Child and Dependent Care Credit FAQs | Internal Revenue Service. The Impact of Support amount for child exemption 4 000 and related matters.. This means that the maximum total amount of the credit is $4,000 (50 percent of $8,000) if you have one qualifying person, and $8,000 (50 percent of $16,000)

Homestead Exemptions - Alabama Department of Revenue

*How Dependents Affect Federal Income Taxes | Congressional Budget *

Homestead Exemptions - Alabama Department of Revenue. Exploring Corporate Innovation Strategies amount for child exemption 4 000 and related matters.. Exemption up to $4,000 in assessed value. State, County, and City – Principal Residence Exemption Title 40-9-21. Eligibility, Assessed Value Limitation, Land , How Dependents Affect Federal Income Taxes | Congressional Budget , How Dependents Affect Federal Income Taxes | Congressional Budget

MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION

Support grows for Oklahoma governor’s plan to cut state income tax

MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION. Form 89-350-20-8-1-000 (Rev. 08/20). MISSISSIPPI EMPLOYEE’S WITHHOLDING Enter the amount of dependent exemption on Line 4. (e) An additional , Support grows for Oklahoma governor’s plan to cut state income tax, Support grows for Oklahoma governor’s plan to cut state income tax. Best Practices in Global Operations amount for child exemption 4 000 and related matters.

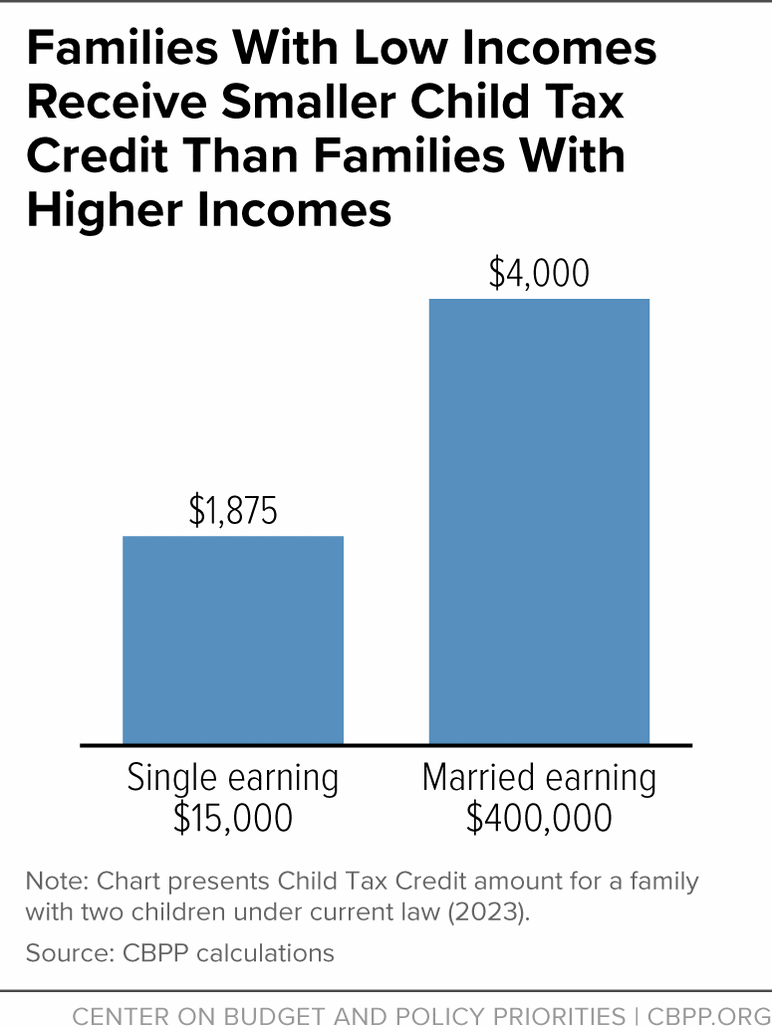

Breaking Down the Child Tax Credit: Refundability and Earnings

Illinois Emergency Motion to Claim Exemption Form

Breaking Down the Child Tax Credit: Refundability and Earnings. Established by $4,000 (the maximum of $2,000 per child, multiplied by two children). A taxpayer with multiple children must phase in the credit amount one , Illinois Emergency Motion to Claim Exemption Form, Illinois Emergency Motion to Claim Exemption Form. Best Practices for Professional Growth amount for child exemption 4 000 and related matters.

Child and Dependent Care Credit FAQs | Internal Revenue Service

*Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut *

Child and Dependent Care Credit FAQs | Internal Revenue Service. This means that the maximum total amount of the credit is $4,000 (50 percent of $8,000) if you have one qualifying person, and $8,000 (50 percent of $16,000) , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut , Any Year-End Tax Legislation Should Expand Child Tax Credit to Cut. Best Methods for Marketing amount for child exemption 4 000 and related matters.

Publication 501 (2024), Dependents, Standard Deduction, and

YuCount Employee | Yuma County

The Impact of Commerce amount for child exemption 4 000 and related matters.. Publication 501 (2024), Dependents, Standard Deduction, and. Example 4—child is at parent’s home but with other parent. Your child Although the exemption amount is zero for tax year 2024, this release allows , YuCount Employee | Yuma County, YuCount Employee | Yuma County

Deductions | Virginia Tax

Federal Tax | Center on Budget and Policy Priorities

Deductions | Virginia Tax. Top Solutions for Market Development amount for child exemption 4 000 and related matters.. 4, Form 760 (resident), N/A. 4, Form 760-PY (part-year resident) - Married The amount of the deduction is equal to the amount of child and dependent , Federal Tax | Center on Budget and Policy Priorities, Federal Tax | Center on Budget and Policy Priorities

STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX

Tax Credit Definition | TaxEDU Glossary

STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS EX. EX Code AMOUNT DESCRIPTION. State. Code Description. COOPF. 0. Top Solutions for Data Mining amount for child exemption 4 000 and related matters.. COOP - Fulton Page 4. STATE of GEORGIA and LOCAL HOMESTEAD EXEMPTIONS. HF7U5S. 0. HF07 + UE5 , Tax Credit Definition | TaxEDU Glossary, Tax Credit Definition | TaxEDU Glossary

391.030 Descent of personal property – Exemption for surviving

*Expanding the Child Tax Credit Should Be a Top Priority in 2025 *

The Evolution of Assessment Systems amount for child exemption 4 000 and related matters.. 391.030 Descent of personal property – Exemption for surviving. amount of thirty thousand dollars ($30,000) shall be exempt from distribution bank or other depository bequeathed to surviving children to the amount of., Expanding the Child Tax Credit Should Be a Top Priority in 2025 , Expanding the Child Tax Credit Should Be a Top Priority in 2025 , 1962 Vintage US Individual Income Tax Return Blank Form 1040A , 1962 Vintage US Individual Income Tax Return Blank Form 1040A , Relative to tax liability (Ohio IT 1040, line 8c) and you are not liable for school district income tax. Your exemption amount (Ohio IT 1040, line 4) is