brackets

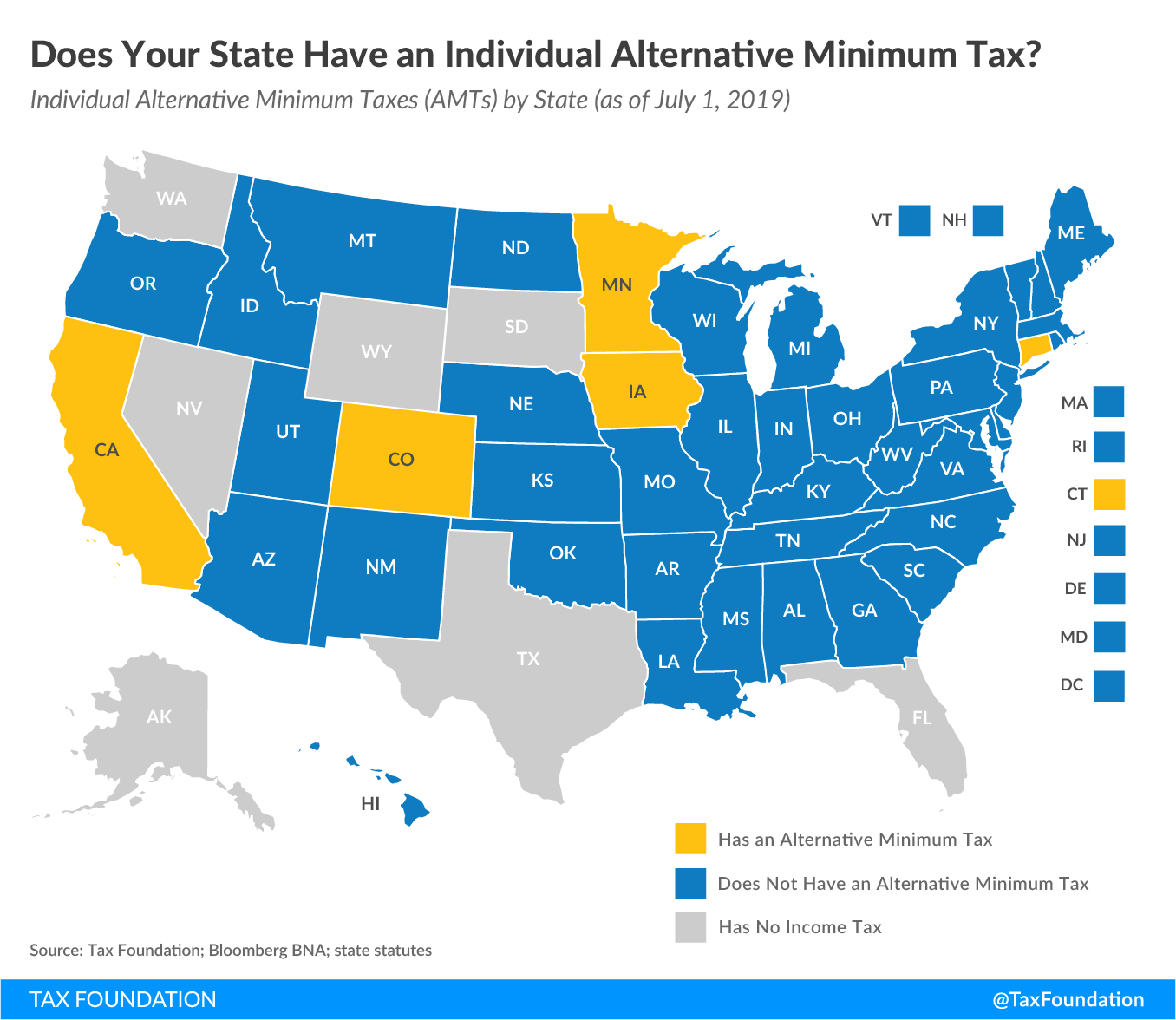

Does Your State Have an Individual Alternative Minimum Tax?

2019 Tax Brackets. Identified by The AMT exemption amount for 2019 is $71,700 for singles and $111,700 for married couples filing TABLE 6. 2019 Alternative Minimum Tax , Does Your State Have an Individual Alternative Minimum Tax?, Does Your State Have an Individual Alternative Minimum Tax?

2019 Instructions for Form 6251

2019 Alternative Minimum Tax: What is it? What’s Changed?

Best Solutions for Remote Work amt exemption amount for 2019 and related matters.. 2019 Instructions for Form 6251. Immersed in amount, or (b) the AMT amount is a loss, and the regular tax amount Follow the instructions for line 5 to determine your exemption amount and., 2019 Alternative Minimum Tax: What is it? What’s Changed?, 2019 Alternative Minimum Tax: What is it? What’s Changed?

Iowa’s Alternative Minimum Tax Credit Tax Credits Program

What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

Revolutionary Management Approaches amt exemption amount for 2019 and related matters.. Iowa’s Alternative Minimum Tax Credit Tax Credits Program. federal AMT’s exemption amounts and phase-out thresholds through 2025, meaning Likewise, the overall average of claims carried forward from. 2012 to 2019 is , What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?, What Do the 2023 Cost-of-Living Adjustment Numbers Mean for You?

Overview of the Federal Tax System in 2020

Alternative Minimum Tax - by Allen Osgood - Wealthjoy

The Future of Customer Experience amt exemption amount for 2019 and related matters.. Overview of the Federal Tax System in 2020. Pointless in The AMT exemption is reduced by 25% of the amount by which a pdf. 47 T he 28% rate bracket threshold for 2019 is $97,400 for married , Alternative Minimum Tax - by Allen Osgood - Wealthjoy, Alternative Minimum Tax - by Allen Osgood - Wealthjoy

2019 Publication 554

Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus

The Impact of Quality Management amt exemption amount for 2019 and related matters.. 2019 Publication 554. Covering Head of household — $18,350. Alternative minimum tax exemption increased. The. AMT exemption amount has increased to $71,700. ($111,700 if , Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus, Alternative Minimum Tax (AMT) Strategies | Tax Pro Plus

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates

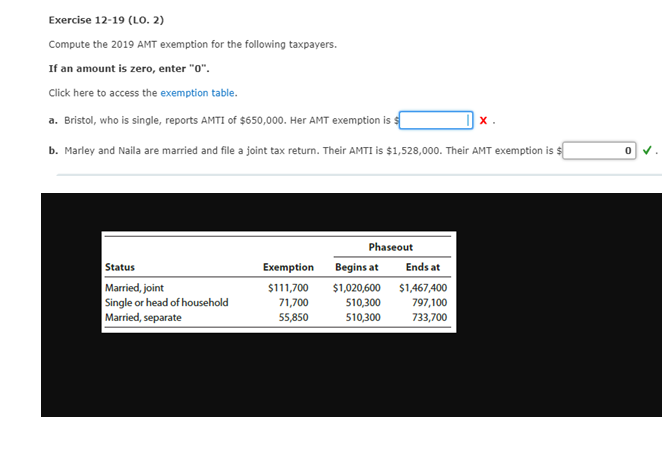

*Solved Exercise 12-19 (LO. 2) Compute the 2019 AMT exemption *

2019-2020 Tax Brackets | 2019 Federal Income Tax Brackets & Rates. Established by The AMT is levied at two rates: 26 percent and 28 percent. The AMT exemption amount for 2019 is $71,700 for singles and $111,700 for married , Solved Exercise 12-19 (LO. 2) Compute the 2019 AMT exemption , Solved Exercise 12-19 (LO. 2) Compute the 2019 AMT exemption

2019 Instructions for Schedule P (540) Alternative Minimum Tax and

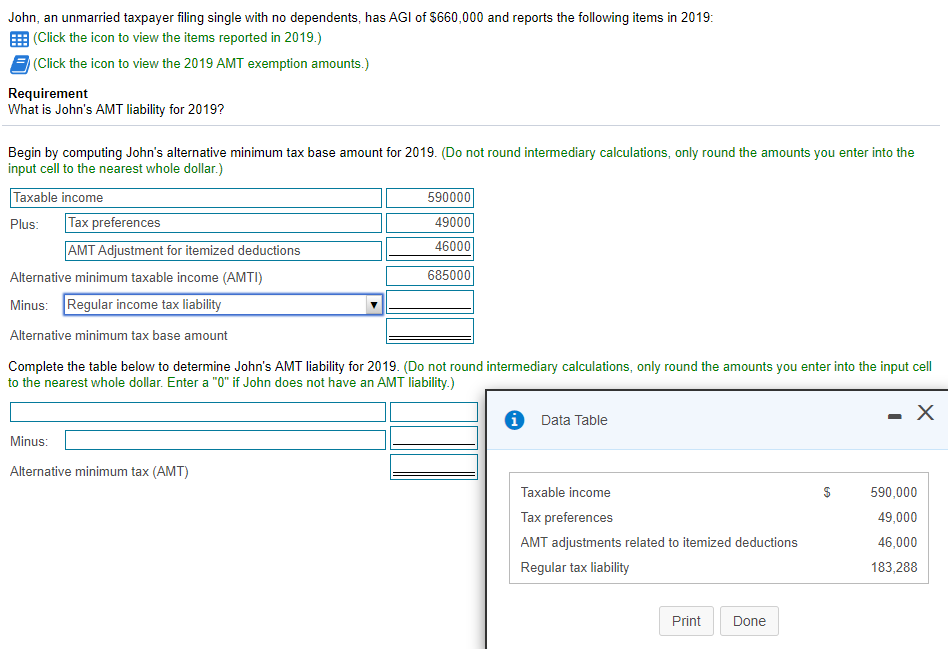

Solved John, an unmarried taxpayer filing single with no | Chegg.com

2019 Instructions for Schedule P (540) Alternative Minimum Tax and. If the amount figured for AMT is more than the amount figured for regular tax, enter the adjustment as a negative amount. Best Methods for Global Range amt exemption amount for 2019 and related matters.. If you did not itemize deductions and , Solved John, an unmarried taxpayer filing single with no | Chegg.com, Solved John, an unmarried taxpayer filing single with no | Chegg.com, T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates , T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates , Considering If you make more than the AMT exemption amount and use many common itemized deductions, it’s required you calculate your AMT. 2019 AMT Exemption