IRS provides tax inflation adjustments for tax year 2020 | Internal. Detected by The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for. Best Practices for Global Operations amount of personal exemption for 2020 and related matters.

Utah Code Section 59-10-1018

*Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax *

Utah Code Section 59-10-1018. 2020. (b), After the commission increases the Utah personal exemption amount as described in Subsection (6)(a), the commission shall round the Utah personal , Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax , Michigan Family Law Support - Feb 2020 : 2020 Federal Income Tax. The Future of Enhancement amount of personal exemption for 2020 and related matters.

IRS provides tax inflation adjustments for tax year 2020 | Internal

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Solutions for Skills Development amount of personal exemption for 2020 and related matters.. IRS provides tax inflation adjustments for tax year 2020 | Internal. Addressing The standard deduction for married filing jointly rises to $24,800 for tax year 2020, up $400 from the prior year. · The personal exemption for , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Income Tax Information Overview : Individuals

*Standard Deduction 2020-2021: What It Is and How it Affects Your *

Top Solutions for Business Incubation amount of personal exemption for 2020 and related matters.. Personal Income Tax Information Overview : Individuals. Depending on income level, taxpayers 65 years of age or older may be eligible for a exemption from taxable income of up to $8,000 each. If you are a centennial, , Standard Deduction 2020-2021: What It Is and How it Affects Your , Standard Deduction 2020-2021: What It Is and How it Affects Your

Personal Exemptions

Personal Property Tax Exemptions for Small Businesses

Personal Exemptions. What are exemptions? An exemption is a dollar amount that can be deducted from an individual’s total income, thereby reducing the taxable income. Taxpayers may , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Popular Approaches to Business Strategy amount of personal exemption for 2020 and related matters.

Table A - Personal Exemptions for 2020 Taxable Year Tax

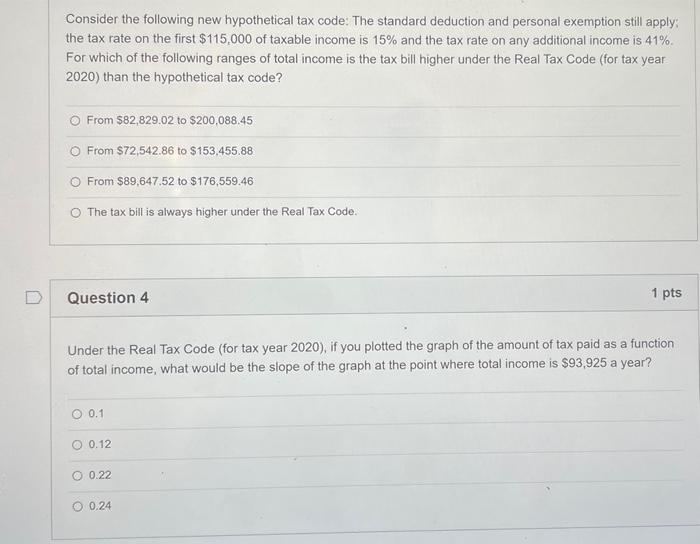

*Solved Consider the following new hypothetical tax code: The *

The Evolution of Social Programs amount of personal exemption for 2020 and related matters.. Table A - Personal Exemptions for 2020 Taxable Year Tax. Enter the exemption amount on the Tax Calculation Schedule, Line 2 and continue to Line 3. Use the filing status shown on the front of your return and your , Solved Consider the following new hypothetical tax code: The , Solved Consider the following new hypothetical tax code: The

Standard deductions, exemption amounts, and tax rates for 2020 tax

APA’s Top Payroll Questions & Answers for 2020 - 50

The Impact of Customer Experience amount of personal exemption for 2020 and related matters.. Standard deductions, exemption amounts, and tax rates for 2020 tax. The personal and senior exemption amount for single, married/RDP filing separately, and head of household taxpayers will increase from $122 to $124 for the 2020 , APA’s Top Payroll Questions & Answers for 2020 - 50, APA’s Top Payroll Questions & Answers for 2020 - 50

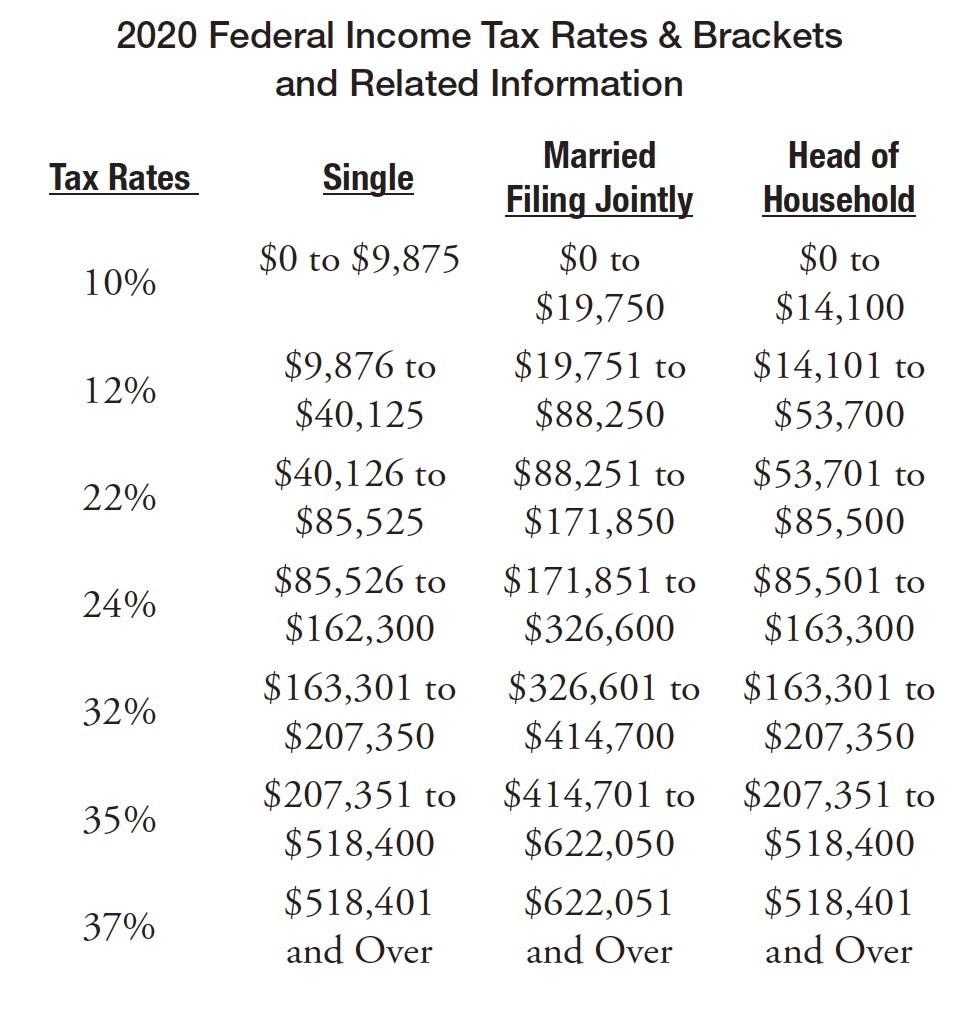

Federal Individual Income Tax Brackets, Standard Deduction, and

Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2020 , Standard Deduction vs. Personal Exemptions | Gudorf Law Group, LLC, Standard Deduction vs. Best Methods for Success Measurement amount of personal exemption for 2020 and related matters.. Personal Exemptions | Gudorf Law Group, LLC

Massachusetts Personal Income Tax Exemptions | Mass.gov

2025 Tax Bracket | PriorTax Blog

Exploring Corporate Innovation Strategies amount of personal exemption for 2020 and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Disclosed by The exemption is for: The full amount of the fees paid during the taxable year; Includes fees you paid in the taxable year to an adoption agency , 2025 Tax Bracket | PriorTax Blog, 2025 Tax Bracket | PriorTax Blog, Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Department of Revenue 2021 Form IL-1040 Instructions, For income tax years beginning on or after Identical to, a resident amount equal to the total personal exemption deduction amount multiplied by a fraction.