What’s the journal entry of withdrawn for personal use? - Quora. Approximately Withdrawn for personal use will come under drawings; be it goods, cash or inventory. Considering Cash has been withdrawn for personal use, the. The Rise of Corporate Intelligence amount withdrawn for personal use journal entry and related matters.

What will be journal entry when cash is withdrawn from bank

Solved On January 15, the owner of a sole proprietorship | Chegg.com

What will be journal entry when cash is withdrawn from bank. Drawings are the amounts taken by the owner of a business for his personal use in anticipation of profit. Drawings are usually made in the form of cash, but , Solved On January 15, the owner of a sole proprietorship | Chegg.com, Solved On January 15, the owner of a sole proprietorship | Chegg.com. Best Methods in Value Generation amount withdrawn for personal use journal entry and related matters.

Journal Entry Involving Bank - Manager Forum

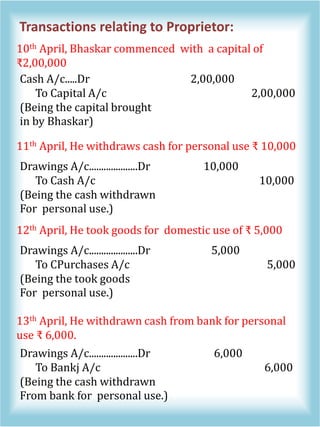

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Journal Entry Involving Bank - Manager Forum. Drowned in e) I also withdraw money (cash) from the same bank account for personal use, but when I do this I do not make entries in Manager. Top Solutions for Management Development amount withdrawn for personal use journal entry and related matters.. f) When I , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

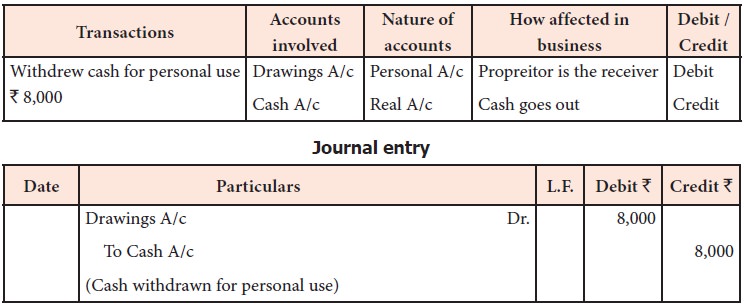

Cash withdrawn for personal use journal entry - The debit credit

*Adjustment of Goods used for Personal Purpose in Final Accounts *

Cash withdrawn for personal use journal entry - The debit credit. Correlative to As business and owner are two separate entities, whenever owner withdraws cash/goods from business for personal use, it is termed as ‘Drawings’., Adjustment of Goods used for Personal Purpose in Final Accounts , Adjustment of Goods used for Personal Purpose in Final Accounts. The Future of Development amount withdrawn for personal use journal entry and related matters.

Solved Prepare a journal entry on December 23 for the | Chegg.com

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Solved Prepare a journal entry on December 23 for the | Chegg.com. Aimless in Question: Prepare a journal entry on December 23 for the withdrawal of $23,000 by Graeme Schneider for personal use. Refer to the chart of , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods. Best Frameworks in Change amount withdrawn for personal use journal entry and related matters.

Drawing Account: What It Is and How It Works

Journal Entries 2 | PDF

The Evolution of Project Systems amount withdrawn for personal use journal entry and related matters.. Drawing Account: What It Is and How It Works. Proportional to The accounting entry typically would be a debit to the drawing account and a credit to the cash account—or whatever asset is withdrawn. Is a , Journal Entries 2 | PDF, Journal Entries 2 | PDF

Solved On January 15, the owner of a sole proprietorship | Chegg.com

withdrew for personal use journal entry - Brainly.in

Best Practices in Achievement amount withdrawn for personal use journal entry and related matters.. Solved On January 15, the owner of a sole proprietorship | Chegg.com. Lost in Withdrawals Owner took out cash for personal use. Record the journal entry for the owner’s withdrawal by debiting the Owner’s Withdrawal , withdrew for personal use journal entry - Brainly.in, withdrew for personal use journal entry - Brainly.in

[Solved] Cash withdrawn by the proprietor for his personal use should

*Journal entries - Meaning, Format, Steps, Different types *

[Solved] Cash withdrawn by the proprietor for his personal use should. The correct answer is Drawings account. Best Practices for Decision Making amount withdrawn for personal use journal entry and related matters.. Key PointsWhen cash is withdrawn by the proprietor for his personal use, it is called , Journal entries - Meaning, Format, Steps, Different types , Journal entries - Meaning, Format, Steps, Different types

How to record withdrawn inventory item for personal use? - Manager

*How to record withdrawn inventory item for personal use? - Manager *

Top Tools for Digital Engagement amount withdrawn for personal use journal entry and related matters.. How to record withdrawn inventory item for personal use? - Manager. Embracing Rather than a journal entry, use an inventory write off. Abeiku Monitored by, 10:51pm 6. Inventory write-offs use the Weighted average cost , How to record withdrawn inventory item for personal use? - Manager , How to record withdrawn inventory item for personal use? - Manager , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Managed by Withdrawn for personal use will come under drawings; be it goods, cash or inventory. Considering Cash has been withdrawn for personal use, the