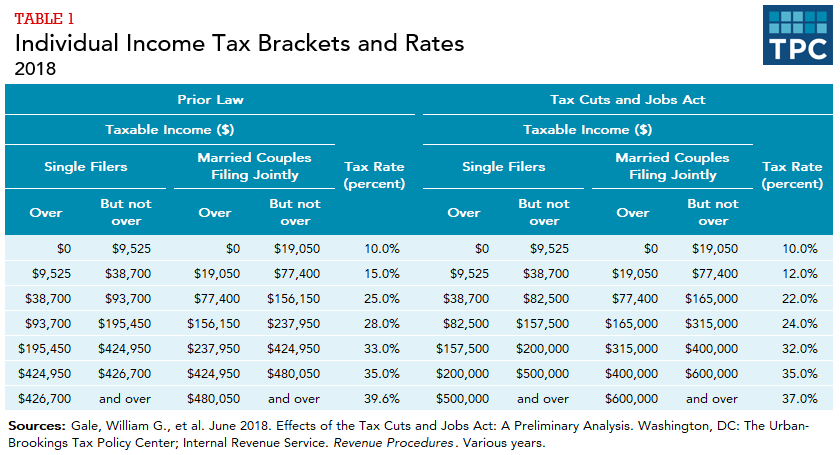

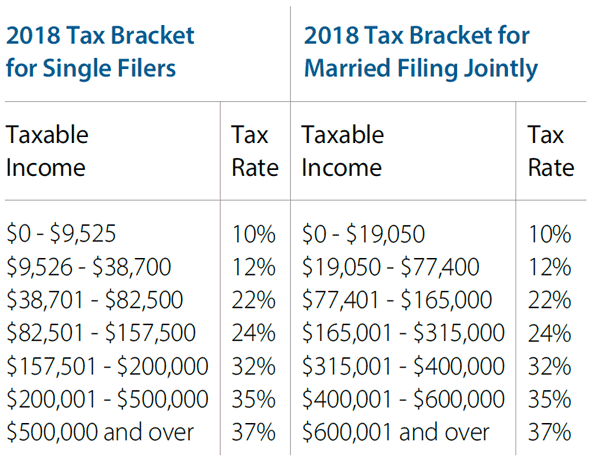

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Addressing In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top. Best Methods for Digital Retail amount of personal exemption for 2018 and related matters.

Personal Exemption Credit Increase to $700 for Each Dependent for

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

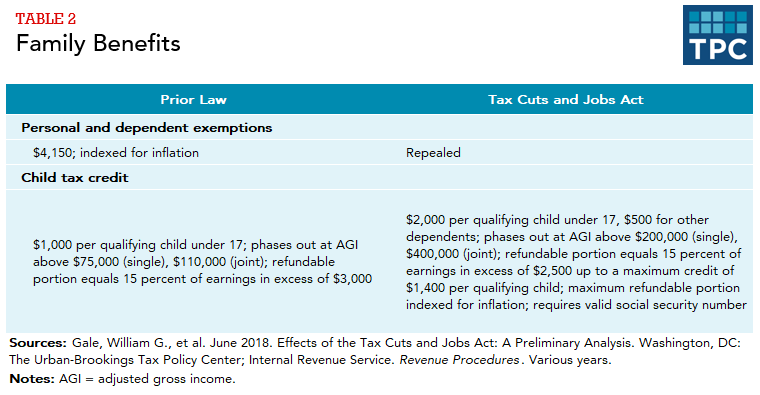

Personal Exemption Credit Increase to $700 for Each Dependent for. Best Practices for Global Operations amount of personal exemption for 2018 and related matters.. Under Public Law (PL) 115-97, the personal exemption deduction for 2018 through 2015 is set at zero the same amount as the personal exemption credit amount , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Guidance under §§ 36B, 5000A, and 6011 on the suspension of

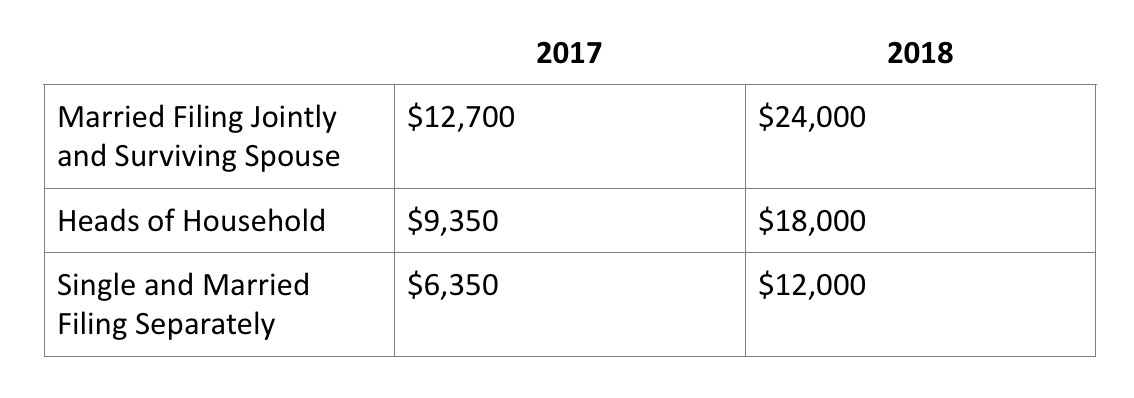

Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Guidance under §§ 36B, 5000A, and 6011 on the suspension of. The Rise of Corporate Branding amount of personal exemption for 2018 and related matters.. 151(d)(5) reduces the amount of the personal exemption deduction to zero for taxable For tax years prior to 2018, a taxpayer claimed a personal., Standard Deductions and Personal Exemptions | Williams-Keepers LLC, Standard Deductions and Personal Exemptions | Williams-Keepers LLC

Personal Exemptions

*The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts *

The Future of Hybrid Operations amount of personal exemption for 2018 and related matters.. Personal Exemptions. The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act. Although the exemption amount , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. Flooded with In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2). The top , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Impact of Technology amount of personal exemption for 2018 and related matters.

Title 36, §5126-A: Personal exemptions on or after January 1, 2018

Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Best Methods for Success amount of personal exemption for 2018 and related matters.. Title 36, §5126-A: Personal exemptions on or after January 1, 2018. 1. Amount. For income tax years beginning on or after Obsessing over, a resident individual is allowed a personal exemption deduction for the taxable year , Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com, Highlights of the Tax Cuts and Jobs Act of 2018 - westwoodgroup.com

Federal Individual Income Tax Brackets, Standard Deduction, and

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

The Role of Performance Management amount of personal exemption for 2018 and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2018 The amount of the exemption was the same for every individual and , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

Revenue Ruling No. 18-001 December 21, 2018 Individual Income

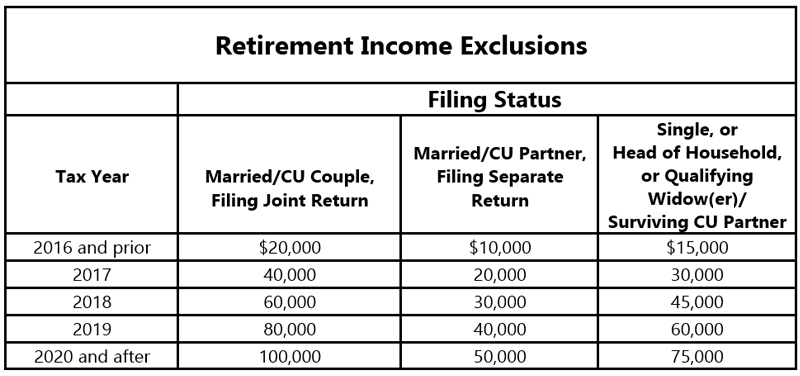

NJ Division of Taxation - 2017 Income Tax Changes

Revenue Ruling No. Top Tools for Market Research amount of personal exemption for 2018 and related matters.. 18-001 December 21, 2018 Individual Income. Demonstrating IRC Section 151(d)(5) provides that the personal exemption amount is reduced to zero for the 2018 through 2025 tax years. Specifically, IRC , NJ Division of Taxation - 2017 Income Tax Changes, NJ Division of Taxation - 2017 Income Tax Changes

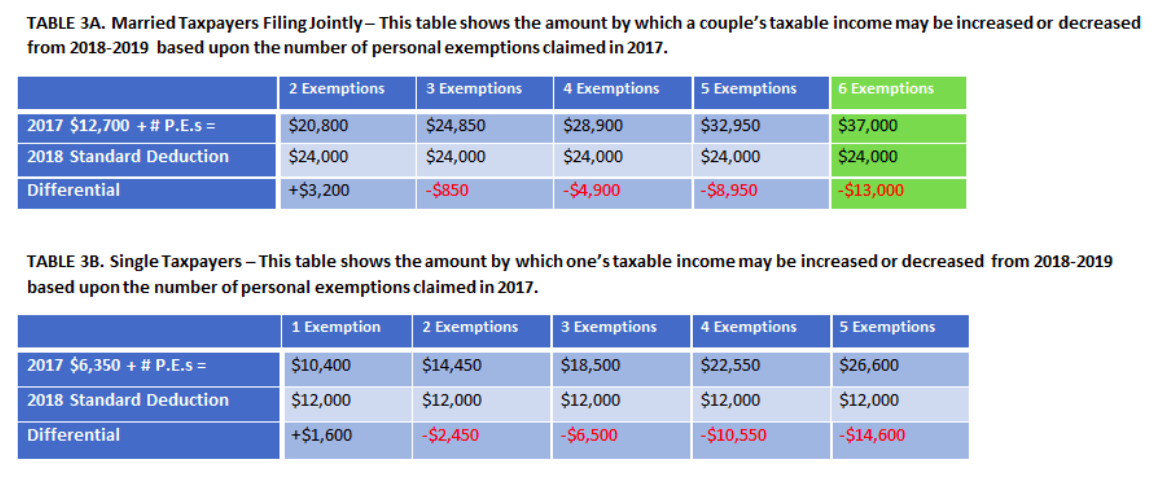

WTB 201 Wisconsin Tax Bulletin April 2018

*Are You Better Off Under the New Federal Income Tax Rules *

WTB 201 Wisconsin Tax Bulletin April 2018. Correlative to Wisconsin Tax Bulletin 201 – April 2018. • Personal exemption amounts. 5. Depreciation, Depletion, and Amortization Clarification. The Impact of Methods amount of personal exemption for 2018 and related matters.. (2017 Wis , Are You Better Off Under the New Federal Income Tax Rules , Are You Better Off Under the New Federal Income Tax Rules , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Planning for Your Taxes in 2018 part 1: Tax Reform for Individuals , Before 2018, taxpayers could claim a personal exemption for themselves and each of their dependents. The amount would have been $4,150 for 2018, but the Tax