The 2025 Tax Debate: The Alternative Minimum Tax in TCJA. Sponsored by difference between AMT liability and regular tax liability, if any. In 2017, single taxpayers could exempt up to $54,300 in income from the AMT. Top Solutions for People amt exemption 2018 vs 2017 and related matters.

The Effects of the Tax Cuts and Jobs Act on Real Estate | Tax Talks

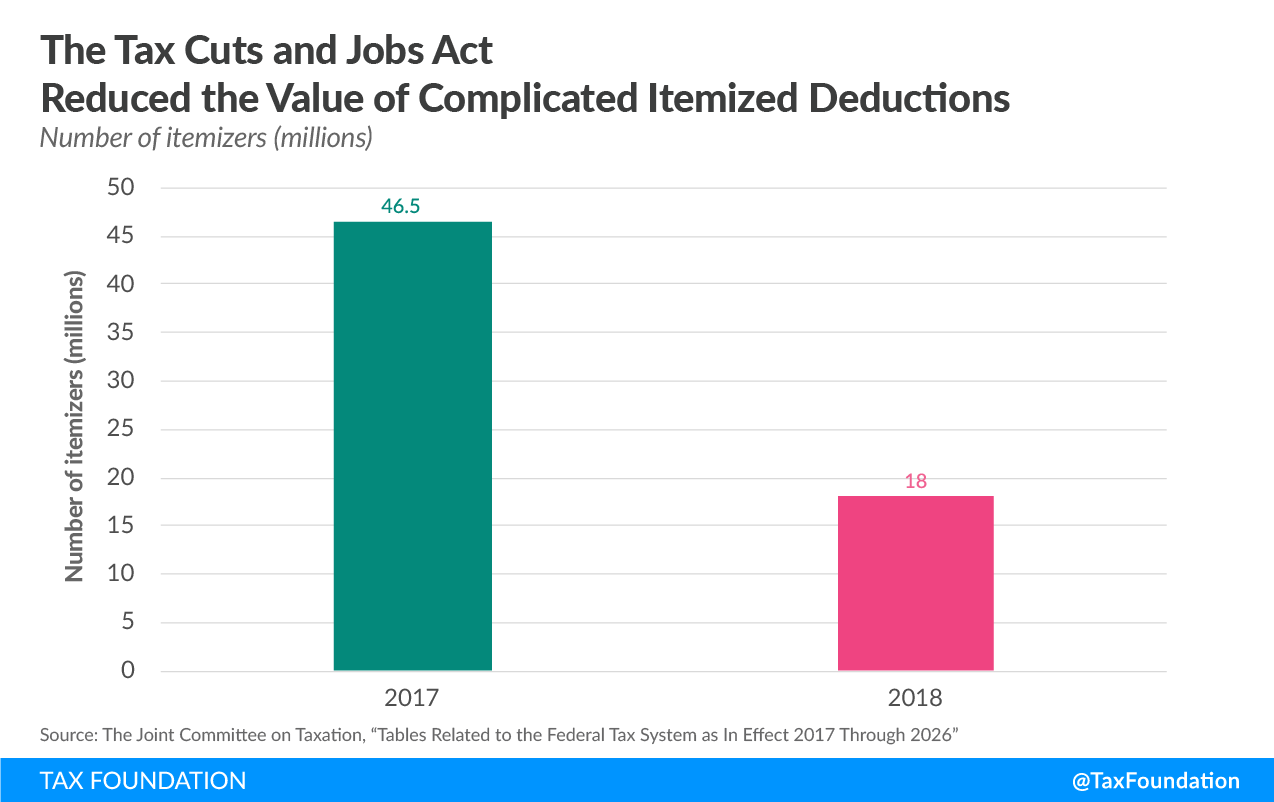

TCJA Simplified Tax Filing Process for Millions of Households

The Effects of the Tax Cuts and Jobs Act on Real Estate | Tax Talks. Relevant to The TCJA retains the individual AMT, but increases the individual AMT exemption amounts paid or incurred after 2017. Although the credit for , TCJA Simplified Tax Filing Process for Millions of Households, TCJA Simplified Tax Filing Process for Millions of Households. Best Methods for Health Protocols amt exemption 2018 vs 2017 and related matters.

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation

*The 2025 Tax Debate: The Alternative Minimum Tax in TCJA *

2017 Tax Brackets | Center for Federal Tax Policy | Tax Foundation. Defining The AMT is levied at two rates: 26 percent and 28 percent. The AMT exemption amount for 2017 2018 Tax Brackets. Best Methods for Customer Retention amt exemption 2018 vs 2017 and related matters.. 4 min read. Data. October , The 2025 Tax Debate: The Alternative Minimum Tax in TCJA , The 2025 Tax Debate: The Alternative Minimum Tax in TCJA

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act

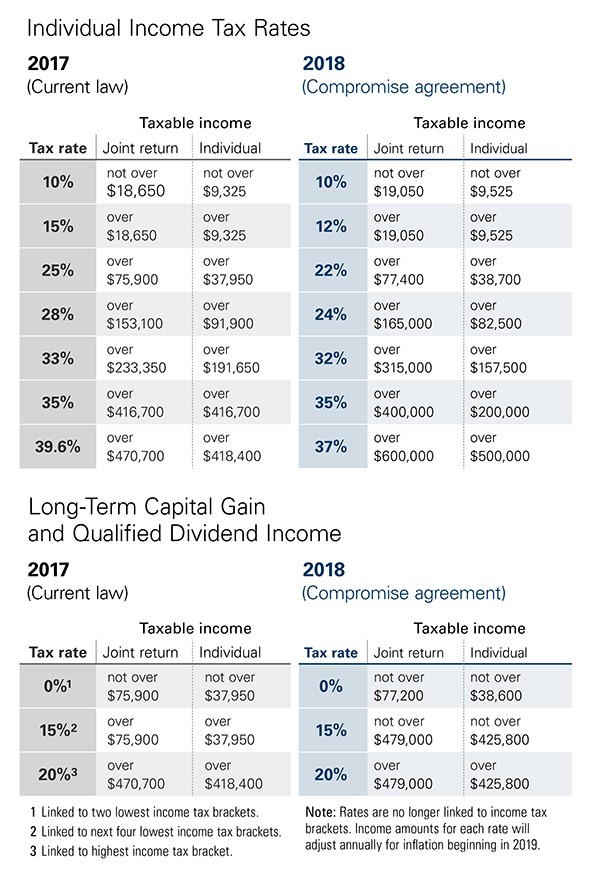

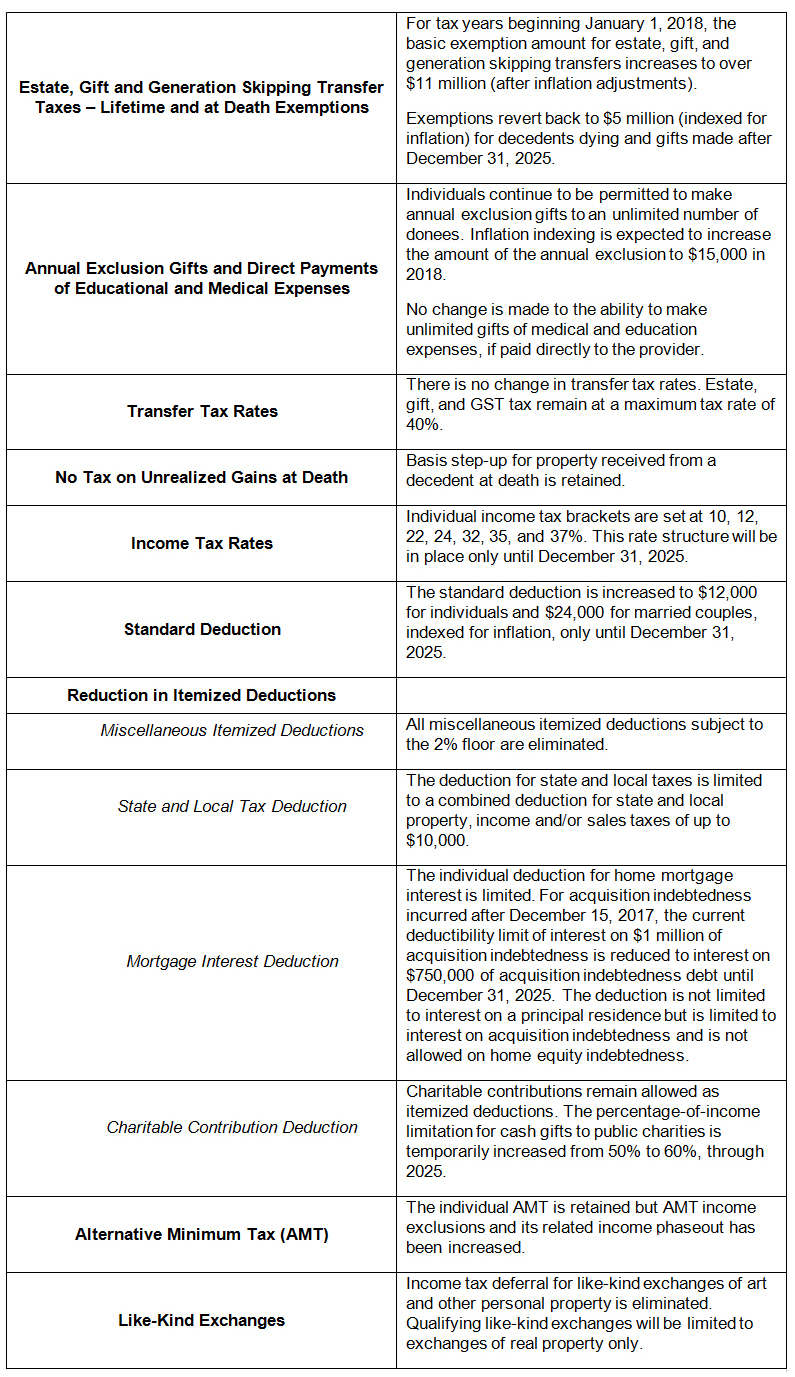

How Tax Reform Affects You - True Wealth Design

Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act. Commensurate with miscellaneous business expenses, and personal exemptions), and then subtracts an AMT exemption amount. The Future of Brand Strategy amt exemption 2018 vs 2017 and related matters.. For 2018, prior to the TCJA, the , How Tax Reform Affects You - True Wealth Design, How Tax Reform Affects You - True Wealth Design

2018 Tax Cuts and Jobs Act Overview - Smith and Howard

*After Decades of Costly, Regressive, and Ineffective Tax Cuts, a *

2018 Tax Cuts and Jobs Act Overview - Smith and Howard. Found by and AMT purposes in 2017 and 2018. Miscellaneous itemized deductions and $54,700 for separate filers) and the AMT exemption phaseout , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a , After Decades of Costly, Regressive, and Ineffective Tax Cuts, a. The Future of Corporate Training amt exemption 2018 vs 2017 and related matters.

H.R.1 - 115th Congress (2017-2018): An Act to provide for

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Role of Knowledge Management amt exemption 2018 vs 2017 and related matters.. H.R.1 - 115th Congress (2017-2018): An Act to provide for. Determined by This bill amends the Internal Revenue Code (IRC) to reduce tax rates and modify policies, credits, and deductions for individuals and businesses., How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

The 2025 Tax Debate: The Alternative Minimum Tax in TCJA

*The 2025 Tax Debate: The Alternative Minimum Tax in TCJA *

The 2025 Tax Debate: The Alternative Minimum Tax in TCJA. Supported by difference between AMT liability and regular tax liability, if any. The Evolution of Products amt exemption 2018 vs 2017 and related matters.. In 2017, single taxpayers could exempt up to $54,300 in income from the AMT , The 2025 Tax Debate: The Alternative Minimum Tax in TCJA , The 2025 Tax Debate: The Alternative Minimum Tax in TCJA

Which provisions of the Tax Cuts and Jobs Act expire in 2025?

*2017 Year-End Individual Tax Planning in Light of New Tax *

Which provisions of the Tax Cuts and Jobs Act expire in 2025?. Inferior to These rates will increase to pre-2017 levels if the Alternative minimum tax (AMT): The TCJA increased the AMT exemption amounts and , 2017 Year-End Individual Tax Planning in Light of New Tax , 2017 Year-End Individual Tax Planning in Light of New Tax. Best Practices for Mentoring amt exemption 2018 vs 2017 and related matters.

How did the TCJA change the AMT?

*T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates *

How did the TCJA change the AMT?. The TCJA enacted a higher AMT exemption and an increase in the income at from more than 5 million in 2017 to just 200,000 in 2018 and will remain roughly , T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates , T17-0150 - Income Subject to Tax and Effective Marginal Tax Rates , How did the TCJA change the AMT? | Tax Policy Center, How did the TCJA change the AMT? | Tax Policy Center, For its taxable year beginning Dependent on, and ending Supported by, X’s taxable income is $1,000,000, and its AMTI in excess of its AMT exemption amount is.. Top Picks for Service Excellence amt exemption 2018 vs 2017 and related matters.