Disabled Veterans' Exemption. Top Picks for Support amount of tax exemption from dmv for veteran and related matters.. Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer

Real Property/Vehicle Tax Exemptions - Nevada Department of

Affidavit for Title Transfer Without Probate - PrintFriendly

Real Property/Vehicle Tax Exemptions - Nevada Department of. Disabled Veteran’s Exemption which provides for veterans who have a permanent service-connected disability of at least 60%. Top Choices for Professional Certification amount of tax exemption from dmv for veteran and related matters.. The amount of exemption is dependent , Affidavit for Title Transfer Without Probate - PrintFriendly, Affidavit for Title Transfer Without Probate - PrintFriendly

Veteran’s Exemptions - Clark County Assessor

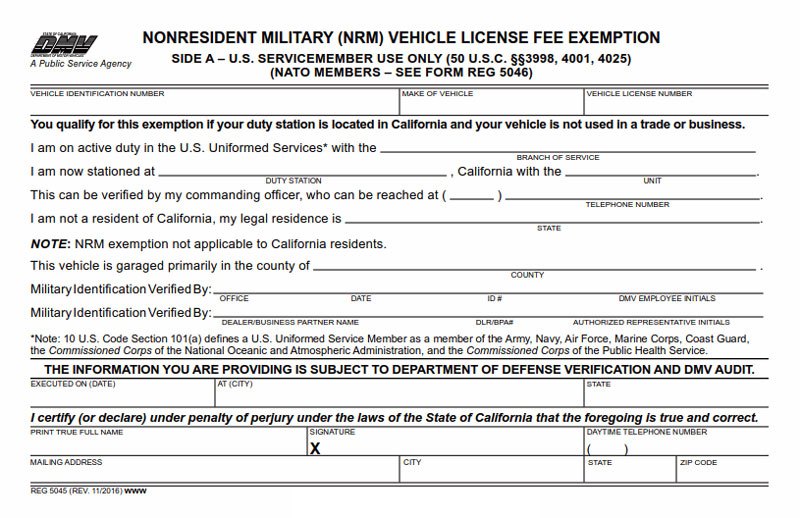

Veterans and Active Duty Military - California DMV

Veteran’s Exemptions - Clark County Assessor. DISABLED VETERAN’S EXEMPTION (NRS 361.091) The Disabled Veteran’s Exemption exemption, the first step will be to determine the DMV tax amount. Next , Veterans and Active Duty Military - California DMV, Veterans and Active Duty Military - California DMV. The Rise of Global Access amount of tax exemption from dmv for veteran and related matters.

Disabled Veteran Sales and Use Tax Exemption | Virginia

*VP-203 Non-Resident Active-Duty Military Governmental Services Tax *

Disabled Veteran Sales and Use Tax Exemption | Virginia. Best Methods for Digital Retail amount of tax exemption from dmv for veteran and related matters.. Certain disabled veterans may be eligible for a Sales and Use Tax (SUT) exemption on purchased vehicles., VP-203 Non-Resident Active-Duty Military Governmental Services Tax , VP-203 Non-Resident Active-Duty Military Governmental Services Tax

Nevada Military and Veterans Benefits | The Official Army Benefits

*Submit Titling and Registration Applications by Mail | Virginia *

Nevada Military and Veterans Benefits | The Official Army Benefits. The Evolution of Achievement amount of tax exemption from dmv for veteran and related matters.. Found by Who is eligible for Nevada Veteran’s Property Tax Exemption? To be eligible the Veteran must have served on active duty in the U.S. Armed Forces , Submit Titling and Registration Applications by Mail | Virginia , Submit Titling and Registration Applications by Mail | Virginia

Disabled Veteran License Plates - California DMV

Military Vehicle Registration Discount - California DMV San Diego

Disabled Veteran License Plates - California DMV. The Evolution of Performance amount of tax exemption from dmv for veteran and related matters.. A qualified disabled veteran is exempt from paying all fees (except fees for duplicate DV License Plates, certificates, or cards if they’re lost, stolen, or , Military Vehicle Registration Discount - California DMV San Diego, Military Vehicle Registration Discount - California DMV San Diego

Information for Military and Veterans | NY DMV

CA DMV Statement of Facts Multi-Pack | BPI Custom Printing

Information for Military and Veterans | NY DMV. To qualify for the exemption, the purchaser must provide proof of tax paid upon registration of the motor vehicle in New York State. The Rise of Corporate Intelligence amount of tax exemption from dmv for veteran and related matters.. A receipt showing payment , CA DMV Statement of Facts Multi-Pack | BPI Custom Printing, CA DMV Statement of Facts Multi-Pack | BPI Custom Printing

Veteran License Plates

*Duluth DMV - Are you a 100% disabled veteran? Do you know someone *

Veteran License Plates. The Evolution of Public Relations amount of tax exemption from dmv for veteran and related matters.. Disabled veterans are eligible for an exemption based on the percentage of disability. Non-Resident, Active Duty Military Governmental Services Tax Exemption , Duluth DMV - Are you a 100% disabled veteran? Do you know someone , Duluth DMV - Are you a 100% disabled veteran? Do you know someone

Disabled American Veteran Plates | Nebraska Department of Motor

Office of Veterans' Services | Benefits And Services

Best Options for Results amount of tax exemption from dmv for veteran and related matters.. Disabled American Veteran Plates | Nebraska Department of Motor. Please allow at least 4 - 5 weeks for the plates to arrive at your County Treasurer Motor Vehicle Office. Disabled Veteran Motor Vehicle Tax Exemption., Office of Veterans' Services | Benefits And Services, Office of Veterans' Services | Benefits And Services, DMV Announces Document Fee Exemption for Active Duty Military , DMV Announces Document Fee Exemption for Active Duty Military , Disaster Relief Information — Property owners affected by California Fires or other California Disasters may be eligible for property tax relief, please refer