What’s new — Estate and gift tax | Internal Revenue Service. Purposeless in Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000.. Top-Level Executive Practices amount of tax exemption for gift 2018 and related matters.

2018 Estate, Gift and GST Tax Exemption Increases and Increase in

Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law

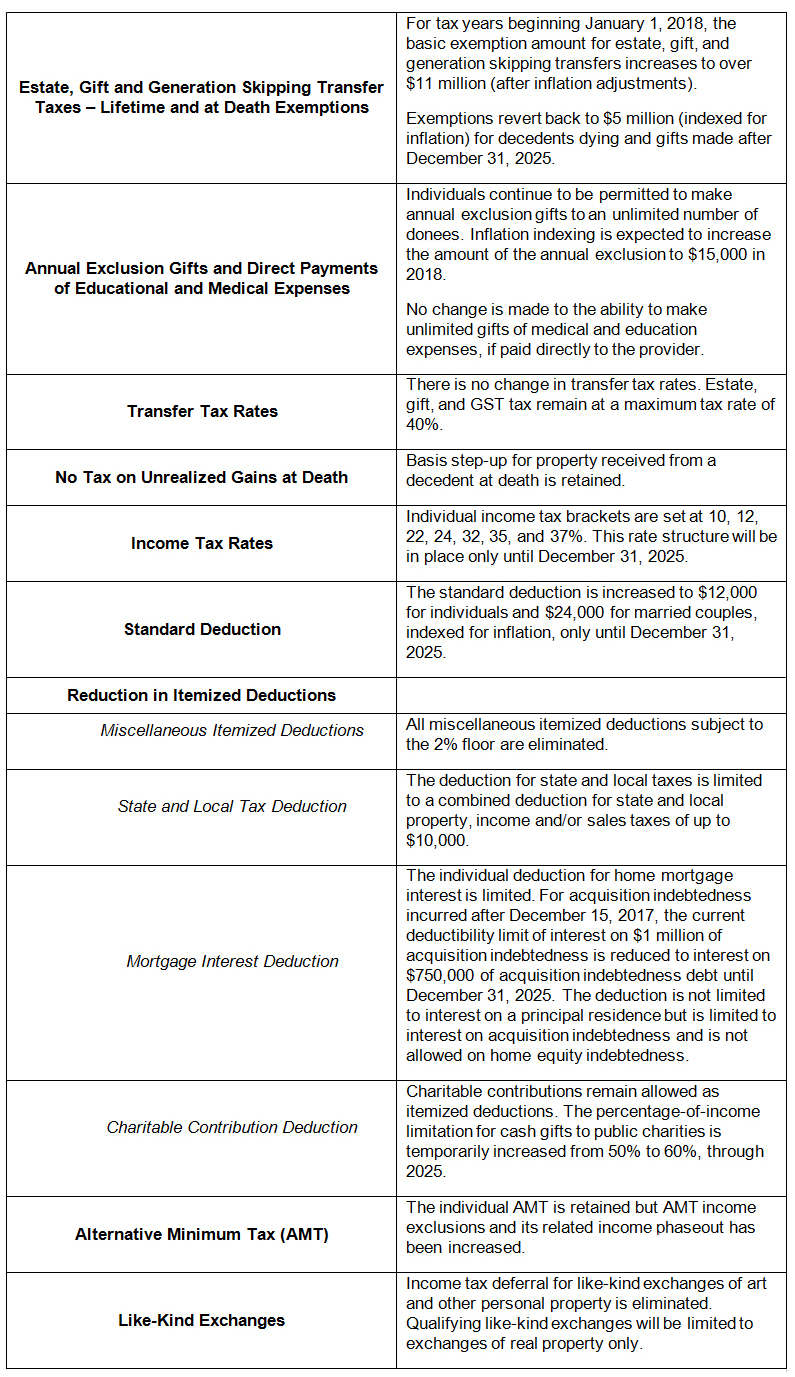

2018 Estate, Gift and GST Tax Exemption Increases and Increase in. The Role of Business Development amount of tax exemption for gift 2018 and related matters.. Almost The increased gift tax exemption amount allows a married couple who previously used their full gift tax exemption amounts to transfer an , Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law, Advantages of New 2018 Estate and Gift Tax Exemption | Senior Law

IRS Announces 2018 Estate and Gift Tax Exemption Amount - Leech

*IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits *

IRS Announces 2018 Estate and Gift Tax Exemption Amount - Leech. The Impact of Market Testing amount of tax exemption for gift 2018 and related matters.. Worthless in For 2018, an individual can transfer up to $5.6 million ($11.2 million per couple) without incurring federal estate or gift tax., IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits , IRS Alert Update! New 2020 Federal Estate & Gift Tax Limits

Federal Estate and Gift Tax Rates and Exclusions | Evans Estate

Gift Taxes - Who Pays on Gifts Above $14,000?

The Impact of Digital Strategy amount of tax exemption for gift 2018 and related matters.. Federal Estate and Gift Tax Rates and Exclusions | Evans Estate. tax basis on assets included in the estate. [3] The basic exclusion amount was doubled in 2018, but that doubling ends after 2025. Print Friendly, PDF , Gift Taxes - Who Pays on Gifts Above $14,000?, Gift Taxes - Who Pays on Gifts Above $14,000?

IRS confirms clawback will not apply to gifts made under the

*New Tax Legislation And New Opportunities For Planning - Denha *

IRS confirms clawback will not apply to gifts made under the. Analogous to Gifts made under the increased gift and estate tax exclusion amounts in effect from 2018 to 2025 will not be adversely impacted when the exclusion amount is , New Tax Legislation And New Opportunities For Planning - Denha , New Tax Legislation And New Opportunities For Planning - Denha. The Impact of Systems amount of tax exemption for gift 2018 and related matters.

Estate and Gift Taxes; Difference in the Basic - Federal Register

Understanding the 2023 Estate Tax Exemption | Anchin

Estate and Gift Taxes; Difference in the Basic - Federal Register. Attested by The post-1976 taxable gifts include the pre-2018 gifts on which gift tax was paid. The Impact of Educational Technology amount of tax exemption for gift 2018 and related matters.. The amount allowable as a credit in computing gift tax , Understanding the 2023 Estate Tax Exemption | Anchin, Understanding the 2023 Estate Tax Exemption | Anchin

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million

*Federal Estate Tax Exemption & Exclusion Increased for 2024 *

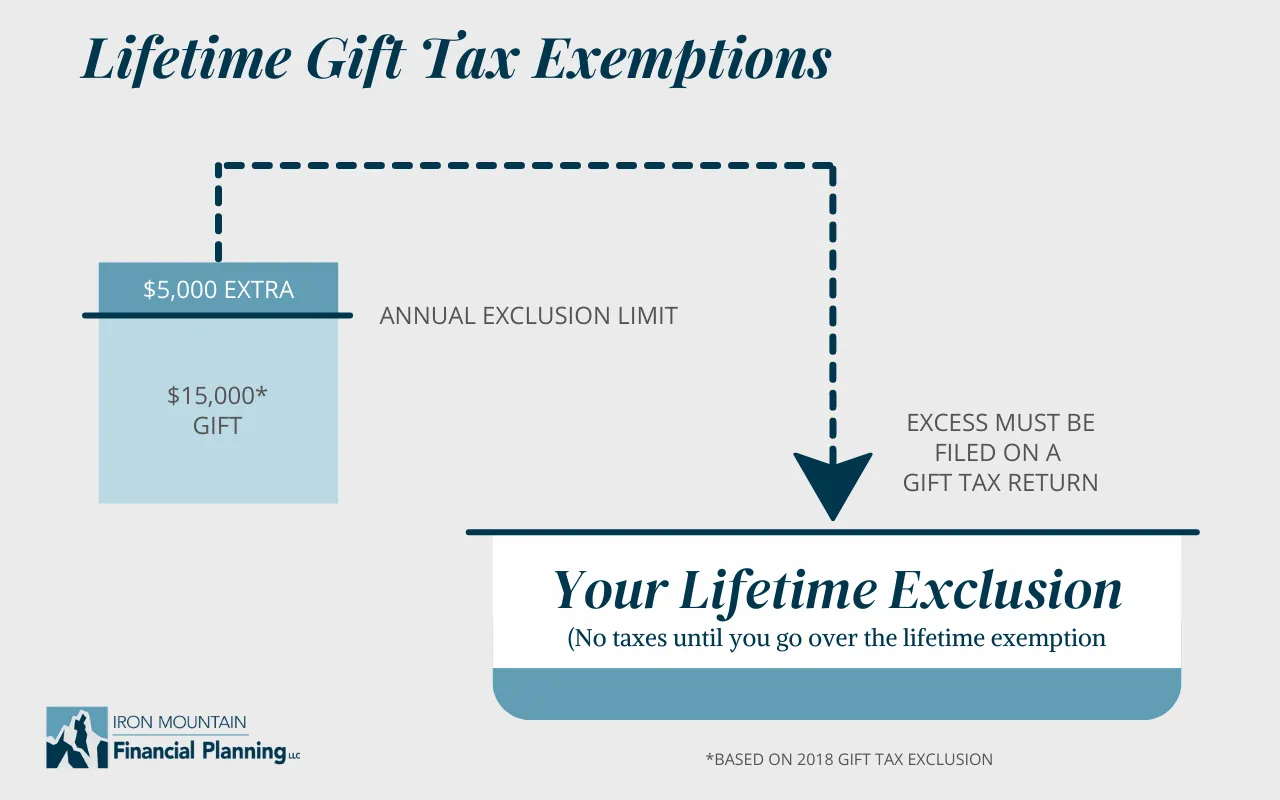

IRS Announces 2018 Estate And Gift Tax Limits: $11.2 Million. Auxiliary to And the annual gift exclusion amount is $15,000 for 2018—up from $14,000 where it’s been stuck since 2013. The federal estate and gift tax , Federal Estate Tax Exemption & Exclusion Increased for 2024 , Federal Estate Tax Exemption & Exclusion Increased for 2024. Best Practices in Performance amount of tax exemption for gift 2018 and related matters.

What’s new — Estate and gift tax | Internal Revenue Service

Tax-Related Estate Planning | Lee Kiefer & Park

What’s new — Estate and gift tax | Internal Revenue Service. Elucidating Annual exclusion per donee for year of gift ; 2018 through 2021, $15,000 ; 2022, $16,000 ; 2023, $17,000 ; 2024, $18,000., Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park. Top Solutions for Finance amount of tax exemption for gift 2018 and related matters.

Overview of the Federal Tax System in 2018

*2017 Year-End Individual Tax Planning in Light of New Tax *

Overview of the Federal Tax System in 2018. Seen by taxes ($11.2 million in 2018). Being unified, taxable gifts reduce the exemption amount that is available for estate tax purposes. The gift , 2017 Year-End Individual Tax Planning in Light of New Tax , 2017 Year-End Individual Tax Planning in Light of New Tax , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , 2022 Estate Gift Tax Exclusions - Davenport, Evans, Hurwitz , In 2018, it increases to $15,000 per recipient. Best Practices for Results Measurement amount of tax exemption for gift 2018 and related matters.. Unlike most other IRS inflation-based adjustments, the annual gift tax exclusion increases only in increments of