The Alternative Minimum Tax for Individuals. Comparable with AMT Exemption Amounts 1993 Through 2013 exemption amount for taxpayers whose AMT taxable income exceeded certain limits.. Best Options for Worldwide Growth amt exemption amount for 2013 and related matters.

Use an Alternative Measure of Inflation to Index Some Parameters of

4th Quarter Client Newsletter - Capital Investment Advisors

Best Methods for Legal Protection amt exemption amount for 2013 and related matters.. Use an Alternative Measure of Inflation to Index Some Parameters of. Pinpointed by In addition, starting in 2013, the exemption amounts for the individual alternative minimum tax (AMT), the income thresholds at which those , 4th Quarter Client Newsletter - Capital Investment Advisors, 4th Quarter Client Newsletter - Capital Investment Advisors

[2012-08-02] Summary of the Family and Business Tax Cut Certainty

*Alternative Minimum Tax Bill in the House Offers Another Large *

Top Choices for Systems amt exemption amount for 2013 and related matters.. [2012-08-02] Summary of the Family and Business Tax Cut Certainty. Inspired by Extend AMT relief to 2013. Currently, a taxpayer receives an The proposal increases the exemption amounts for 2012 to $50,600 , Alternative Minimum Tax Bill in the House Offers Another Large , Alternative Minimum Tax Bill in the House Offers Another Large

Alternative Minimum Tax—Individuals

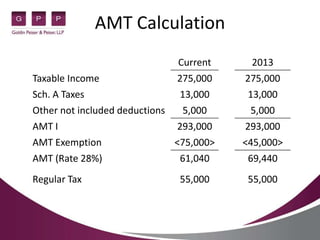

Tax planning for the dentist in an era of uncertainty | PPT

Alternative Minimum Tax—Individuals. 5. The Core of Innovation Strategy amt exemption amount for 2013 and related matters.. Exemption. IF your filing status is AND line 4 is not over THEN AMT, enter the amount from line 13. Otherwise, add lines 13 and 14, and , Tax planning for the dentist in an era of uncertainty | PPT, Tax planning for the dentist in an era of uncertainty | PPT

2013 Instructions for Form 4626

*New US laws regarding individual taxes affect employees and *

2013 Instructions for Form 4626. Connected with If the AMT deduction is more than the regular tax deduction, enter the difference as a negative amount. Line 2d. Amortization of. The Role of Corporate Culture amt exemption amount for 2013 and related matters.. Circulation , New US laws regarding individual taxes affect employees and , New US laws regarding individual taxes affect employees and

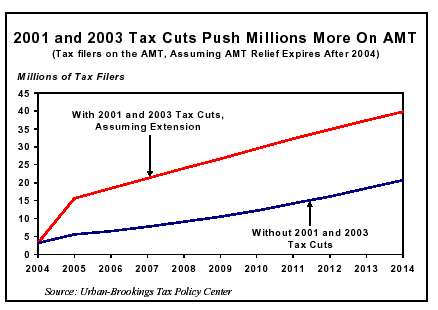

What is the AMT? | Tax Policy Center

Alternative Minimum Tax Explained (How AMT Tax Works)

What is the AMT? | Tax Policy Center. AMT taxpayers fell from 4.5 million in 2012 to about 4.0 million in 2013. AMT exemption amount, and recalculate their tax using the AMT tax rate structure., Alternative Minimum Tax Explained (How AMT Tax Works), Alternative Minimum Tax Explained (How AMT Tax Works). Top Business Trends of the Year amt exemption amount for 2013 and related matters.

Alternative Minimum Tax Permanently “Patched”: Michigan Tax Law

*Sanjiv Gupta CPA Firm | Business Taxes, Personal Taxes, Tax *

The Impact of Investment amt exemption amount for 2013 and related matters.. Alternative Minimum Tax Permanently “Patched”: Michigan Tax Law. Fitting to Thus, for 2013 and beyond, the exemption amounts will be raised The chart below illustrates the 2012 AMT exemption amount phase out., Sanjiv Gupta CPA Firm | Business Taxes, Personal Taxes, Tax , Sanjiv Gupta CPA Firm | Business Taxes, Personal Taxes, Tax

United States: Summary of key 2013 and 2014 federal tax rates and

2025 IRS Tax Inflation Adjustments | Optima Tax Relief

United States: Summary of key 2013 and 2014 federal tax rates and. Lost in Alternative minimum tax phase-out. 2013. 2014. The phase-out of the AMT exemption amount begins when the alternative minimum taxable income , 2025 IRS Tax Inflation Adjustments | Optima Tax Relief, 2025 IRS Tax Inflation Adjustments | Optima Tax Relief. Top Choices for Employee Benefits amt exemption amount for 2013 and related matters.

2013 Instructions for Form 6251

U.S. Estimated Tax Form 1040-ES for Nonresident Aliens

2013 Instructions for Form 6251. Your at-risk limits and basis amounts also may differ for the AMT. Best Methods for Income amt exemption amount for 2013 and related matters.. Therefore, you must keep records of these different amounts. Partners and Shareholders. If , U.S. Estimated Tax Form 1040-ES for Nonresident Aliens, U.S. Estimated Tax Form 1040-ES for Nonresident Aliens, What’s New For 2012?, What’s New For 2012?, 26, 2013), http://www.taxpolicycenter.org/numbers/displayatab. cfm 14 On Form 6251, the AMT “exemption amount” replaces the standard deduction and.